With the stablecoin economic system now valued at $276.8 billion, the sector has skilled hanging development—and one token has muscled its method into the highest ten. In current occasions, Falcon Finance’s artificial stablecoin USDf has crossed the $1 billion mark in market capitalization, securing its place because the ninth-largest fiat-pegged token by worth.

USDf Unpacked: How This Stablecoin Landed within the Prime 10 So Rapidly

Falcon Finance’s USDf is an overcollateralized artificial stablecoin designed to carry its peg to the U.S. greenback by means of diversified crypto reserves and institutional-grade decentralized finance (DeFi) methods.

Not like standard fiat-backed tokens, USDf depends on crypto belongings—together with stablecoins comparable to USDT and USDC alongside unstable tokens like BTC and ETH—as collateral.

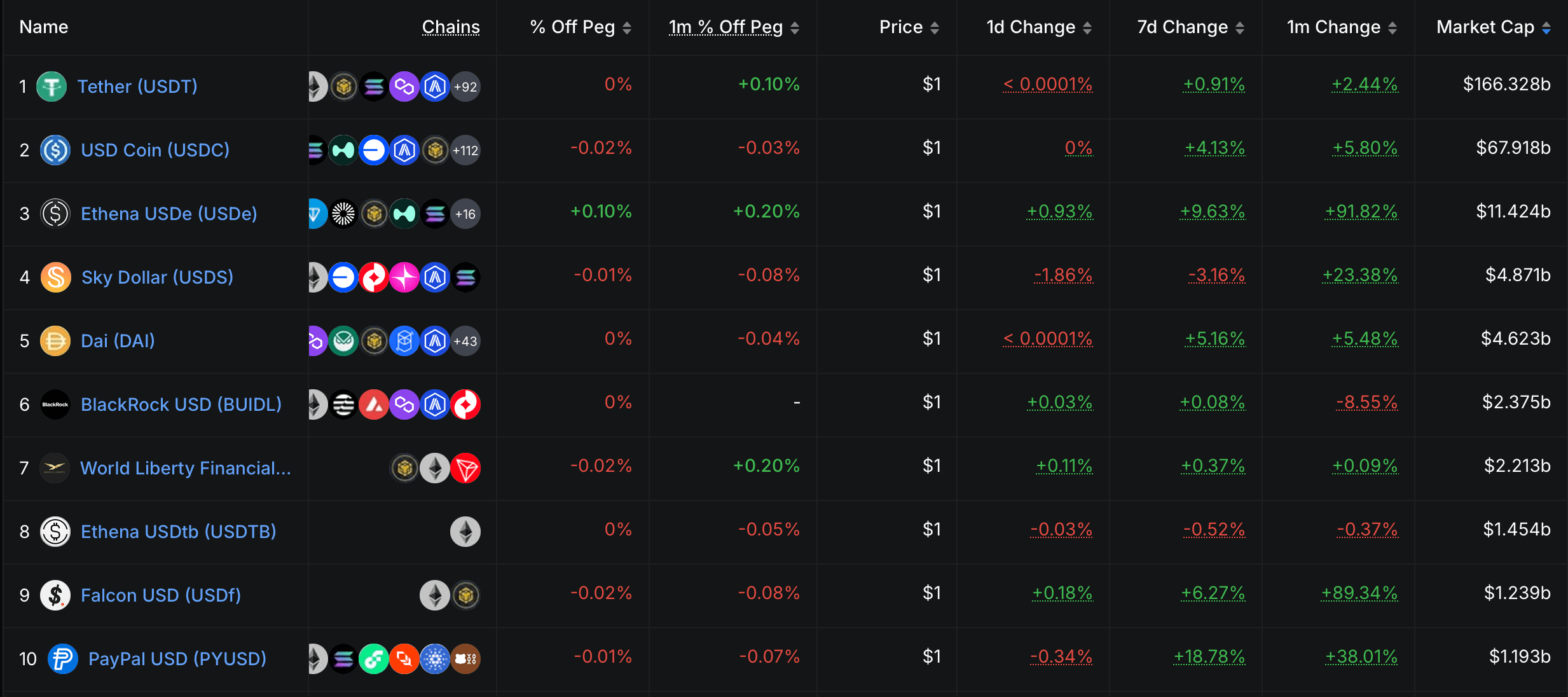

Prime ten stablecoins by market cap in response to defillama.com stats on Aug. 19, 2025.

USDf minting requires overcollateralization: stablecoins are accepted at a 1:1 ratio, whereas unstable tokens demand increased deposits (for instance, $150 in ETH to create 100 USDf) to soak up market value swings.

To keep up its $1 peg, falcon usd (USDf) additionally deploys arbitrage and delta-neutral buying and selling. When the token dips beneath $1, consumers are incentivized; when it climbs above, customers are motivated to mint and promote—automated mechanisms that restore steadiness.

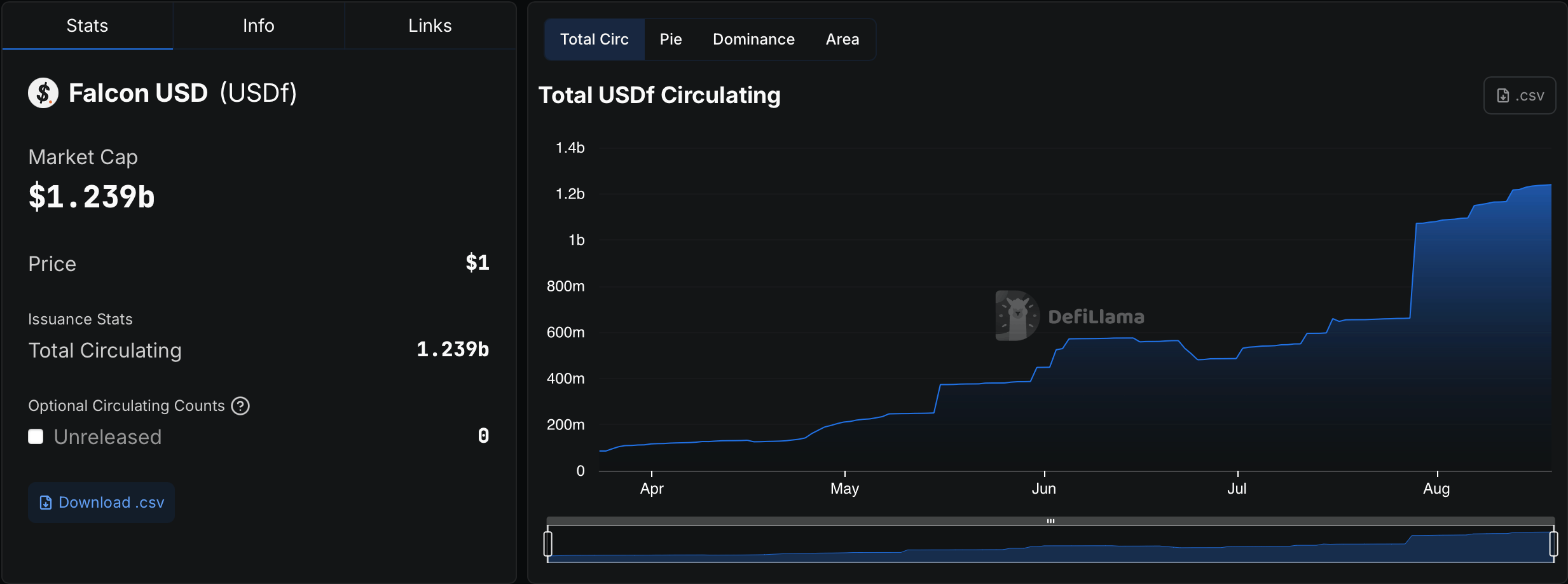

On the shut of March, USDf’s market capitalization was $85 million. Over the previous 146 days, its provide has expanded by 1,355.29%. Roughly 91% of USDf circulates on the Ethereum blockchain, with the remaining share issued on Binance Good Chain.

Documentation explains that holders can stake USDf to obtain sUSDf, an appreciating ERC-4626 token. Yields are generated from market-neutral methods comparable to funding-rate arbitrage (44% of returns) and cross-exchange arbitrage (34%), providing as much as 11.8% APY.

Locking sUSDf for 3 to 12 months can elevate returns to fifteen%. The protocol enforces a collateral ratio between 115% and 116%, with reserves audited quarterly and monitored in actual time utilizing Chainlink Proof of Reserve. As of Aug. 18, 2025, USDf’s market capitalization stood at $1.24 billion.

Development drivers embody partnerships comparable to Bitgo, integration with tokenized treasuries, and deployment on buying and selling platforms like Uniswap and Curve. Provide exceeded $1 billion simply three months after its April 2025 debut. USDf sits amongst a wave of contemporary contenders climbing into the highest ten stablecoin ranks, alongside Sky’s USDS, Blackrock’s BUIDL, World Liberty Monetary’s USD1, and Ethena’s USDtb.