Within the final couple of days, Bitcoin (BTC USD) has seen its value fluctuate between a low of $102,335.72 and a excessive of $106,428.81.

The value motion makes it seem like BTC has stagnated inside this value vary, unable to retest its all-time excessive (ATH) of $109,114.88.

Regardless of Bitcoin’s value being lower than 3% away from this historic peak, it seems caught.

This has fueled speculations in some quarters that Bitcoin might need been overbought and may not document additional progress.

What Bitcoin’s Mayer A number of Signifies

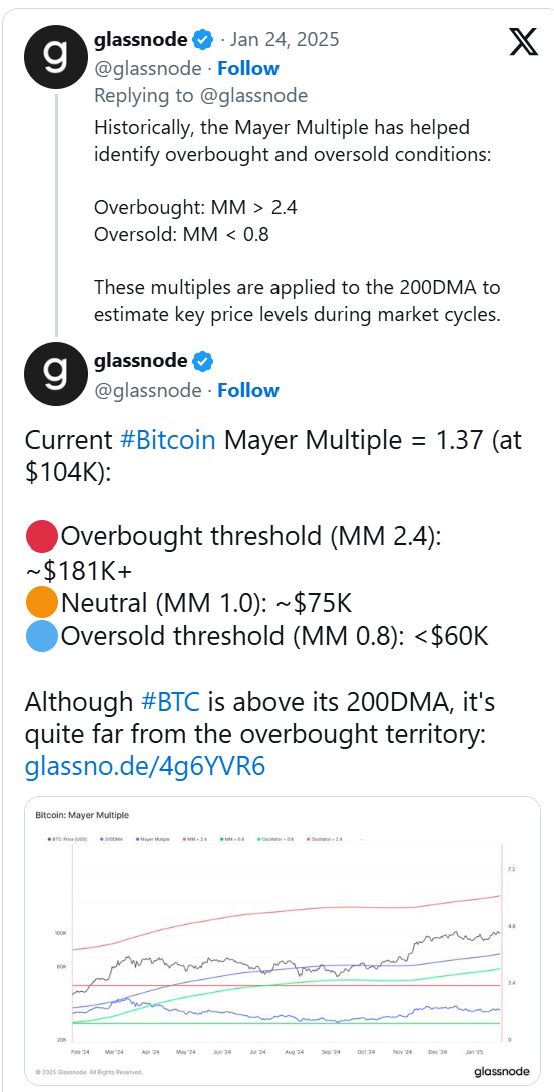

Glassnode, a number one on-chain and monetary metrics platform, has addressed these considerations.

Counting on Bitcoin’s Mayer A number of (MM) indicators, Glassnode famous that Bitcoin will not be oversold but.

– Commercial –

It stated the value would wish to exceed $181,000 earlier than falling into the overbought zone.

Different analysts have even projected the next value vary between $145,000 and $249,000. These relied on Bitcoin’s value multiplier tendencies.

For readability, the Mayer A number of (MM) is a well-liked metric created by Hint Mayer. It helps assess whether or not Bitcoin has been overbought, oversold, or traded in a impartial zone.

That is often benchmarked in opposition to its historic value sample.

Supply: X

It’s obtained by dividing the present value of Bitcoin (BTC USD) by its 200-day transferring common. Relying on the worth obtained, analysts may decide if Bitcoin is both overvalued or undervalued.

It’s price mentioning that the device doesn’t point out if an investor can purchase, maintain, or promote Bitcoin.

The present Bitcoin MM worth because the asset’s value hovers round $104,000 is 1.37. This means that Bitcoin’s value is 1.37 occasions its 200-day transferring common.

It alerts optimistic momentum for the digital asset because it stays throughout the impartial zone and never but within the overbought territory.

Bitcoin (BTC USD) Path to $181,000: Bull Run Simply Starting?

The Bitcoin MM indicator supplies perception into the seemingly value trajectory for the world’s main digital coin.

The MM stage has to rise above 2.4 or $181,000 for BTC to flip into the overbought zone. At that stage, it implies that the Bitcoin market has develop into overheated and will crash.

As of this writing, Bitcoin value trades at $106,123.90, representing a 1.18% enhance within the final 24 hours.

The present value stage exhibits Bitcoin (BTC USD) nonetheless has about $74,000 to broaden per the MM indicator.

Specialists recommend that Bitcoin’s bull run has not commenced, given the large value hole between its present and projected costs.

They keep that whereas Bitcoin’s value has risen above the 200-day transferring common, it’s nonetheless removed from being overbought.

It is because the present MM worth of 1.37 is effectively under the overbought threshold of two.4.

It means that Bitcoin’s market stays wholesome and performing effectively, with potential for additional progress.

Bitcoin Key Assist Ranges

Bitcoin within the broader crypto market has managed to remain above the psychological stage of $100,000.

The coin has discovered assist at $100,700 because it has not dropped under this stage within the final 4 days.

Market observers say BTC should discover assist above the $104,000 value mark to document greater efficiency.

Moreover, traders must revive their curiosity within the asset as buying and selling quantity has dipped considerably.

As of this writing, Bitcoin’s buying and selling quantity has suffered a 13.74% decline to $71.97 billion.

Analysts opine {that a} rebound in traders’ confidence and broader market dynamics may set Bitcoin on an upward journey towards the $181,000 value projection.