Desk of Contents

Who Is Tom Lee?What Is Bitmine’s Ethereum Technique?How Does MAVAN Match In?What About These Billions in Losses?Is the Saylor Comparability Honest?What’s Subsequent for Lee and Bitmine?Often Requested Questions

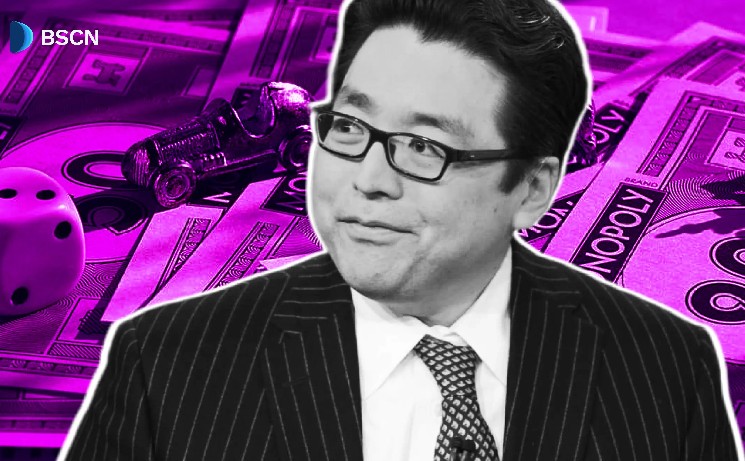

Tom Lee is the chairman of Bitmine Immersion Applied sciences, an organization accumulating Ethereum at a tempo that makes Michael Saylor’s Bitcoin shopping for look cautious. With 4.28 million $ETH on the books and over $6 billion in unrealized losses, Lee has turn into probably the most aggressive institutional advocate for Ethereum in public markets.

The comparability to Saylor is not simply catchy branding. Lee runs the identical playbook: use a public firm treasury to stack a single crypto asset, defend the technique via brutal drawdowns, and wager that long-term appreciation will reward affected person holders. The distinction is pace. Critics level out Lee is shopping for $ETH at roughly 12 instances Saylor’s tempo with Bitcoin.

Who Is Tom Lee?

Earlier than turning into crypto’s loudest Ethereum bull, Lee constructed his repute on Wall Road. He served as Chief Fairness Strategist at J.P. Morgan from 2007 to 2014, the place his market calls earned him a following amongst institutional traders. He graduated from the Wharton Faculty on the College of Pennsylvania with a level in economics and is a CFA charterholder. He co-founded Fundstrat International Advisors, the place he nonetheless serves as managing accomplice and head of analysis.

Lee was among the many first main Wall Road strategists to cowl Bitcoin formally, issuing consumer analysis stories as early as 2013. That early entry gave him credibility when crypto went mainstream. He grew to become a fixture on CNBC applications like Quick Cash, Halftime Report, and Closing Bell, the place he frequently presents takes on markets, tech, and digital belongings.

His worth predictions have a tendency towards the daring. He at the moment forecasts Bitcoin hitting $200,000 to $250,000 by the tip of 2026. For Ethereum, his thesis facilities on utility: sensible contracts, asset tokenization, and what he calls “the way forward for finance.”

Tom Lee (fundstrat.com)

What Is Bitmine’s Ethereum Technique?

On June 30, 2025, Lee was appointed Chairman of the Board at Bitmine Immersion Applied sciences (NYSE American: BMNR). The corporate had beforehand operated as a Bitcoin miner however pivoted to turn into what it calls “the world’s main Ethereum treasury agency.”

The technique is simple. Bitmine acquires, holds, and manages $ETH as its main treasury reserve asset. The corporate additionally presents digital ecosystem companies, together with consulting and advisory work, however the core enterprise is accumulation.

Bitmine’s inside philosophy goes by “the alchemy of 5%.” The aim is to finally management as much as 5% of Ethereum’s complete provide via treasury administration, staking, and participation in decentralized finance protocols.

As of February 1, 2026, Bitmine holds 4,285,125 $ETH. That represents roughly 3.55% of Ethereum’s circulating provide. The corporate added 41,788 $ETH price $96 million in simply the previous week, persevering with to purchase via market weak point.

Most of those holdings are staked. Whole staked $ETH reached 2,897,459, up roughly 888,000 prior to now week alone.

How Does MAVAN Match In?

Bitmine plans to launch MAVAN (Made-in-America Validator Community) in Q1 2026. This devoted staking infrastructure goals to generate substantial yield whereas contributing to the Ethereum community safety.

At scale, the corporate tasks potential annual staking rewards of $374 million at a 2.81% efficient staking price. The validator community represents Bitmine’s effort to earn yield on its large holdings fairly than leaving them idle.

What About These Billions in Losses?

Here is the place the Saylor comparability will get uncomfortable. With $ETH buying and selling round $2,100–$2,250 in early February 2026, Bitmine’s holdings are valued at roughly $9.4–$9.7 billion. However the firm’s value foundation places it deep underwater, with unrealized losses exceeding $6 billion.

Lee has addressed this straight. He calls the losses “by design,” explaining that Bitmine is structured like an index product meant to trace and outperform $ETH over a full market cycle. Drawdowns throughout downturns are anticipated, not feared.

“BitMine has been steadily shopping for Ethereum, as we view this pullback as engaging, given the strengthening fundamentals,” Lee mentioned in a latest assertion. “In our view, the worth of $ETH is just not reflective of the excessive utility of $ETH and its position as the way forward for finance.”

He is pushed again on critics who argue the losses cap $ETH‘s upside, calling them “a function, not a bug” of the long-term method.

Is the Saylor Comparability Honest?

The parallel has apparent benefit. Each males use public firm treasuries to build up crypto. Each defend their methods via extreme drawdowns. Each body their chosen asset as important infrastructure for the long run monetary system.

However there are variations price noting. Lee’s tempo of accumulation far exceeds Saylor’s. Bitmine has constructed its place sooner, which implies better publicity throughout unstable intervals. Lee’s compensation construction additionally ties his private upside to particular milestones: 500,000 shares for reaching 4% of $ETH provide, plus stock-based incentives and assured funds totaling $35 million over 4 years.

Trade observers give Lee credit score for one factor, no matter how the commerce performs out. His high-profile advocacy has helped educate establishments about Ethereum’s potential, probably accelerating adoption even when his personal wager underperforms.

Bitmine at the moment ranks as the highest public Ethereum treasury holder, forward of companies like SharpLink and Bit Digital.

What’s Subsequent for Lee and Bitmine?

Lee attributes latest crypto weak point to diminished leverage following the October 2025 crash, plus spillover results from declines in treasured metals. He cites enhancing on-chain metrics, together with record-high day by day Ethereum transactions and lively addresses, as proof that fundamentals stay sturdy regardless of worth motion.

The corporate has additionally diversified barely. In January 2026, Bitmine invested $200 million in Beast Industries, the corporate behind MrBeast. It is an uncommon transfer that blurs the road between digital platforms and finance.

Whether or not Lee’s wager pays off will depend on Ethereum’s worth trajectory over the approaching years. For now, he is dedicated to the technique that earned him the Saylor comparability: hold shopping for, hold staking, and watch for the market to meet up with the basics.

Sources:

- PR Newswire — Bitmine press launch (Feb 2, 2026) with $ETH holdings, staking figures, MAVAN plans, and Lee quotes on fundamentals

- CoinDesk — Protection of Lee defending $6B+ unrealized losses as “by design”

- The Block — Lee’s “function, not a bug” protection and Ethereum treasury rankings

- Benzinga — Lee’s $200K-$250K Bitcoin prediction for 2026

- CoinDesk — Lee’s January 2026 outlook and Ethereum “way forward for finance” feedback

- Fundstrat — Tom Lee biography confirming Wharton schooling and J.P. Morgan tenure

- Wikipedia — Lee’s background, early Bitcoin protection, and Bitmine chairmanship