A Sui Basis’s “infrastructure companion” was noticed promoting $400 million value of SUI tokens, elevating market issues and hypothesis. The whale has now ready one other $20 million value of SUI within the pockets used for the continued promoting spree.

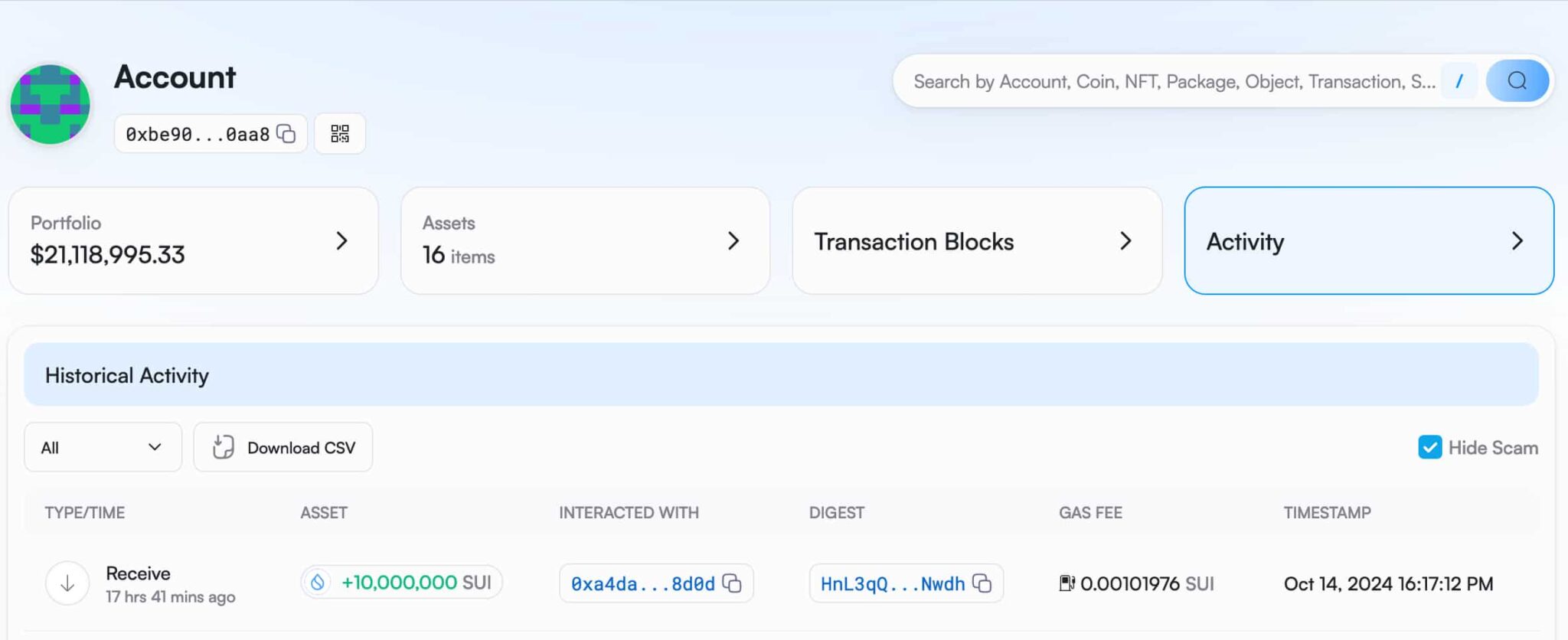

Specifically, the decentralized finance (DeFi) analyst VIKTOR recognized the account ‘0xbe90d(…)’ as Sui Basis’s alleged “infrastructure companion.” On October 14, the account acquired 10 million SUI after briefly stopping a constant $400 million promoting spree.

The analyst defined this whale receives tokens from two different accounts, one being the ‘0xa4da59(…),’ from this latest transaction. Notably, the origin accounts have roughly $430 million and $230 million value of SUI in staking, supposedly beneath vesting contracts.

Sui responds to insider buying and selling allegations: ‘Infrastructure companion in compliance’

On October 13, an X submit by lightcrypto went viral with allegations of a Sui insider promoting $400 million. Sui’s official account responded to those allegations, denying that any insider had bought this quantity throughout the claimed interval.

But, the response speculated that the referred account was not from an insider however an “infrastructure companion,” confirming the lockup. Sui’s account defined that this infrastructure companion is “in compliance” with the vesting guidelines and is overseen by a custodian.

“Whereas the poster didn’t present the pockets deal with, we imagine the doubtless proprietor of the pockets is an infrastructure companion who owns tokens beneath a lockup schedule. All token lockups are enforced by certified custodians and repeatedly monitored by Sui Basis, and this companion is in compliance.”

– Sui official account on X

On that observe, tokens locked in vesting contracts are normally enforced programmatically by the protocol by means of sensible contracts, not custodians. Utilizing trusted custodians to implement the lockup contract goes in opposition to the decentralized and trustless nature of cryptocurrencies, elevating critical issues.

As of this writing, the Sui Basis has not responded to Finbold’s two makes an attempt to make clear this and different questions.

Sui locked staking rewards and month-to-month unlocks

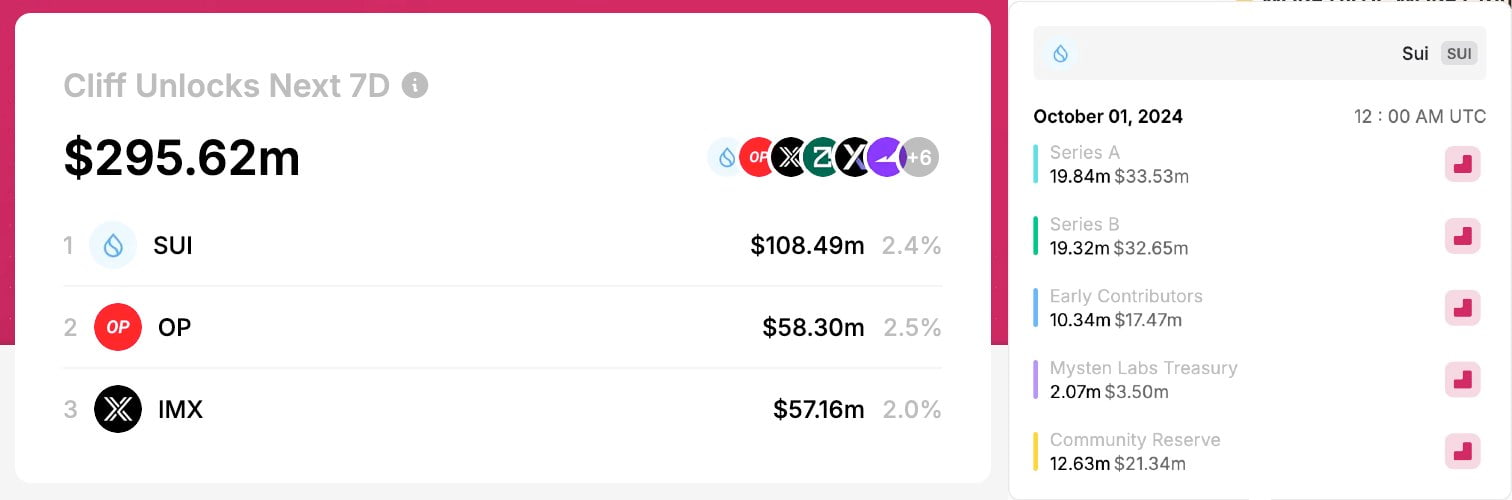

One other unconventional method of Sui tokenomics is permitting the supposedly locked tokens to stake for unlocked staking rewards.

This determination permits for over 72% of the nonetheless non-circulating provide to generate positive factors for what some contributors name insiders.

They embody the Sui Basis, Mysten Labs, and, particularly, Collection A and B personal buyers. The final group absorbs 61% of month-to-month unlocks, as Finbold reported warning of Sui’s $100 million unlock in October.

In November, the market ought to anticipate one other related unlock that may put much more tokens into circulation by means of market gross sales. Beforehand, SUI reached an all-time excessive worth of $2.36, sounding alarms by being ‘Overbought’ in a number of time frames.

This most up-to-date promoting spree and now anticipated 10 million SUI extra dump are a cautionary story on the significance of a undertaking’s tokenomics, which might affect the market’s sentiment and worth motion as provide and demand play their function in a undertaking’s economics.