Bitcoin’s value stays in a state of indecision, confined inside a decent consolidation vary bounded by the 100-day and 200-day transferring averages.

An impending breakout from this vary will doubtless decide the asset’s short-term course.

Technical Evaluation

By Shayan

The Each day Chart

Bitcoin has been caught in a multi-month consolidation between the $55K-$71K value vary since March 2024, with no clear development or course rising.

This extended interval of sideways motion signifies an total equilibrium between consumers and sellers, with accumulation occurring on the decrease finish of the vary and distribution on the prime. Regardless of this, a bearish signal has not too long ago appeared as Bitcoin broke under the 200-day transferring common at $63.4K.

Nonetheless, the downward momentum was halted upon reaching the 100-day transferring common at $61K, the place the value has since entered a part of low-volatility consolidation.

Bitcoin is squeezed inside a slim vary, constrained by the 100-day and 200-day transferring averages. This means that an impending breakout might decide its short-term course. A decisive transfer outdoors this vary would doubtless sign the following main development.

The 4-Hour Chart

On the 4-hour chart, an ascending wedge sample has shaped through the current extended consolidation part. The worth has been oscillating between this wedge’s higher and decrease boundaries, which usually factors to a continuation of the preliminary bearish development if it breaks downward.

Following elevated promoting strain close to the 0.786 Fibonacci OTE stage, Bitcoin skilled a major rejection, inflicting the value to cascade towards the wedge’s decrease boundary.

BTC is consolidating after receiving assist at this stage, however sellers intention to interrupt under the wedge’s decrease trendline, which coincides with the $60K assist area. Ought to this breakdown happen, the following essential goal for Bitcoin would be the $58K assist area.

On-chain Evaluation

By Shayan

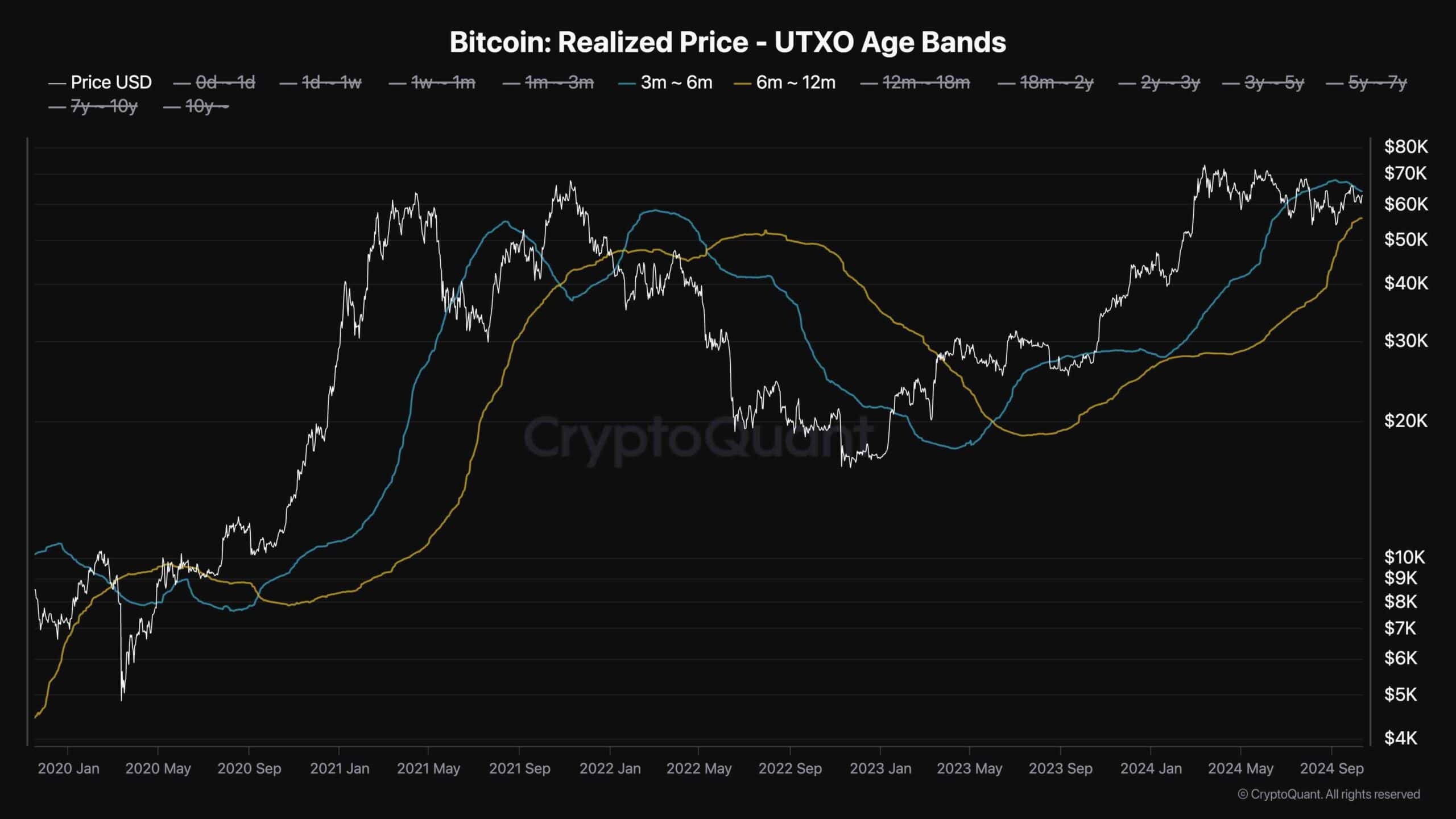

One key on-chain metric for understanding Bitcoin market conduct is the realized value UTXO age bands. This metric highlights the common value at which holders acquired their cash, damaged down by how lengthy they’ve held them.

Traditionally, the realized value within the 3-6 months (short-term) and 6-12 months (long-term) cohorts have served as essential assist or resistance ranges. When Bitcoin struggles to interrupt above the common purchase value of those teams, it typically signifies a bearish development. Conversely, if the cryptocurrency can break above this realized value, it suggests rising bullish momentum, as new consumers are keen to carry even at larger ranges.

At current, Bitcoin’s value is hovering between the realized costs of those two teams:

- $64K for the short-term holders (3-6 months)

- $55K for the long-term holders (6-12 months)

Bitcoin not too long ago surged towards the 3-6 month holders’ realized value of $64K, indicating a take a look at of this key resistance stage. A profitable breakthrough above this stage might sign upward momentum and probably proceed the bullish development. Nonetheless, if Bitcoin fails to interrupt above this zone, it could counsel renewed promoting strain from short-term holders, resulting in bearish retracements towards the $55K stage.