Knowledge reveals that over the previous 19 days, the tokenized U.S. Treasuries sector has expanded by 4.86%, amassing an extra $340 million.

$340M Shift to Tokenized Treasuries Indicators Institutional Embrace

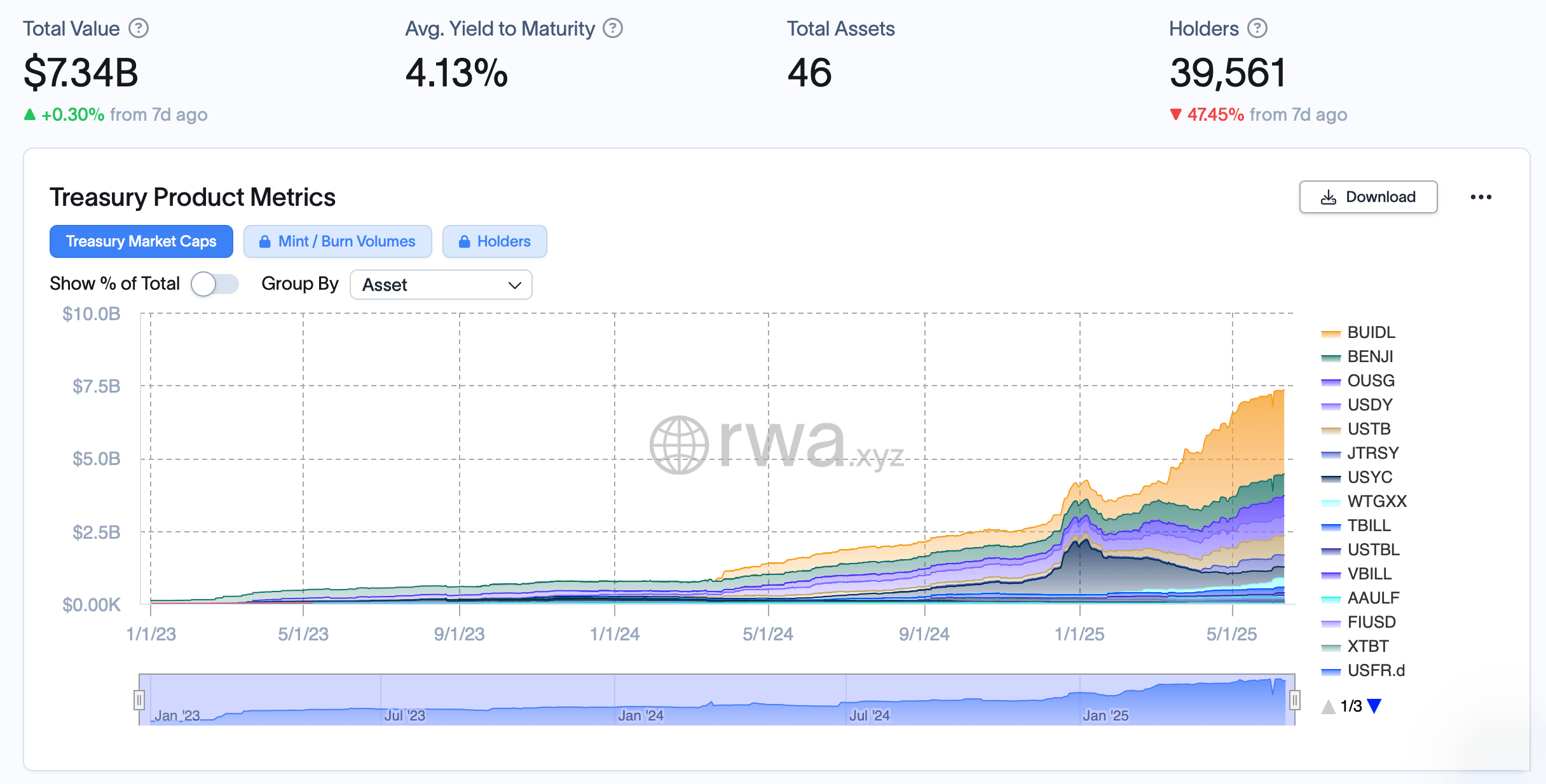

As of June 12, 2025, the blockchain-integrated U.S. Treasury fund market is valued at $7.34 billion, in response to rwa.xyz stats. Since Could 24, the sector has attracted roughly $340 million in inflows, reflecting a 4.86% improve. Blackrock’s USD Institutional Digital Liquidity Fund, recognized by its ticker BUIDL, at the moment holds a $2.890 billion market capitalization—a slight dip of $23 million from the $2.913 billion registered 19 days earlier.

BUIDL holds the excellence of being the most important tokenized U.S. Treasury fund by web asset worth, at the moment backed by 79 particular person holders. Trailing BUIDL is the Franklin Onchain U.S. Authorities Cash Fund, often called BENJI, with a steadiness of $742.04 million. Since Could 24, BENJI has contracted by $16 million, down from its earlier complete of $758 million, and is now held by roughly 607 traders.

The Ondo Quick-Time period US Authorities Bond Fund, or OUSG, at the moment ranks third by web asset worth, holding $691 million. That marks a $54 million improve from its $637 million complete recorded 19 days earlier. As per rwa.xyz information, OUSG now counts 73 distinct holders. Shut behind in fourth place is Ondo’s different tokenized providing, USDY, which has reached $683 million after climbing by $52 million throughout the identical interval. As of June 12, USDY is held by 15,492 distinctive individuals.

Claiming the fifth spot amongst tokenized funds is the Superstate Quick Period U.S. Authorities Securities Fund, now holding $668 million. That displays a $12 million uptick from its $656 million complete recorded on Could 24. A number of funds outdoors the highest 5 additionally attracted capital, collectively contributing to the $340 million added throughout the sector.

The regular climb in tokenized treasury holdings factors to a rising urge for food for blockchain-integrated monetary devices, hinting at broader institutional consolation with digitized real-world belongings. As capital continues to filter into these funds, the momentum suggests a redefinition of conventional fixed-income methods.