USST, a brand new stablecoin launched on Friday, Oct. 10 by stablecoin platform STBL, co-founded by one among Tether’s founders, slipped under its $1 peg to as little as $0.96 inside hours of debuting on Curve, sparking issues over confidence within the venture.

On the time of writing, USST is buying and selling at round $0.9776, down 1.5% in 24 hours with a market cap of roughly $967,000 and simply 52 holders, based on knowledge from GeckoTerminal.

USST/USD worth. Supply: GeckoTerminal

The Curve pool confirmed round $965,000 in liquidity and 24-hour buying and selling quantity of $484,000, with web outflows of about $466,000. To date, 50 transactions have been recorded up to now 24 hours.

Earlier as we speak, STBL introduced a brand new USST-related partnership with Ondo Finance – which has a complete worth locked (TVL) of $1.76 billion — that makes Ondo’s USD-pegged, tokenized yield-bearing asset, USDY, the first collateral for USST. As much as $50 million in USST stablecoin mints might be backed by USDY, based on a press launch shared with The Defiant. For its half, USDY is collateralized by U.S. Treasuries and money deposits.

STBL is a decentralized protocol that provides each a stablecoin, USST, in addition to a separate yield-bearing NFT, YLD, that customers obtain once they mint USST. The venture is co-founded by Reeve Collins, one of many co-founders of Tether, who was additionally the USDT issuer’s CEO from 2013-2015. Tether’s USDT dominates international stablecoin markets, with a present market capitalization of $177 billion, making up over 58% of the sector, per DefiLlama.

The early depeg occasion underscores how troublesome it may be for brand new stablecoins to ascertain confidence, the place liquidity depth, transparency, and credible collateral are essential to sustaining a greenback peg.

What It Means

Catie Romero, CEO and co-founder of crypto development and advisory agency BABs, instructed The Defiant that early peg wobbles are frequent amongst new steady launches. Romero stated that the depeg “seems to be like a liquidity-calibration situation greater than a structural failure,” including:

“Shallow pool depth, incentives nonetheless spinning up, and uneven mint/redemption flows can exaggerate small sells.”

Kadan Stadelmann, CTO of Komodo Platform, echoed Romero’s stance, noting that whereas USST hasn’t structurally failed but, there may be some threat.

“Small deviations within the peg are frequent early on within the lifetime of stablecoins, but when they’re not resolved they might undermine all the STBL ecosystem, which might result in outflows from STBL into different stablecoin ecosystems,” Stadelmann stated. “Previously, stablecoin tasks have managed such depegs by way of boosted yields, reserve injections, and buybacks.”

Romero added that after shopping for and promoting routes work easily, market makers normally step in to stabilize the value as soon as returns make it worthwhile.

STBL Token Drops

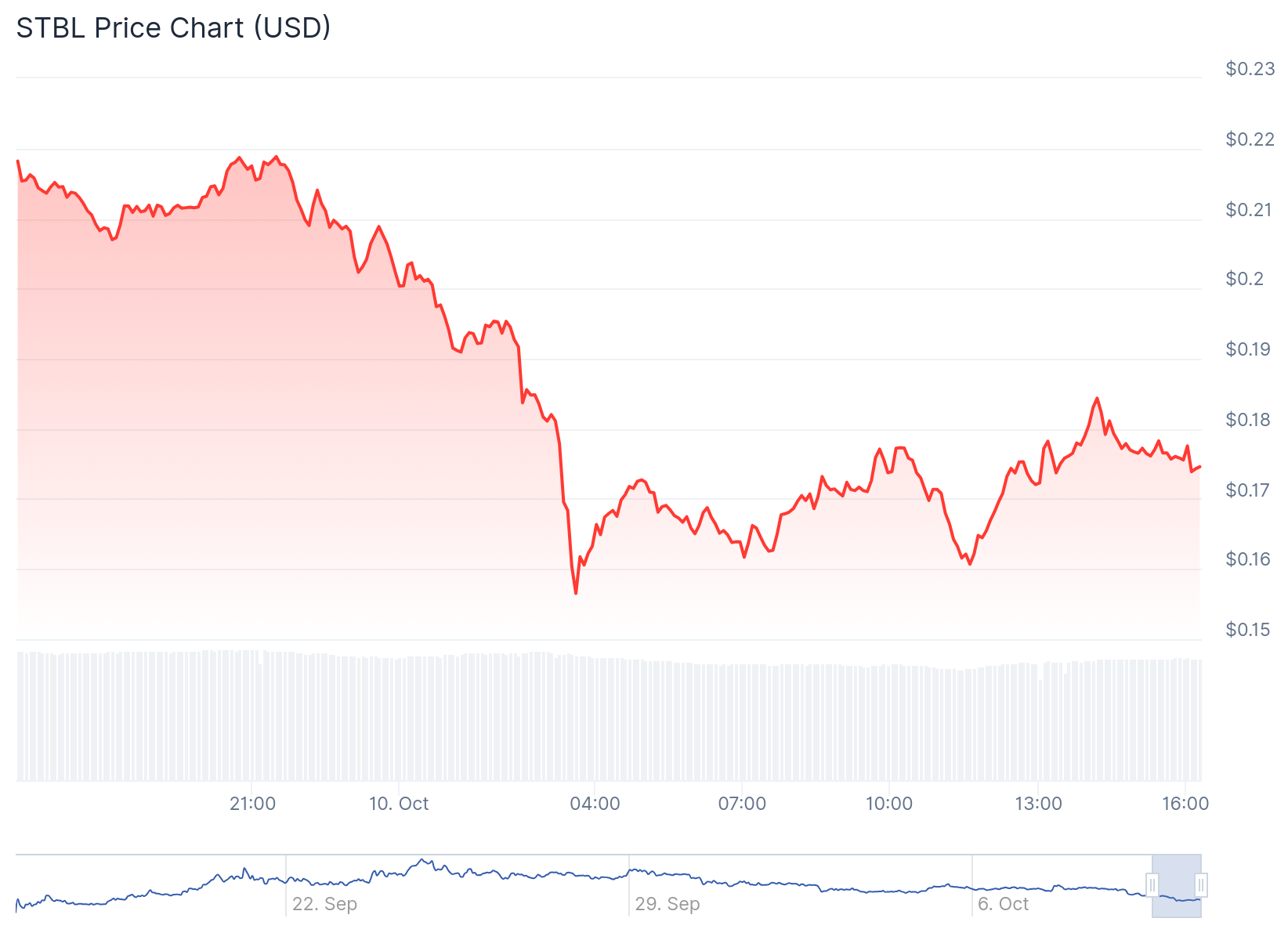

In the meantime, STBL, the ecosystem’s governance token which simply launched on the BNB Chain ecosystem final month, fell sharply over the previous 24 hours, amid a broader selloff, doubtless reflecting a lack of confidence as USST made its shaky debut. STBL is presently buying and selling round $0.17, down 18% on the day and over 36% on the week.

STBL 24-hour worth chart. Supply: CoinGecko

“It’s a credibility check right here, not an post-mortem. STBL is underneath vital strain,” Romero instructed The Defiant. She added that the token’s drop as we speak “suggests a reflexive loop between governance token confidence and the perceived resilience of the stablecoin (one thing we’ve seen in prior early-stage ecosystems just like the UST pre-peg restoration),” referencing one among crypto’s largest collapses, involving Terra’s algorithmic stablecoin, UST.

She added that whereas as we speak’s USST depeg isn’t substantial in crypto phrases, it’s sufficient to shake investor confidence, no less than briefly.

“Social knowledge reveals that unfavorable sentiment spiked 3.2x after the peg slipped, amplifying the narrative quicker than liquidity might rebalance,” Romero continued. In the meantime, Stadelmann echoed the sentiment, saying that STBL’s token has suffered because of USST’s depeg.

“There are actually doubts concerning the venture’s general viability,” he stated. “Customers are watching to see how the venture reacts and if it nips the problems within the bud and is ready to restore confidence.”