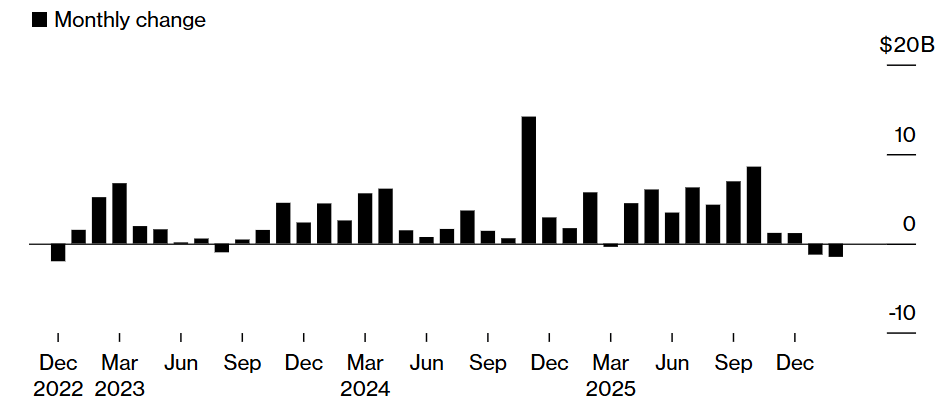

Tether’s $USDT, the world’s largest US dollar-pegged stablecoin, is heading for its steepest month-to-month decline in years as giant holders step up redemptions, in keeping with blockchain information.

The circulating provide of USDt ($USDT) fell by about $1.5 billion to date in February, following an $1.2 billion lower in January, in keeping with Artemis Analytics information reported by Bloomberg. This places $USDT on monitor for the most important month-to-month drop in three years, weeks after the collapse of cryptocurrency trade FTX in November 2022.

The $USDT provide logged a $2 billion lower in December 2022 after the collapse of FTX and its 150 subsidiaries despatched shockwaves by means of the crypto trade.

The decline might sign a contraction in crypto market liquidity, as Tether’s $USDT is the first on-ramp for crypto buyers. Its $183 billion market capitalization accounts for about 71% of the entire stablecoin market, in keeping with CoinMarketCap.

Tether $USDT, month-to-month proportion provide change, month-to-month combination. Supply: Artemis Analytics, Bloomberg

Cointelegraph reached out to Tether for touch upon what’s driving the February provide drop, however had not obtained a response by publication.

Associated: BlackRock enters DeFi as institutional crypto push accelerates: Finance Redefined

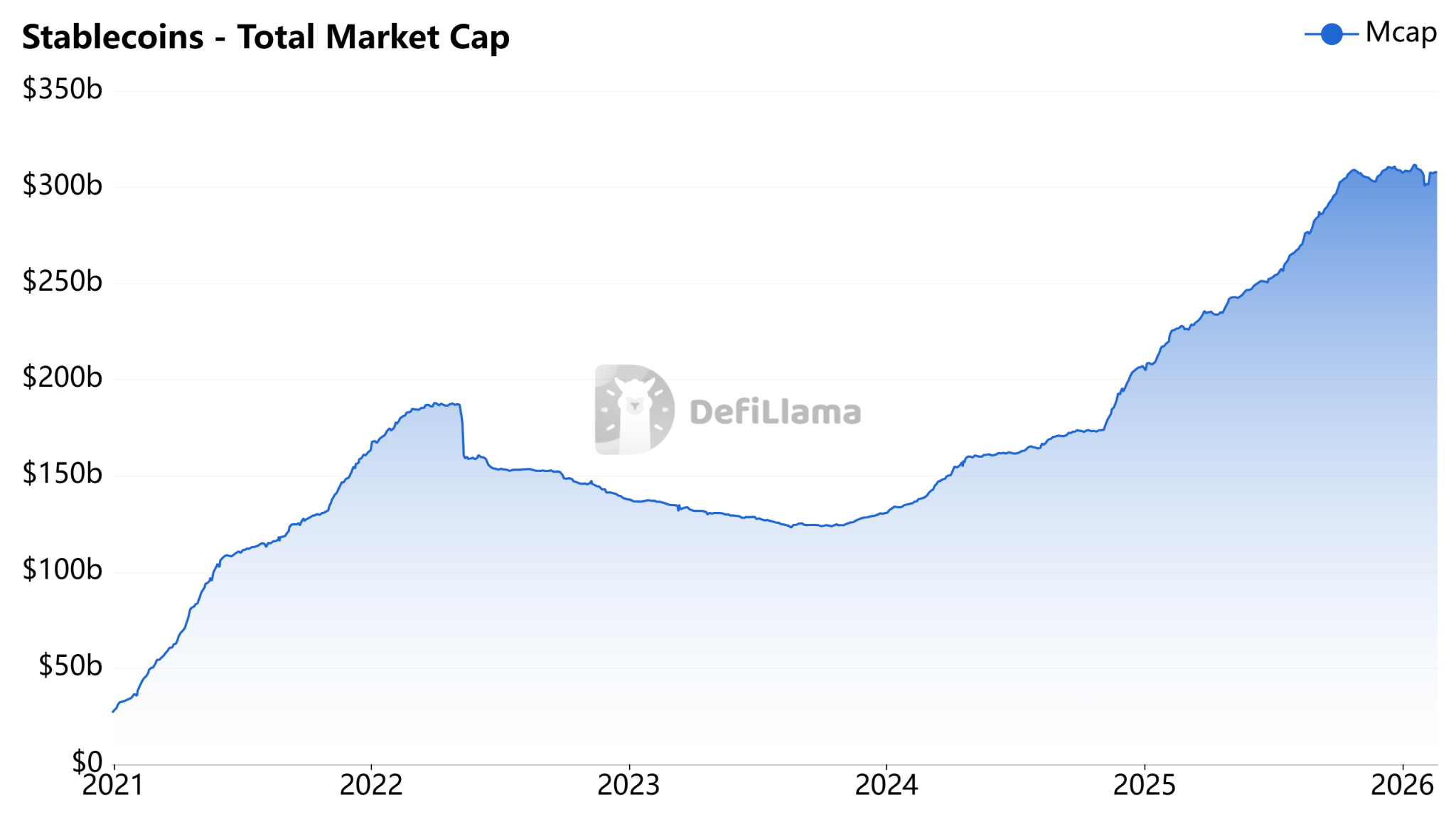

Whole stablecoin market cap flat in February

The pullback in $USDT has not translated right into a broader contraction throughout dollar-linked stablecoins.

The full market capitalization of stablecoins throughout all exchanges has risen 2.33% to date in February, from $300 billion to $307 billion, in keeping with DeFiLlama information.

Whole stablecoin market capitalization. Supply: DeFiLlama

Whereas the 2 main stablecoins, $USDT and Circle’s $USDC ($USDC), each decreased by 1.7% and 0.9%, respectively, the Trump-family-linked World Liberty Monetary’s $USD1 ($USD1) stablecoin recorded a 50% enhance in market capitalization over the previous month and was valued at $5.1 billion as of Friday, in keeping with DeFiLlama.

Associated: Wells Fargo sees ‘YOLO’ commerce driving $150B into Bitcoin and danger belongings

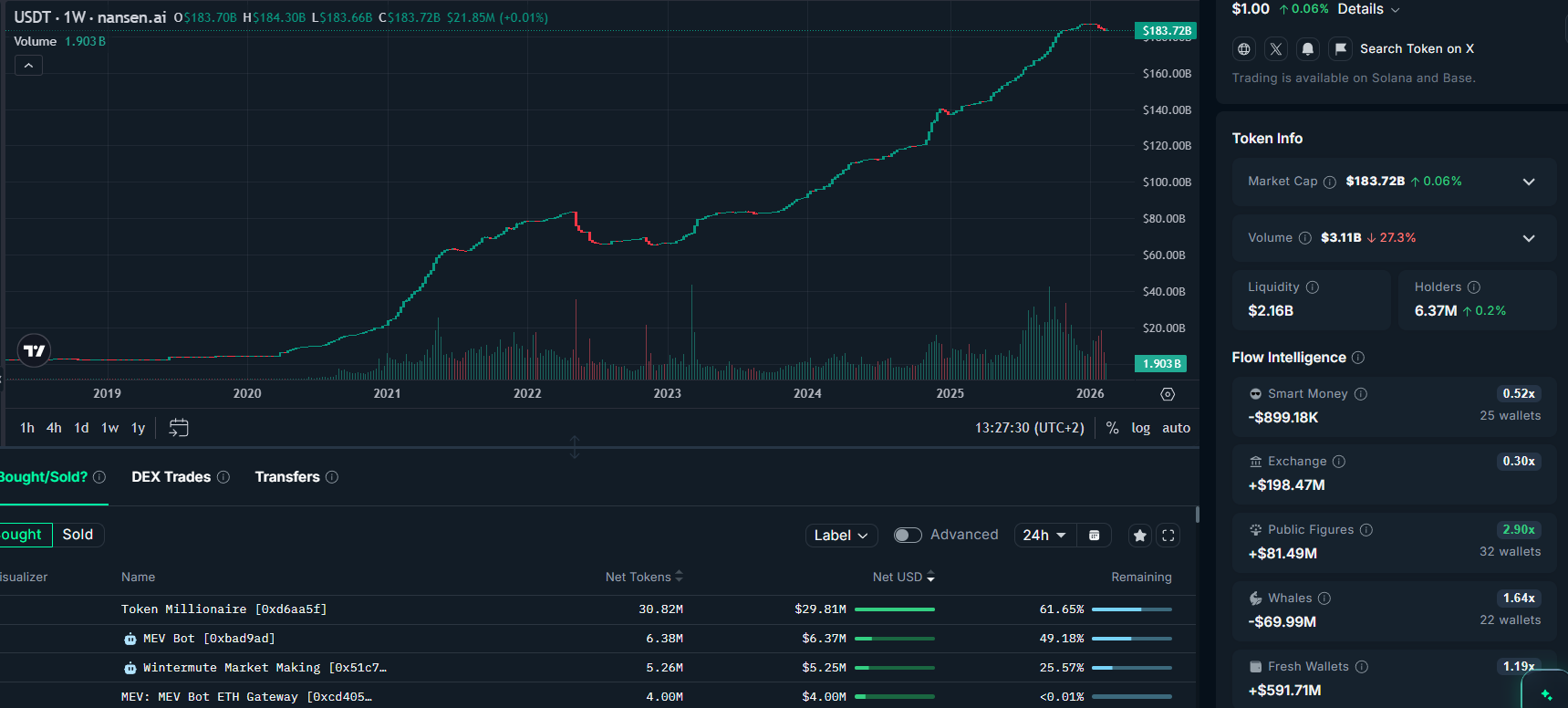

Whales and good cash merchants offload $USDT, however recent wallets stepping in

Whales, or giant cryptocurrency buyers, have been chopping their $USDT holdings, however new members are bringing recent demand for the main stablecoin.

Whale wallets bought $69.9 million $USDT throughout 22 wallets over the previous week, marking a 1.6-fold enhance within the promoting charge of this cohort, in keeping with crypto intelligence platform Nansen.

$USDT on Ethereum, token God mode, 1-year chart. Supply: Nansen

The main merchants by returns, tracked as “good cash,” have additionally been internet sellers of $USDT. On the similar time, new wallets created previously 15 days purchased roughly $591 million value of $USDT over the week, in keeping with the platform.

The combined flows spotlight a market break up between giant holders redeeming or reallocating capital and new entrants stepping in to take the opposite facet, whilst general stablecoin issuance stays broadly regular.

Journal: Crypto needed to overthrow banks, now it’s changing into them in stablecoin battle