Swiss crypto financial institution AMINA has develop into the primary to straight assist Ripple’s RLUSD stablecoin. The transfer marks a considerable milestone for the fintech firm. AMINA will supply custody and buying and selling companies at launch to all RLUSD holders. The financial institution goals to additional broaden its companies within the coming months. In line with Myles Harrison, AMINA’s Chief Product Officer, “We’re proud to be the primary financial institution to assist RLUSD and to offer our shoppers with entry to one of the crucial anticipated digital property available in the market.“

Ripple Set To Make A Splash In The Stablecoin Market?

The stablecoin market has seen an unbelievable rise in reputation over the previous few years. The GENIUS (Guiding and Establishing Nationwide Innovation for U.S. Stablecoins) Act just lately handed the US Senate. The invoice is presently awaiting approval within the Home of Representatives. Many anticipate the invoice to be made into regulation very quickly. President Trump will possible go the invoice as quickly because it reaches his desk. Ripple’s entry into the stablecoin market couldn’t have come at a greater time.

Ripple USD (RLUSD) has attained a market cap of $469.21 million. It’s presently the 164th-largest crypto venture by market cap. The venture will almost definitely climb the charts very quickly.

Will XRP Profit?

XRP doesn’t have any direct hyperlinks to Ripple’s stablecoin venture. Nonetheless, if RLUSD good points momentum, XRP will possible profit from extra consciousness.

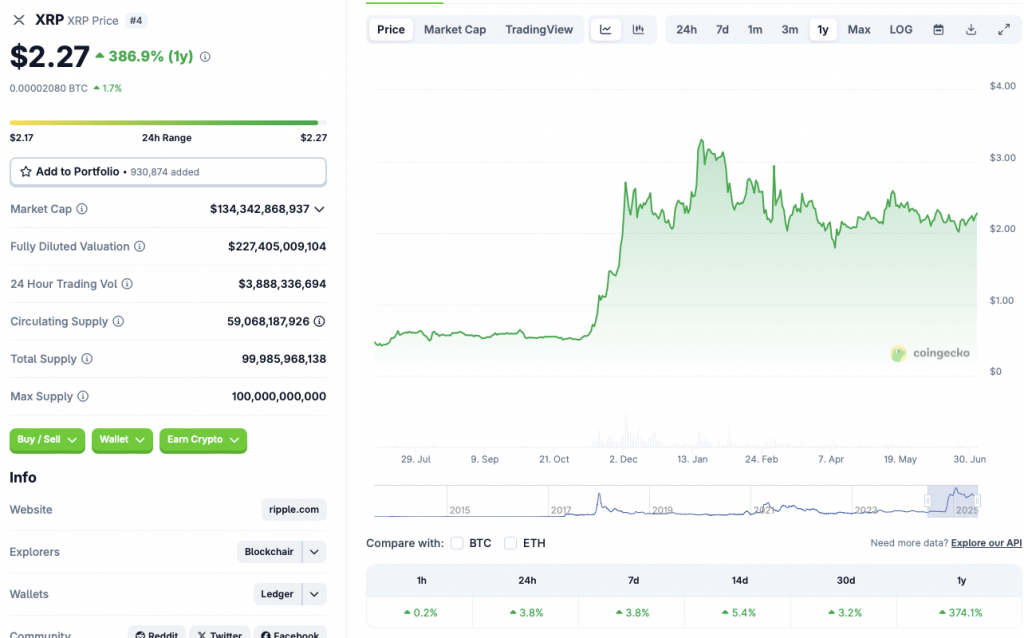

Ripple’s XRP token appears to be following the market-wide resurgence. XRP is buying and selling solely within the inexperienced zone at this time. The asset is up 3.8% within the each day charts, 3.8% within the weekly charts, 5.4% within the 14-day charts, 3.2% over the earlier month, and 374.1% since July 2024.

XRP followers are additionally wanting ahead to the SEC’s resolution on a spot XRP ETF. The asset might see an enormous value rally if an ETF is authorized.