Pattern Analysis, an funding agency led by Jack Yi, founding father of Liquid Capital, has bought its whole Ethereum ($ETH) place, reportedly locking in losses of practically $750 million.

The massive-scale sell-off comes as Ethereum continues its broader downturn, with the altcoin down greater than 30% up to now month. The worth efficiency has reignited debate over whether or not $ETH is approaching a market backside.

Pattern Analysis Sells Ethereum Amid Market Volatility

BeInCrypto lately reported that Pattern Analysis started transferring Ethereum to Binance at the start of the month. On-chain analytics platform Lookonchain confirmed that the agency accomplished the sell-off yesterday.

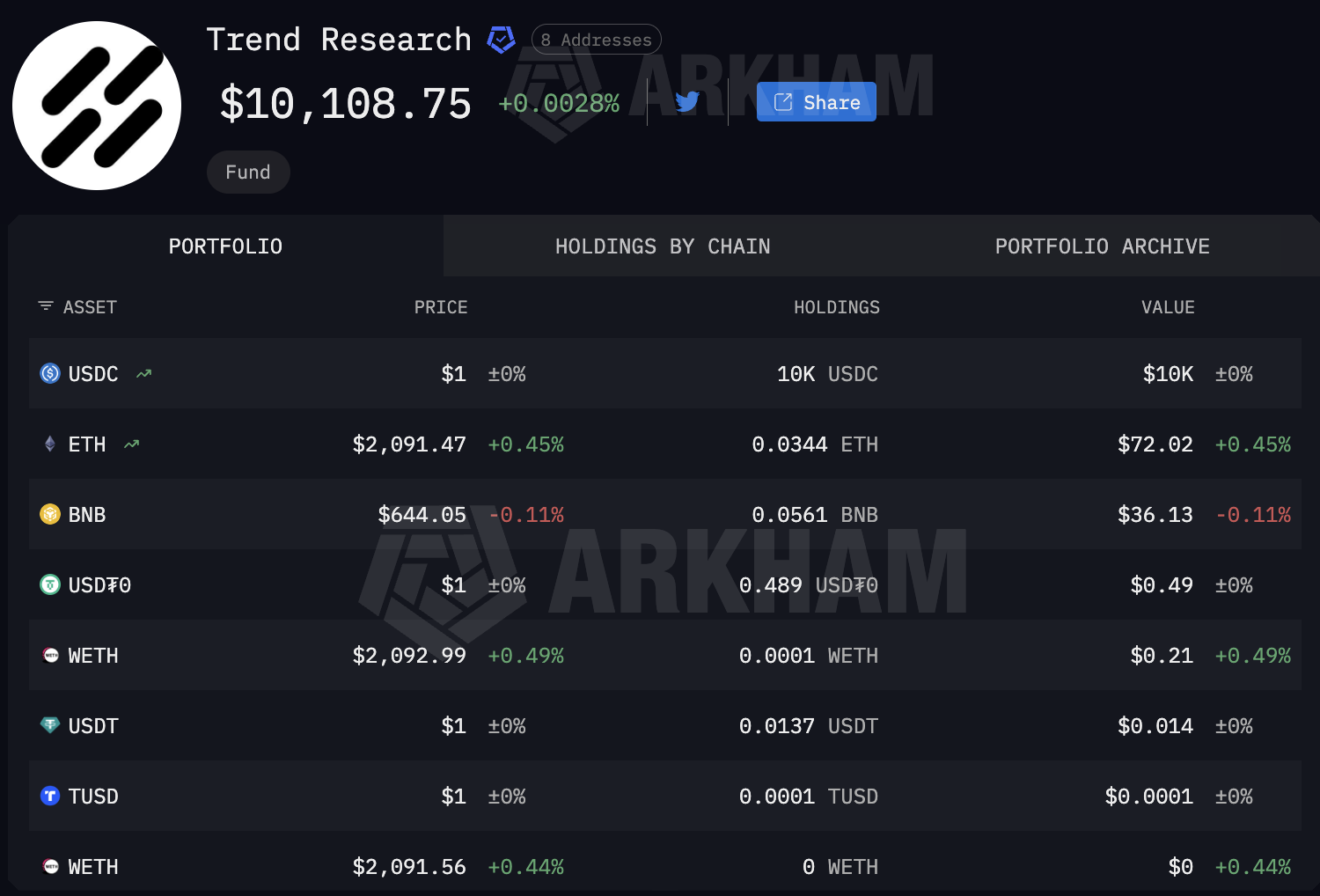

In whole, Pattern Analysis moved 651,757 $ETH, value roughly $1.34 billion, to Binance at a mean value of $2,055. The transactions lowered the agency’s $ETH holdings to simply 0.0344 $ETH, valued at round $72.

Information from Arkham Intelligence corroborates the near-complete exit, exhibiting residual balances of roughly $10,000 in USDC and minor quantities of different tokens.

“The full loss is ~$747 million,” Lookonchain wrote.

The exit adopted a leveraged technique constructed on the decentralized finance (DeFi) lending protocol Aave. An analyst defined that Pattern Analysis initially bought $ETH on centralized exchanges and deposited it as collateral on Aave.

The agency then borrowed stablecoins in opposition to the collateral and repeatedly reinvested the borrowed funds into further $ETH purchases, making a recursive leveraged place that considerably elevated each publicity and liquidation threat.

As $ETH’s value continued to say no, the place moved nearer to the liquidation threshold. Relatively than threat pressured liquidation, Pattern Analysis selected to unwind the complete place voluntarily.

🚨Jack Yi’s Pattern Analysis constructed a $2.6 BILLION $ETH leveraged lengthy place by way of Aave.

This month, they bought their whole holdings for $1.74 billion to repay their loans.

They misplaced $750 MILLION on this commerce. pic.twitter.com/00B8OYLiGC

— Ash Crypto (@AshCrypto) February 8, 2026

Whereas Pattern Analysis pivoted to promoting, BitMine has taken the alternative strategy. Regardless of mounting unrealized losses, the agency has continued to extend its publicity, lately buying $42 million value of Ethereum.

What an Ethereum Market Backside Might Imply for Bitmine and Pattern Analysis

The opposing methods come amid a interval of heightened market volatility for Ethereum. BeInCrypto Markets knowledge reveals that the second-largest cryptocurrency has declined 32.4% over the previous month.

On February 5, $ETH additionally slipped under $2,000 earlier than recovering. At press time, Ethereum was buying and selling at $ 2,094.16, up round 0.98% over the previous 24 hours.

$ETH) Value Efficiency”>

$ETH) Value Efficiency”>

Ethereum ($ETH) Value Efficiency. Supply: BeInCrypto Markets

Amid the downturn, some analysts have advised that Ethereum could also be approaching a market backside. One analyst described Pattern Analysis’s exit because the “largest capitulation sign.”

“Such pressured exits usually occur close to main lows,” Axel acknowledged.

Joao Wedson, founding father of Alphactal, additionally famous that Ethereum’s value backside is prone to happen months earlier than Bitcoin’s, citing the quicker liquidity cycle sometimes noticed in altcoins.

In line with Wedson, some chart indicators counsel that Q2 2026 may mark a possible value backside for $ETH.

“Some charts already point out that Q2 2026 may mark a possible value backside for $ETH. Capitulation has arrived, and realized losses are set to extend sharply,” Wedson added.

$ETH is extremely oversold.

We’ve had 6 crimson months in a row, with the 1M RSI now tagging bear market backside ranges.

Statistically, the R/R for $ETH could be very excessive right here.

Added $SOL, already hodl good luggage of $ETH.

It is trying optimistic for these large weapons now.

I actually consider… pic.twitter.com/mku1VbCOP4

— Sykodelic 🔪 (@Sykodelic_) February 6, 2026

Whereas no backside has been confirmed but, the likelihood may carry broader implications for institutional sentiment, significantly as some companies select to de-risk whereas others proceed to build up amid ongoing market weak spot.

If Ethereum is certainly approaching a market backside, BitMine’s continued accumulation may show well-timed, positioning the agency to learn from a future restoration.

Nonetheless, if draw back strain persists, Pattern Analysis’s determination to completely unwind its place might finally be seen as a prudent transfer to restrict the dangers related to leveraged methods.

The publish Pattern Analysis’s Ethereum Exit Leads to Practically $750 Million Losses, however Did It Promote on the Backside? appeared first on BeInCrypto.

$ETH Promote-Off.”>

$ETH Promote-Off.”>