Ethereum worth has risen for 3 consecutive weeks, helped by the continuing restoration of cryptocurrencies. ETH, the second-biggest cryptocurrency, rose to $3,670 on Tuesday, as technicals and fundamentals pointed to extra beneficial properties within the present quarter. So, how excessive can ETH get this 12 months?

Polymarket customers are bullish on Ethereum worth

There are rising odds that the ETH worth will proceed doing properly this 12 months. A Polymarket ballot with over $2 million exhibits that the percentages of ETH reaching $4,500 on March 31 are at 55%. If that occurs, it implies that the ETH worth will rise by over 23% from the present stage.

One other Polymarket ballot exhibits that the percentages of the coin hovering to an all-time excessive by June have risen to 56%. The percentages that the ETH worth will get to $5,000 this 12 months have risen to 65%.

Due to this fact, merchants are optimistic that the coin will do properly in the long run. That is notable since Polymarket has confirmed to be a extremely correct prediction market reminiscent of its prediction in regards to the US presidential election when it predicted that Trump would win.

ETH worth technicals level to a rebound

In the meantime, Ethereum worth has sturdy technicals, pointing to extra beneficial properties in the long run. The weekly chart exhibits that the ETH has shaped a symmetrical triangle chart sample. The higher aspect of this triangle connects the best swings since November 2021.

This triangle has extra room to type, that means one other drop to the decrease aspect can’t be dominated out. Moreover, the coin has shaped a triple-top chart sample at $4,085. A triple-top is a well-liked bearish reversal sample.

I simply can’t recover from how good this $ETH weekly chart seems to be. Time to remind everybody what an actual ETH rally seems to be like. I’m prepared.

The Ethereum worth has remained above the 50-week and 100-week Exponential Shifting Averages (EMA), which is a constructive signal. It has moved barely under the 23.6% Fibonacci Retracement stage and shaped a cup and deal with sample.

Due to this fact, ETH worth will possible proceed rising within the subsequent few months. For this to occur, the coin might want to soar and cross the higher aspect of the triple-top sample at $4,085. If this occurs, the following stage to observe would be the all-time excessive of $4,883. It is going to then surge to the important thing psychological level at $5,000 if it flips the ATH.

ETH worth day by day chart

Key catalysts for Ethereum

The value of ETH has quite a few catalysts that would enhance it in the long term. First, the primary quarter is normally the best-performing one. It rose by 59% in Q1 ’24 and 52% in Q1 ’23. The typical beneficial properties in Q1 are 83%, and the coin has solely fallen two first quarters since 2017.

Second, spot Ethereum ETFs are doing properly and seeing sturdy inflows, an indication of sturdy demand. All ETH ETFs have gathered over $2.7 billion in inflows, bringing the mixed belongings to $13.47 billion. Extra inflows will proceed within the subsequent few months as demand rises.

Additional, knowledge exhibits that the amount of ETH in exchanges has remained underneath strain. Whereas the quantity has risen up to now few days, it stays a lot decrease than it was just a few years in the past. Falling quantity is an indication that traders are holding the coin for longer.

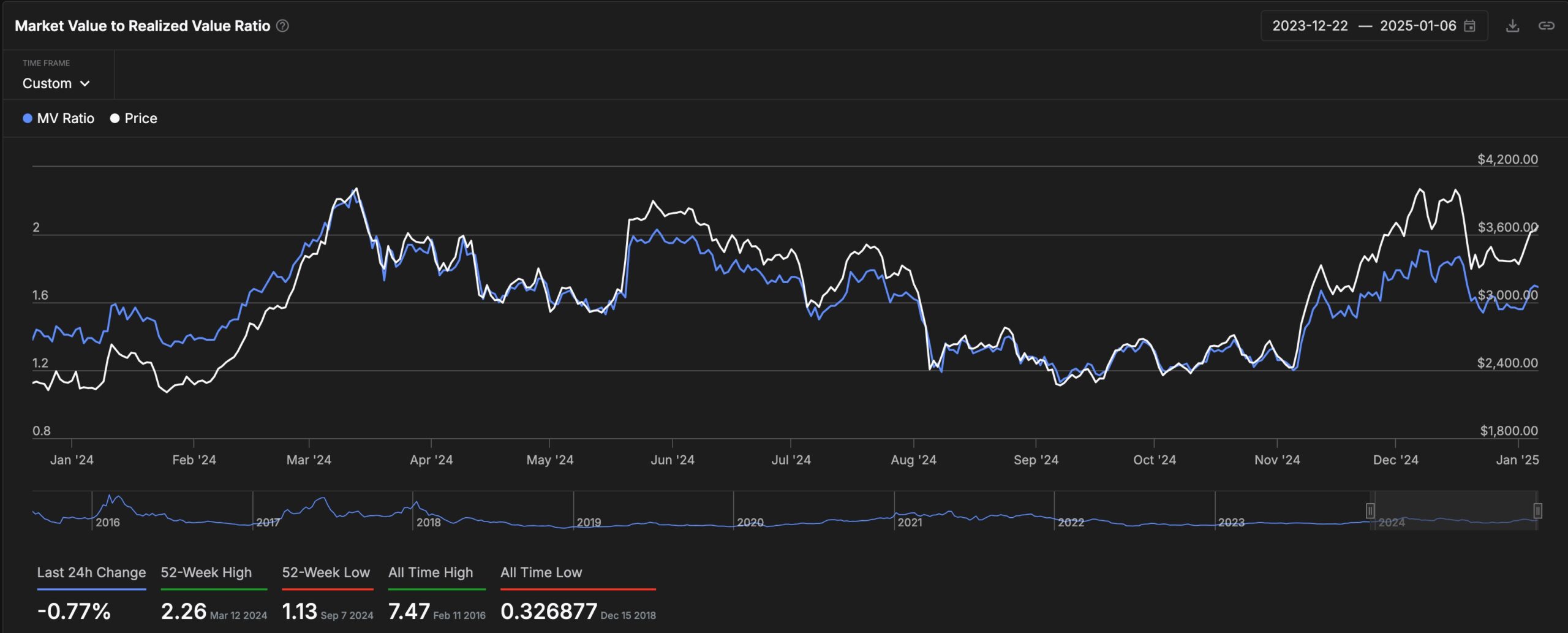

Ethereum can be pretty low cost if you use the MVRV-Z rating indicator. The market worth to relative worth z-score is an indicator that compares the MV and RV, after which standardizes it. A crypto is claimed to be low cost when the MVRV indicator is under 3.8. Ethereum’s determine is at 1.6, that means that the coin has extra upside to go.

Due to this fact, Ethereum has a mix of sturdy technicals and fundamentals that may possible push it greater for longer.

Learn extra: Ethereum worth evaluation: does ETH has extra upside?

The put up Ethereum worth prediction: prime explanation why ETH could surge in 2025 appeared first on Invezz