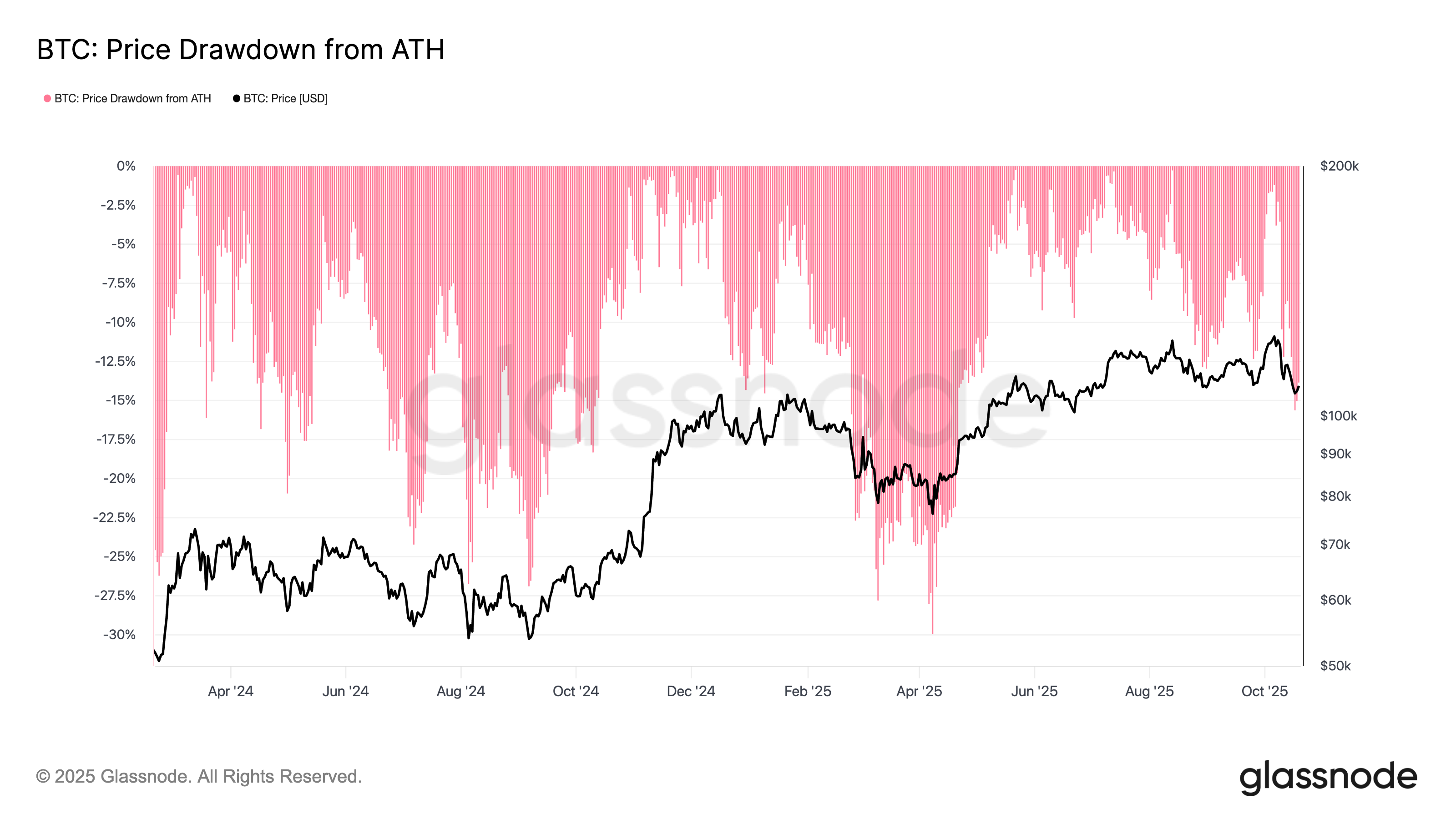

Bitcoin BTC$110,850.81 bottomed out at round $103,500 on Friday, marking an 18% correction from its all-time excessive of $126,200 reached on Oct. 6. This aligns with a normal bull market correction, the place bitcoin sometimes retraces round 20% a sample that has outlined the present cycle because it started in 2023.

Value Drawdown from ATH (Glassnode)

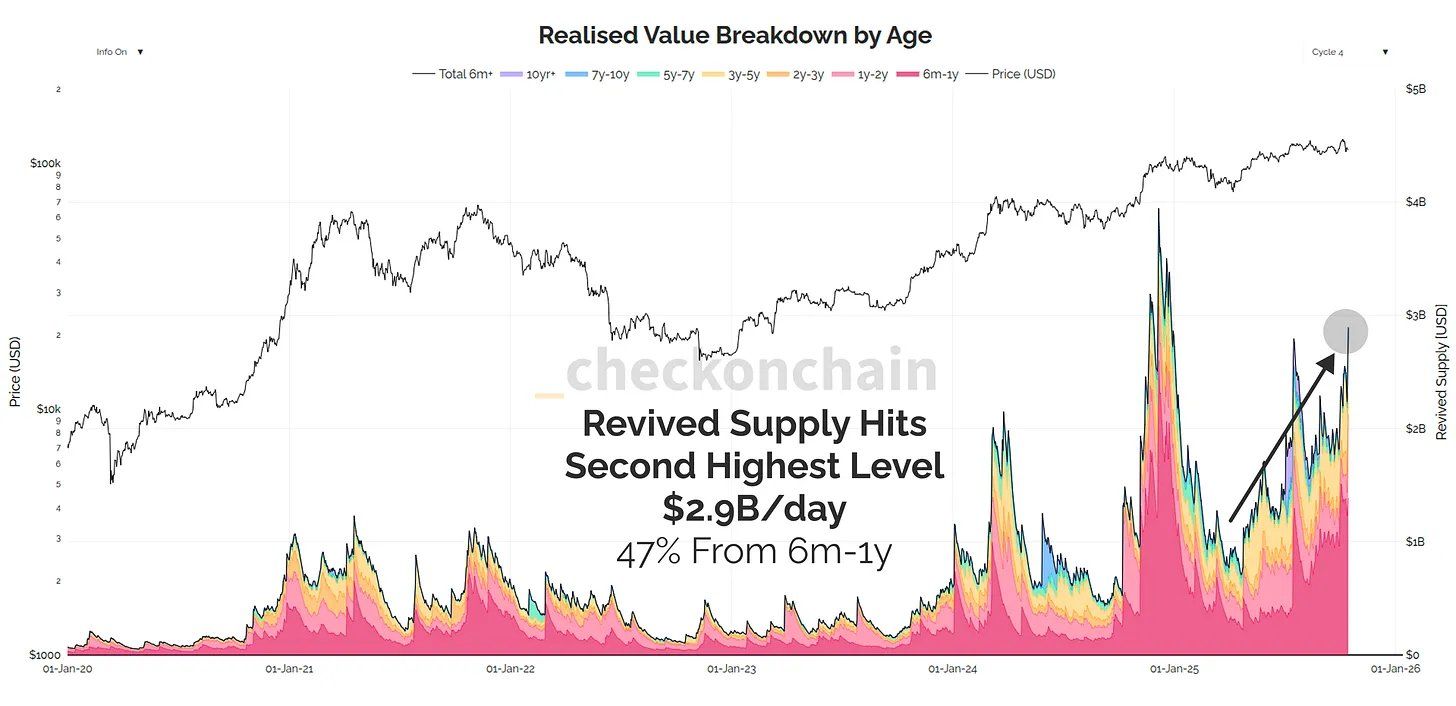

The principle supply of sell-side strain out there is present bitcoin holders, in accordance with analyst Checkmate.

“The sheer quantity of sell-side strain from present bitcoin holders remains to be not extensively appreciated, but it surely has been the supply of resistance. Not manipulation, not paper bitcoin, not suppression. Simply good quaint sellers”, Checkmate famous.

The primary chart illustrates revived provide, which refers back to the whole quantity of cash returning to circulation after being dormant for a sure period of time. Revived provide has just lately reached its second-highest degree of the cycle at $2.9 billion per day.

Notably, 47% of promoting strain is coming from cash held for six months to 1 yr, suggesting that many traders who purchased bitcoin on the finish of 2024 and notably throughout its drop to round $76,000 in April following tariff-related market reactions are actually taking earnings.

Realized Worth breakdown by age (Checkmate)

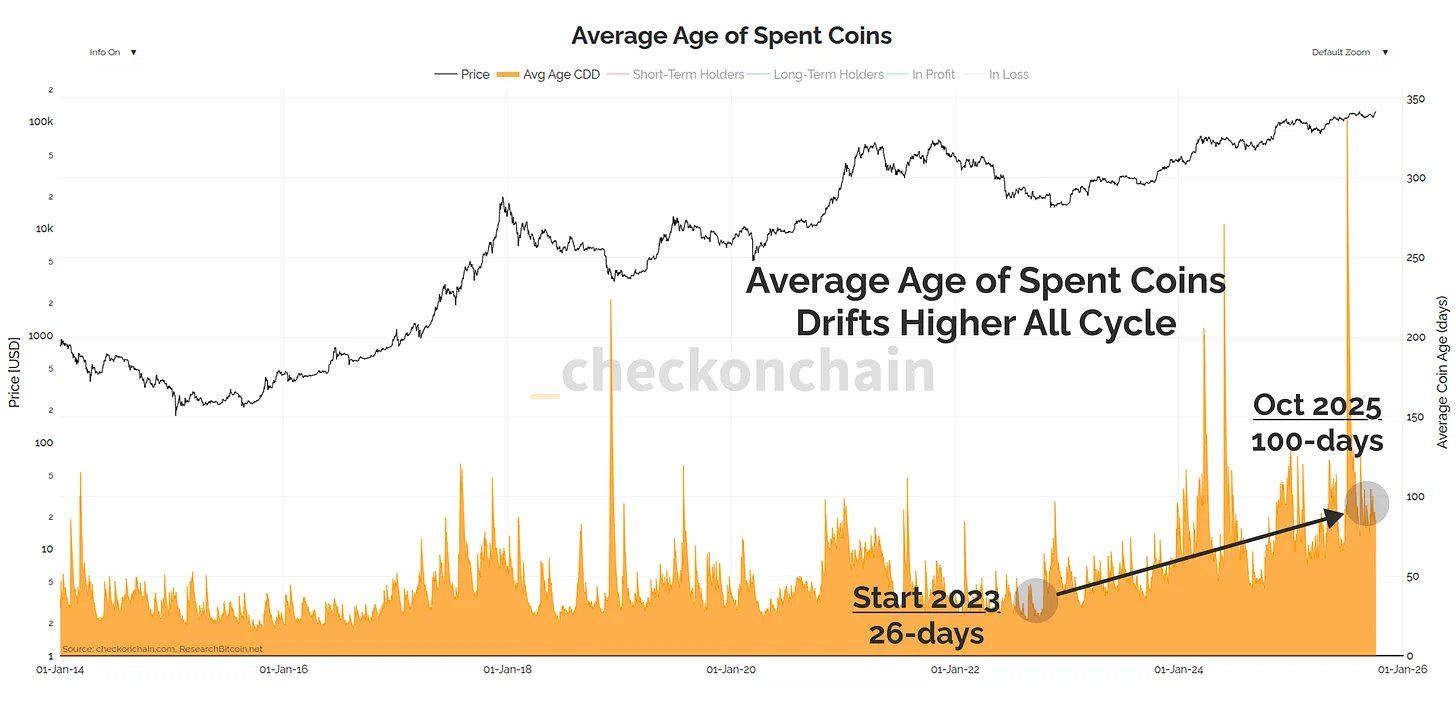

The second chart highlights an identical development by means of the typical age of spent cash, which has continued to rise all through this cycle. Firstly of the cycle in 2023, the typical age of spent cash was 26 days, comparatively younger age, but it surely has now elevated to 100 days. This means that older cash are more and more being spent as holders select to understand beneficial properties.

Common Age of Spent COins (Checkmate)

Supporting this profit-taking narrative, Checkmate additionally reveals that realized earnings have surged to about $1.7 billion per day, one of many highest ranges seen this cycle. In the meantime, realized losses have additionally climbed to $430 million per day, the third-highest degree of the cycle, a excessive degree of capitulation.

Total, the info means that profit-taking stays the dominant market habits, and this continued promoting strain is weighing on bitcoin’s value.