In response to the most recent onchain stats, Bitcoin’s prime ten mining swimming pools presently management a hefty 94.2% of the worldwide hashrate — and so they collectively maintain $6.52 billion in bitcoin throughout their wallets.

Contained in the Secret Stashes of Bitcoin’s Largest Mining Swimming pools and Their Counterparties

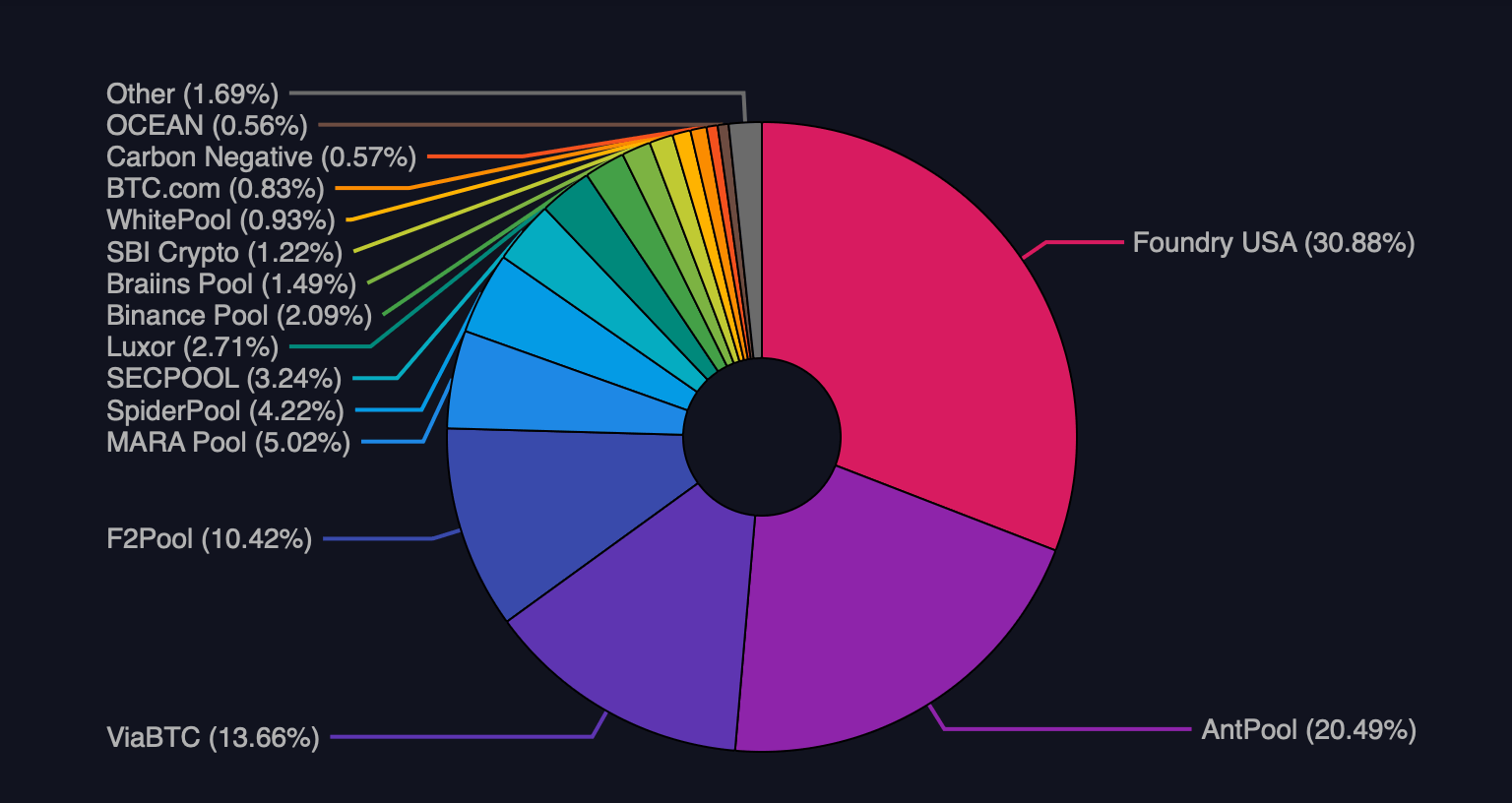

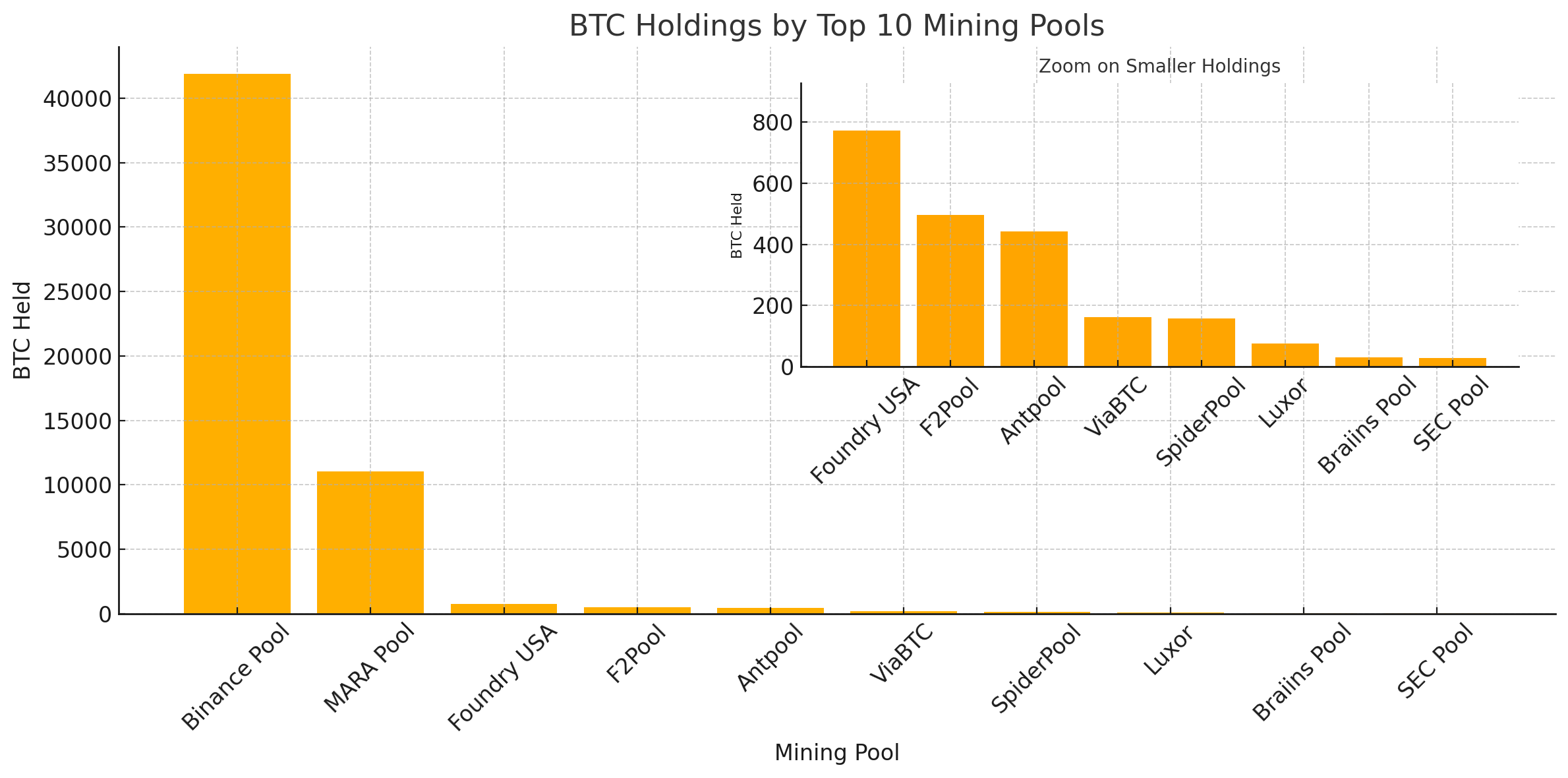

As of right now, the ten greatest mining swimming pools by block manufacturing are Foundry, Antpool, ViaBTC, F2pool, MARA Pool, Spider Pool, SEC Pool, Luxor, Binance Pool, and Braiins Pool. Foundry leads the pack with 30.88% of the worldwide hashrate. Onchain knowledge from Arkham Intelligence exhibits Foundry’s wallets now include 772.652 BTC valued at $91.2 million — a noticeable dip from the greater than 2,000 BTC it held in mid-March 2024.

In relation to counterparties, Foundry continuously transacts with Coinbase. Antpool ranks second in hashpower, presently managing 20.49% of the worldwide whole. As of July 30, Antpool holds 441.839 BTC valued at $52.15 million, with Coinbase additionally serving as its major counterparty. ViaBTC is available in third with 13.65% of the worldwide hashrate in response to mempool.house stats and the entity maintains 162.086 BTC value $19.13 million on the time of writing.

Hashrate distribution on July 30, 2025, in response to mempool.house stats.

ViaBTC works carefully with Coinex, which it owns and helps — the 2 are tightly linked via shared infrastructure and companies. On Wednesday, F2pool held 10.42% of the whole hashrate, and its wallets contained 495.322 BTC value $58.46 million. F2pool works with two key counterparties: Coinbase and the custody agency Cobo.

MARA Pool accounts for five.01% of Bitcoin’s whole computing energy. The corporate additionally features as a bitcoin treasury, with a large 50,000 BTC on its books. MARA’s mining wallets alone maintain 11,034 BTC valued at $1.3 billion. Most of this stash is probably going safeguarded by NYDIG Custody, and onchain patterns recommend MARA additionally transacts with Foundry often. Spider Pool controls 4.22% of Bitcoin’s whole hashpower and holds 157.994 BTC valued at $18.65 million.

Spider pool routinely transacts with Coinbase. Subsequent up is SEC Pool, contributing 3.24% to the community’s hashrate. As of right now, SEC Pool’s wallets maintain about 28.616 BTC value $3.38 million. Onchain exercise exhibits SEC Pool interacts with each Cobo and Coinbase — although Coinbase seems to be the extra frequent associate. Rating eighth by hashrate, Luxor Expertise operates 2.71% of the community’s energy. Presently, Luxor Tech holds 75.278 BTC valued at $8.91 million. Like a number of others, Luxor additionally has an everyday transaction circulation with Coinbase.

Ninth on the record is Binance Pool with a comparatively small 2.09% slice of world hashpower. Nonetheless, the Binance Pool wallets tracked by Arkham present a staggering 41,919 BTC beneath administration, value $4.96 billion. Rounding out the highest ten is Braiins Pool — the pool previously often called Slush — with 1.49% of the worldwide hashrate. Braiins’ wallets include 30.983 BTC, valued at $3.67 million at right now’s charges. The highest ten bitcoin mining swimming pools collectively maintain 55,117.77 BTC as of right now, with an estimated whole worth of $6.52 billion.

The sheer quantity of bitcoin held by these prime miners highlights their twin position as each infrastructure suppliers and long-term stakeholders. Their collective stash, value billions, locations them among the many protocol’s most influential financial actors past simply securing the community.

Such concentrated holdings recommend these swimming pools usually are not merely promoting block rewards however accumulating for strategic functions. Some overtly and a few covertly. Whether or not as treasury reserves, collateral, or institutional leverage, this rising pile of BTC positions miners as highly effective gamers in Bitcoin’s evolving monetary ecosystem.