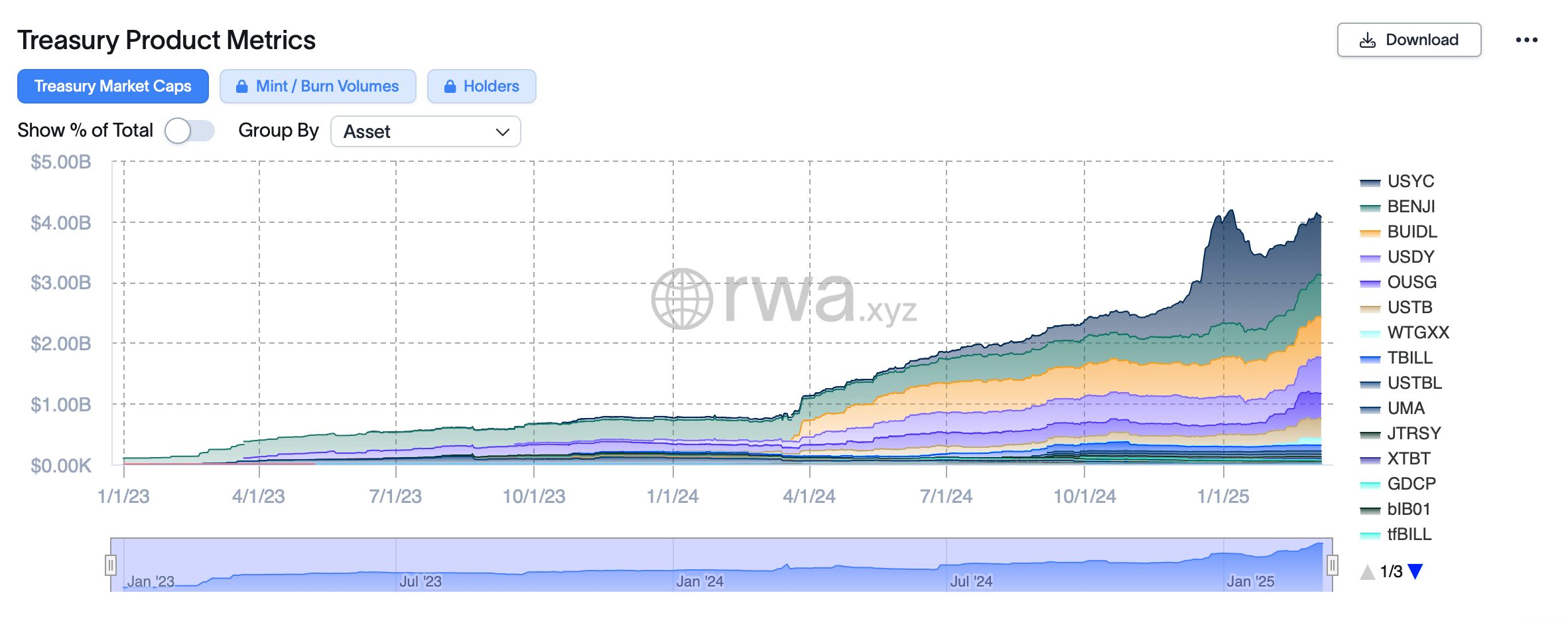

Over the past 103 days, the tokenized U.S. Treasuries sector has expanded by $1.57 billion, surpassing the $4 billion threshold—a testomony to accelerating institutional adoption. Dominating this enviornment is Hashnote Quick Length Yield Coin (USYC), which blends short-term U.S. Treasury holdings with Reverse Repo agreements, providing traders a dual-pronged avenue for yield era.

Hashnote’s USYC Practically Doubles as Tokenized Treasuries Surge Previous $4 Billion

Only recently, tokenized U.S. Treasuries vaulted to a $4.07 billion valuation, based on rwa.xyz knowledge. Primarily a modest dent within the short-term U.S. Treasury holdings briefly offered to counterparties traversing the Federal Reserve’s In a single day Reverse Repurchase Agreements (ON RRP). Although diminutive in scale, this market has defied expectations with a powerful $1.57 billion enlargement throughout 103 days.

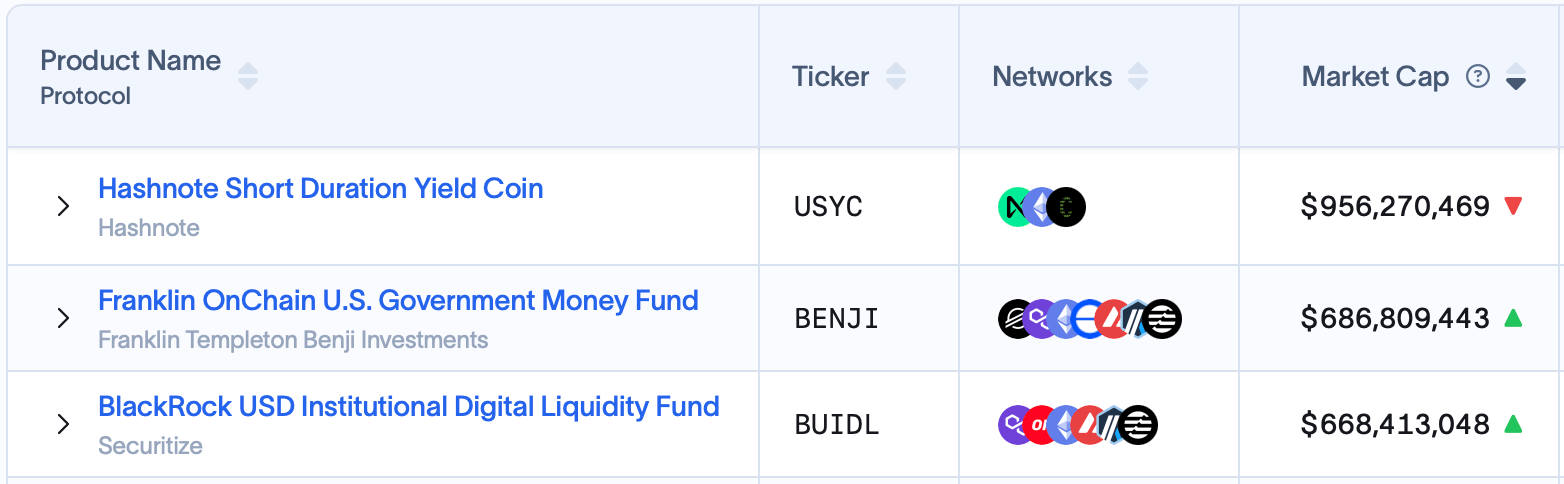

Reigning supreme with the biggest market capitalization, Hashnote Quick Length Yield Coin (USYC) noticed its market valuation balloon by $461.2 million between Nov. 26, 2024, and right now, catapulting from $495.07 million to $956.27 million. World traders outdoors the U.S. might faucet into this car by way of the Hashnote Worldwide Feeder Fund or the Quick Length Yield Fund (SDYF), supplied they clear eligibility hurdles (together with a $100,000 minimal stake).

Stateside individuals should fulfill the Commodity Futures Buying and selling Fee’s (CFTC) Certified Eligible Participant (QEP) standards to entry USYC via the Hashnote Feeder Fund. Following behind USYC is Franklin Templeton’s onchain fund referred to as Franklin Onchain U.S. Authorities Cash Fund additionally known as FOBXX or BENJI. Institutional traders can take part with BENJI via Franklin Templeton’s Institutional Internet Portal.

BENJI can also be out there to institutional traders in a number of European nations, together with Austria, France, Germany, Italy, Liechtenstein, Netherlands, Spain, and Switzerland. Franklin Templeton’s fund, since Nov. 26, grew by $270.35 million to its present market cap of $686.80 million. Claiming the bronze place is Blackrock’s tokenized providing, the Blackrock USD Institutional Digital Liquidity Fund (BUIDL).

Distributed by way of Securitize, BUIDL caters completely to heavyweight institutional shoppers—hedge funds, asset managers, and multinational companies—a spotlight mirrored in its lofty $5 million entry threshold. Although BUIDL as soon as reigned supreme 103 days in the past with a $530.29 million market cap, its progress to $668.41 million now locations it third in a quickly evolving hierarchy. Collectively, the highest three funds command 56.78% of the tokenized Treasury sector’s $4.07 billion valuation.

Additionally distinguished are Ondo’s USDY ($592 million) and OUSG ($408 million), Superstate’s USTB ($328 million), Wisdomtree’s WTGXX ($112 million), and Openeden’s TBILL ($96.54 million). Information from Rwa.xyz reveals these initiatives boast a mean annual share yield (APY) of 4.2%, with 15,463 holders collectively invested throughout 37 tokenized Treasury funds—a close to doubling from 8,754 holders in simply over three months. This explosion of capital and participant inflow indicators a tokenized Treasuries market transitioning from area of interest experiment to mainstream contender.