Operating an Ethereum L2 was traditionally very costly. L2s needed to pay thousands and thousands in knowledge availability prices to the L1.

All that modified with the Dencun hardfork (EIP-4844) in March 2024. It launched an enlargement of blockspace known as “blobs” for L2s to publish batched knowledge extraordinarily cheaply to the L1. Blob area sits in a separate charge market from the L1. It’s about an order of a magnitude cheaper than L1 blockspace, making it a important side of Ethereum’s rollup-centric roadmap.

As an instance that time, Base paid $9.34 million in bills for Q1 2024, which noticed a pointy drop to $699k in Q2 2024 and $42k in Q3 2024, based mostly on TokenTerminal knowledge.

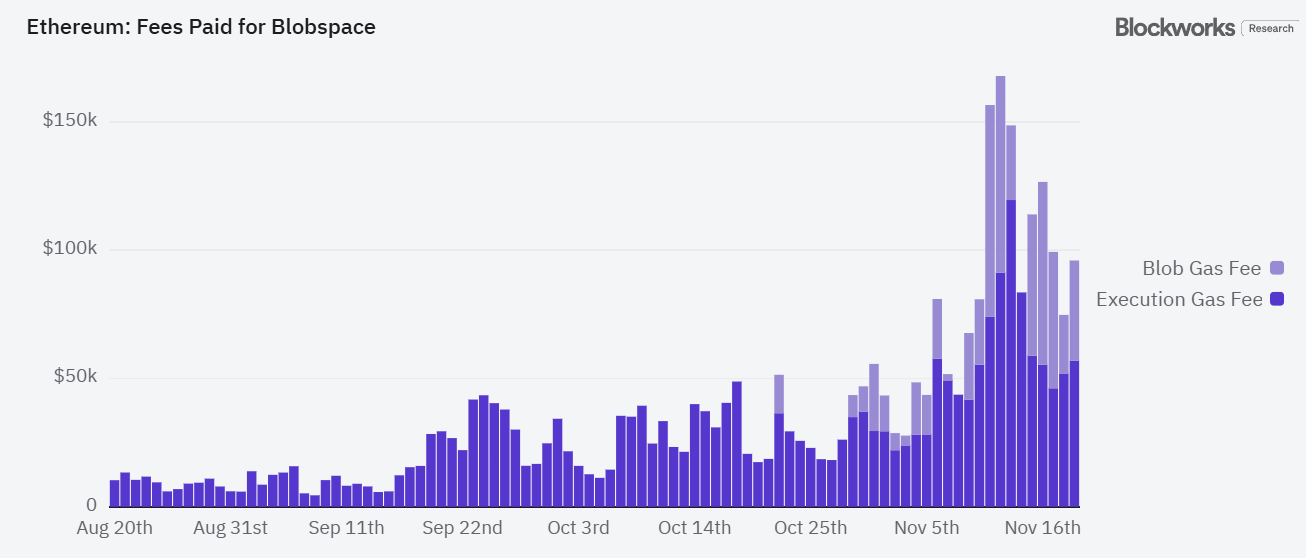

The unhealthy information (or good?) is that blobspace is getting considerably expensive once more as onchain exercise picks up within the bull market.

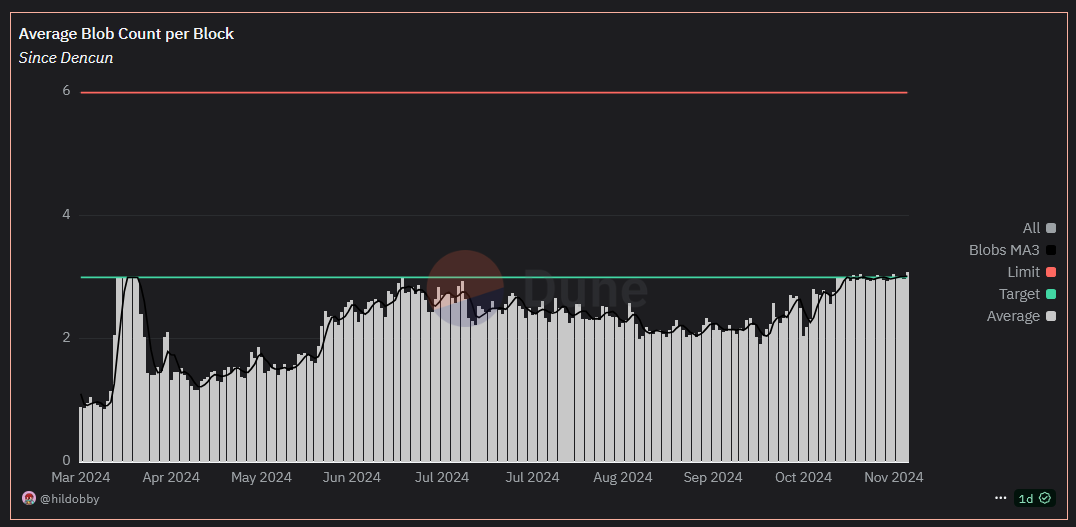

Blobs at this time are restricted to 6 per mainnet block. When blob utilization hits a goal restrict of fifty%, or three, a base charge is launched to manage demand utilization by a whole bunch of L2s. When utilization hits 4 blobs, base charges are additional elevated by as much as 12.5% for the following block.

That’s precisely what’s beginning to happen over the previous a number of weeks (see chart under).

In brief, blobs aren’t free anymore and L2s want to begin paying “lease.” Based mostly on ultrasound.cash, blob charge burn is coming as much as about 212 ETH within the final 30 days, and has generated substantial blob charges to Ethereum mainnet.

So blobs are typically nice. L2s are cheaper to function, and that’s good for L2 customers.

However individuals (learn: ETH holders) aren’t pleased as a result of it appears to be like like L2s are getting away with paying barely any bills to the L1, which thereby accrues much less worth to ETH the asset.

This grievance facilities round pessimism that blob utilization shall be excessive sufficient to return worth to the L1 for 2 key causes:

- L2s are basically a enterprise. They may go for a less expensive knowledge availability supplier like Celestia or EigenDA, or worse nonetheless, a centralized knowledge availability committee (DAC) with weaker safety properties.

- L2s will merely delay posting knowledge again to the L1 when blob markets get costly, as we’ve seen Scroll and Taiko do up to now.

In a debate round blobs at Devcon, Ethereum researcher Ansgar Dietrichs acknowledged the misaligned incentives of L2s however counter-argued that Ethereum’s DA would matter extra in the long run with extra L2 networks coalescing round it as belief bottlenecks emerge round bridging.

There was additionally the “blobs is a loss chief” argument by Blueyard’s Tim Robinson. He notes that whereas blobs don’t generate a lot income at current, they might achieve this in a short time because of the economics of blob design, and pay huge dividends for Ethereum sooner or later. In response to Robinson’s blob simulator, a hypothetical Ethereum L1 processing 10,000 TPS with a 16 MB blob dimension (blob sizes are 125 KB at this time) would burn 6.5% of ETH a yr.

This potential worth accrual for ETH is why blobs could be basically good for Ethereum in the long term. Throttling blob limits or elevating blob charges to extract extra worth from L2s within the brief run would mainly be a foul “rent-seeking” concept.

And Ethereum researchers are placing their cash the place their mouth is. In an Ethereum Analysis publish revealed two days in the past, Toni Wahrstätter known as for both a conservative improve to 4/6 blobs or the next 6/9 blob rely.

In ACDE #197, Vitalik additionally proposed a 33% increment of blob area within the subsequent Pectra laborious fork, which he cautioned was important. In any other case, customers would depart to different chains.

In sum, the complicated debate round blobs boils right down to the query of whether or not Ethereum desires to prioritize the common L2 person and its “Ethereum-aligned” L2 ecosystems, or prioritize worth accrual to ETH the asset.

Ethereum researchers imagine that prioritizing the latter might trigger an exodus of customers and builders to cheaper chains, and are doubling down accordingly on scaling blob area for the long run. Nonetheless, that damages the notion of ETH as an financial asset, which in flip angers ETH token holders within the brief run.

It’s a difficult scenario for Ethereum both method, one which requires the mammoth process of crystal-balling into the long run and accounting for a myriad of “what-ifs.” Time will inform which path is appropriate.