Ethereum is grappling with a decisive assist vary between the 100-day MA ($3.2K) and the 200-day MA ($3K), a crucial area serving because the consumers’ final line of protection.

The end result at this stage is anticipated to form Ethereum’s mid-term trajectory.

Technical Evaluation

By Shayan

The Every day Chart

ETH just lately encountered heightened volatility because it approached the numerous $3.2K-$3K value vary, reflecting an intense battle between consumers and sellers. The worth motion highlights sellers’ makes an attempt to push the asset under these key transferring averages, signaling a possible bearish breakdown.

At present, Ethereum is discovering non permanent assist inside this vary, with the value confined between the $3.2K stage and the bullish flag’s higher boundary. A decisive breakout in both course is prone to decide the following main pattern for Ethereum.

The 4-Hour Chart

On the 4-hour chart, Ethereum consolidated close to the 0.5 ($3.2K) and 0.618 ($3K) Fibonacci retracement ranges earlier than briefly breaking under this crucial assist zone. Nevertheless, robust shopping for curiosity rapidly drove the asset again above the $3.2K mark.

This area stays pivotal because it represents the ultimate major assist zone for consumers. A sustained maintain above the $3.2K stage may reignite bullish momentum, concentrating on a restoration towards greater resistance traces.

Conversely, a breakdown under this vary may set off liquidations, probably driving the value towards the $2.5K assist zone. For now, Ethereum is consolidating close to this crucial area, with a battle between consumers and sellers dictating the market’s subsequent transfer.

Onchain Evaluation

By Shayan

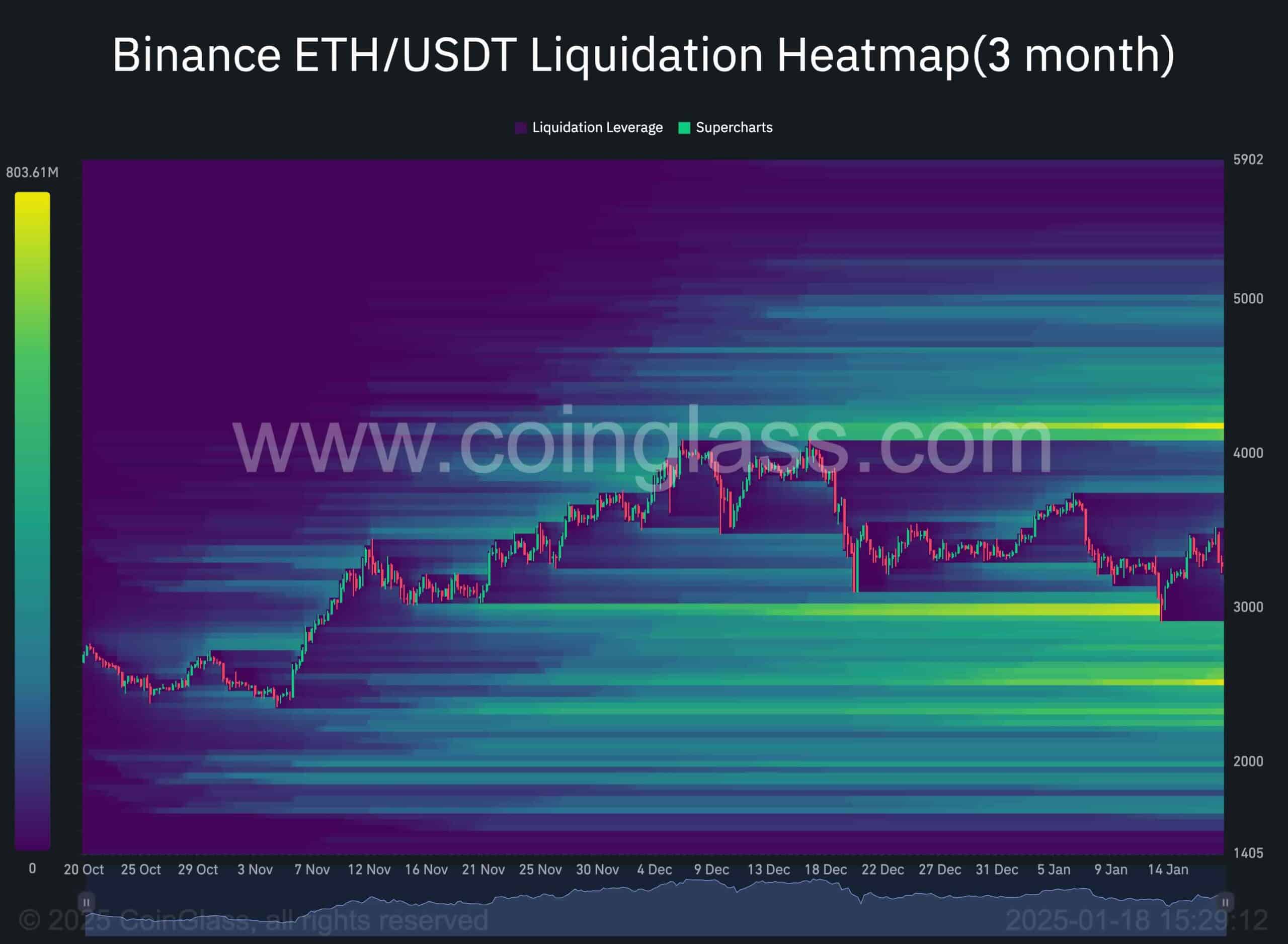

The Binance liquidation heatmap supplies insights into key ranges the place vital liquidation occasions are seemingly. Based mostly on the clustering of liquidation ranges for lengthy and brief positions, these ranges typically act as magnets, driving value motion towards them as market individuals purpose to seize liquidity.

Through the current shake-off, Ethereum grabbed liquidity on the $3K mark, leading to a pointy value restoration. A notable cluster of wrecked ranges nonetheless exists just under the crucial $3K assist, representing long-position liquidations. This makes the $3K space extremely engaging to bears and institutional sellers, rising the chance of a bearish breakout towards these ranges within the mid-term.

Nevertheless, a big liquidity pool additionally rests on the $4K threshold, marking a possible final goal for consumers. Nevertheless, it’s seemingly that the value could seize liquidity under $3K first, making a shakeout section earlier than resuming a bullish trajectory towards $4K. Whereas Ethereum’s present value motion displays consolidation, the $3K stage stays pivotal. A bearish breakout to seize liquidity under $3K is believable within the short-to-mid time period.