Consultants have predicted a rise within the whole worth locked (TVL) within the stablecoin sector to $300 billion, in addition to a rise within the stage of acceptance of those belongings. The opinions of key gamers and analysts within the crypto asset sector have been collected in Cointelegraph. Details:

- Consultants agreed that the dominance of USDC and USDC will proceed whereas the TVL sector will develop.

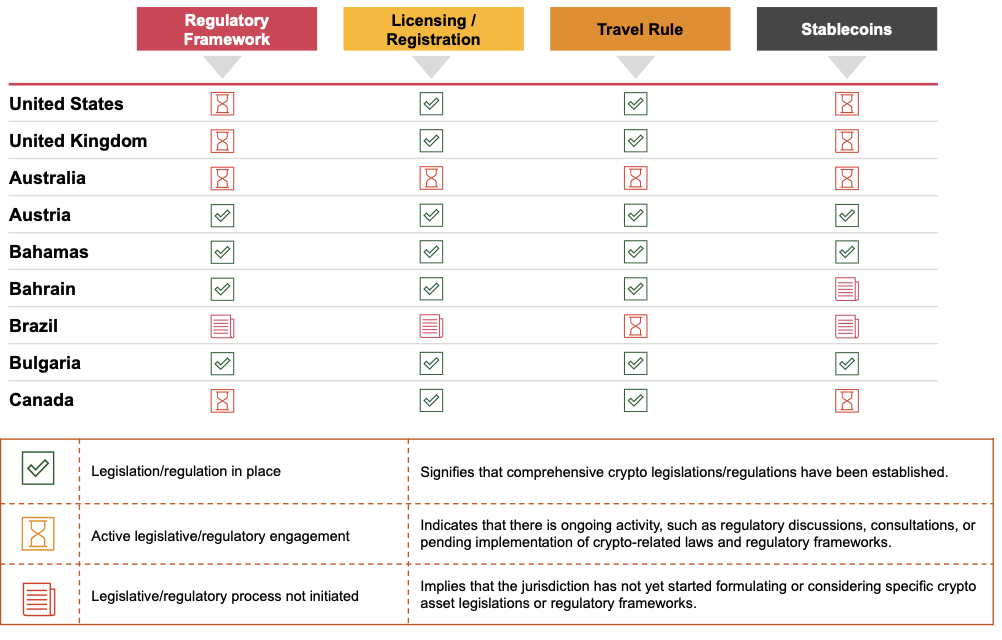

- The principle drawback of the section will stay the inconsistency of guidelines in numerous jurisdictions.

So, let’s dive deep.

TVL of $300 Billion and the Dominance of the Largest Stablecoins

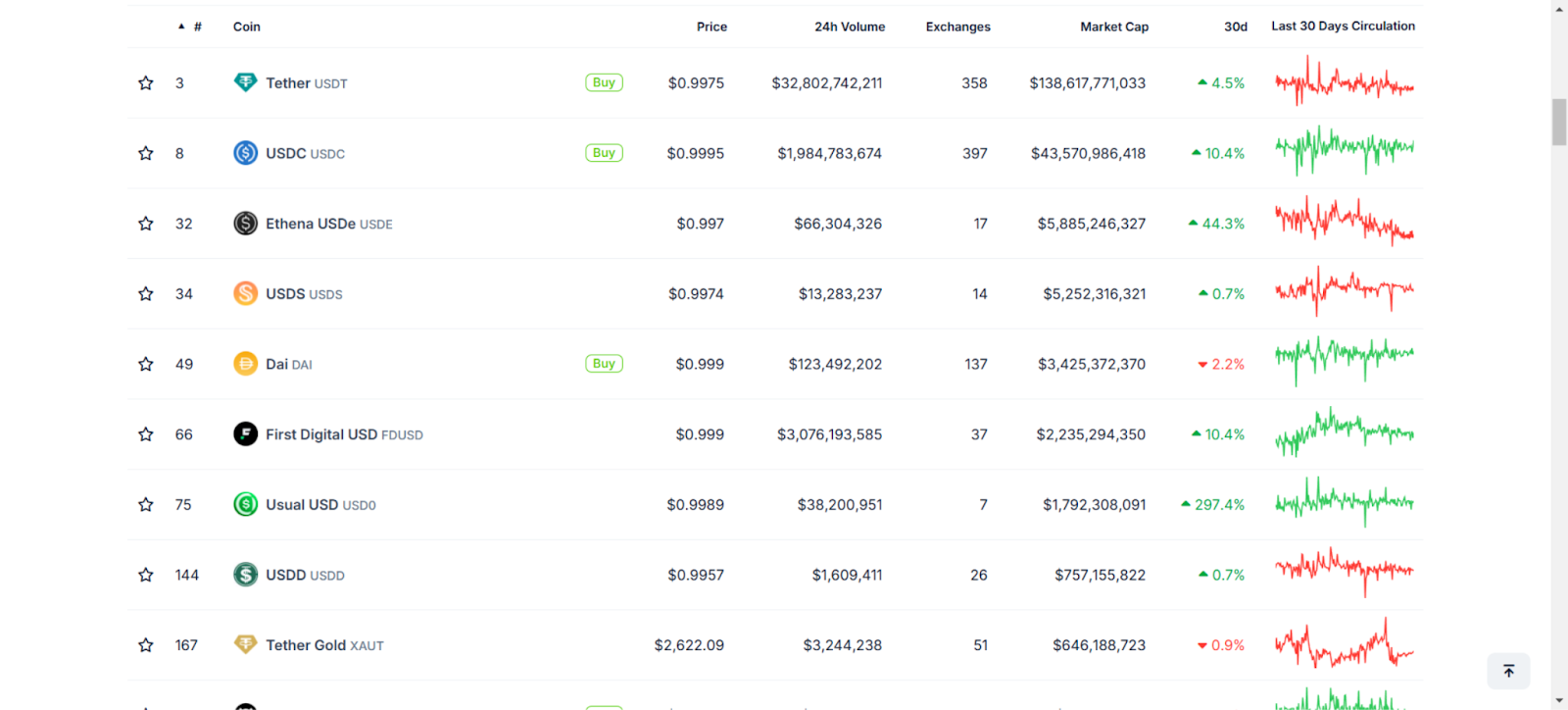

As a reminder, in early December 2024, the entire worth locked on this class up to date its historic excessive at over $200 billion. That is roughly 5% of the crypto market capitalization on the whole.

Most of this quantity, nearly $182 billion, is accounted for by two belongings — USDT and USDC, in keeping with CoinGecko. Consultants are assured that the dominance of those stablecoins will proceed, and the sector’s TVL will exceed $300 billion.

Alchemy Pay’s chief advertising officer, Ailona Tsik, believes that a big market share will stay for stablecoins backed by fiat. Tsik famous that the adoption of those belongings in each rising markets and the decentralized functions sector will speed up.

Customers Will Favor to Earn on their Stablecoins

Because the stablecoin ecosystem matures, customers are more and more on the lookout for methods to generate returns on their holdings. That is well-demonstrated by PayPal’s PYUSD. Business consultants anticipate extra stablecoin issuers will observe go well with in 2025, introducing progressive yield-bearing mechanisms to draw and retain customers.

This demand for incomes alternatives arises out of the customers’ have to combat inflation with out compromising the steadiness of their digital belongings. This development represents a pure evolution from the mere use of stablecoins as a retailer of worth or medium of change to see them as productive devices of finance. Nonetheless, the growing presence of “unique” yield-generating stablecoins may introduce advanced dangers that retail customers may not absolutely perceive, in keeping with Vishal Gupta. This once more underlines the necessity for clear danger disclosure and clear regulatory frameworks that effectively stability investor safety with area for innovation.

One other issue that might additional speed up institutional adoption is the current development towards yield-bearing stablecoins, as companies search for efficient methods to handle treasury operations whereas incomes returns on their digital asset holdings. This improvement additionally bodes nicely for the broader prediction of elevated stablecoin utilization in B2B funds and cross-border transactions.

One such perspective venture is Molecula. It presents protected deposits for stablecoin holders, particularly for conventional buyers.

Demand for Playing cards with Help for Stablecoins

Based on Cuy Sheffield, head of cryptocurrency at Visa, 2024 was a interval of renewed demand for these belongings. On the identical time, the out there methods to spend stablecoins stay restricted, the skilled believes.

On this regard, he expects the demand for playing cards supporting stablecoins to develop considerably in 2025.

Based on Sheffield, Visa plans to increase its capabilities to permit issuers to instantly pay on such playing cards with the corporate by means of stablecoins.

Uphold CEO Simon McLoughlin is assured that stablecoins will turn out to be a brand new development in worldwide funds in 2025. He additionally cited examples of recent belongings specialised for cross-border funds. The latter embrace, specifically, the RLUSD stablecoin from Ripple Labs.

Invoice Zielke, the market director at BitPay, additionally said this. Based on him, in 2024, stablecoins account for five% of all transactions on the platform. On the identical time, they occupy about 25% of the entire quantity.

Zielke believes that this development will proceed in 2025. Based on him, the position of stablecoins in B2B funds will solely enhance.

The Key Downside is Regulatory Variations

“One of many key challenges we foresee for stablecoins in 2025 is navigating the evolving regulatory panorama,” Alchemy Pay’s Tsik mentioned.

Ben Reynolds, head of stablecoins at BitGo, elaborated on this concept. Based on him, regulatory uncertainty and lack of transparency will stay the important thing challenges for the sector in 2025.

The principle impediment to eliminating that is the inconsistency of approaches in numerous nations, as identified by Vishal Gupta, founding father of the True Markets venture.

On this regard, Gupta emphasised that jurisdictions with clear, easy, and comprehensible guidelines are more likely to profit, whereas markets with overly advanced and burdensome rules will lose. The skilled is referring to the MiCA regulation within the EU.

It’s value reminding that representatives of stablecoin issuers have repeatedly said the dangers generated by this regulatory framework.

Stablecoin Developments in 2025

Consultants have recognized three fundamental areas through which the event of stablecoins is anticipated to be essentially the most speedy:

- L2 options;

- Profitability;

- Compatibility.

Zielke believes that the important thing development would be the introduction of stablecoins on the second stage, for instance, within the Arbitrum, Optimism, and Base networks. Reynolds identified that the sector is more likely to obtain a lift when it comes to blockchain compatibility and consolidation.

This may permit stablecoins to maneuver seamlessly throughout the ecosystem, creating new alternatives in retail and institutional markets.

Morph’s COO, Azeem Khan, added that new stablecoins with a built-in profitability mechanism are more likely to seem in the marketplace. For example, he talked about PYUSD from PayPal, whose homeowners can obtain remuneration for instantly proudly owning the asset.

Conclusion

The stablecoin market may surge in 2025, with forecasters predicting that TVL will attain $300 billion. USDT and USDC are very more likely to additional construct on their market share, with new use circumstances arising for worldwide funds and card providers. Nonetheless, inconsistency in regulatory approaches from regulators stays a key problem, with additional improvement doubtless round L2 options, yield mechanisms, and cross-chain interoperability. Whereas innovation continues with “unique” stablecoins, business leaders are elevating the bar to stability innovation with transparency and client safety.

BIO:

Stacey Surprise is a content material marketer who enjoys sharing finest practices for self-development and careers with others. In her free time, Stacey is fond of latest dance and basic French films. You might be at liberty to succeed in out to her at GuestpostingNinja@gmail.com or for collaboration strategies.