A fast take a look at the numbers reveals that the Center East and North Africa (MENA) area has skilled outstanding crypto-related progress over the previous yr. That is thanks, largely, to Bitcoin’s meteoric 120% rise (via 2024) which catapulted the sector’s market cap to slightly beneath $3.8 trillion.

Throughout this rise, the MENA area turned the seventh-largest crypto market on the planet, accounting for 7.5% of world transaction quantity.

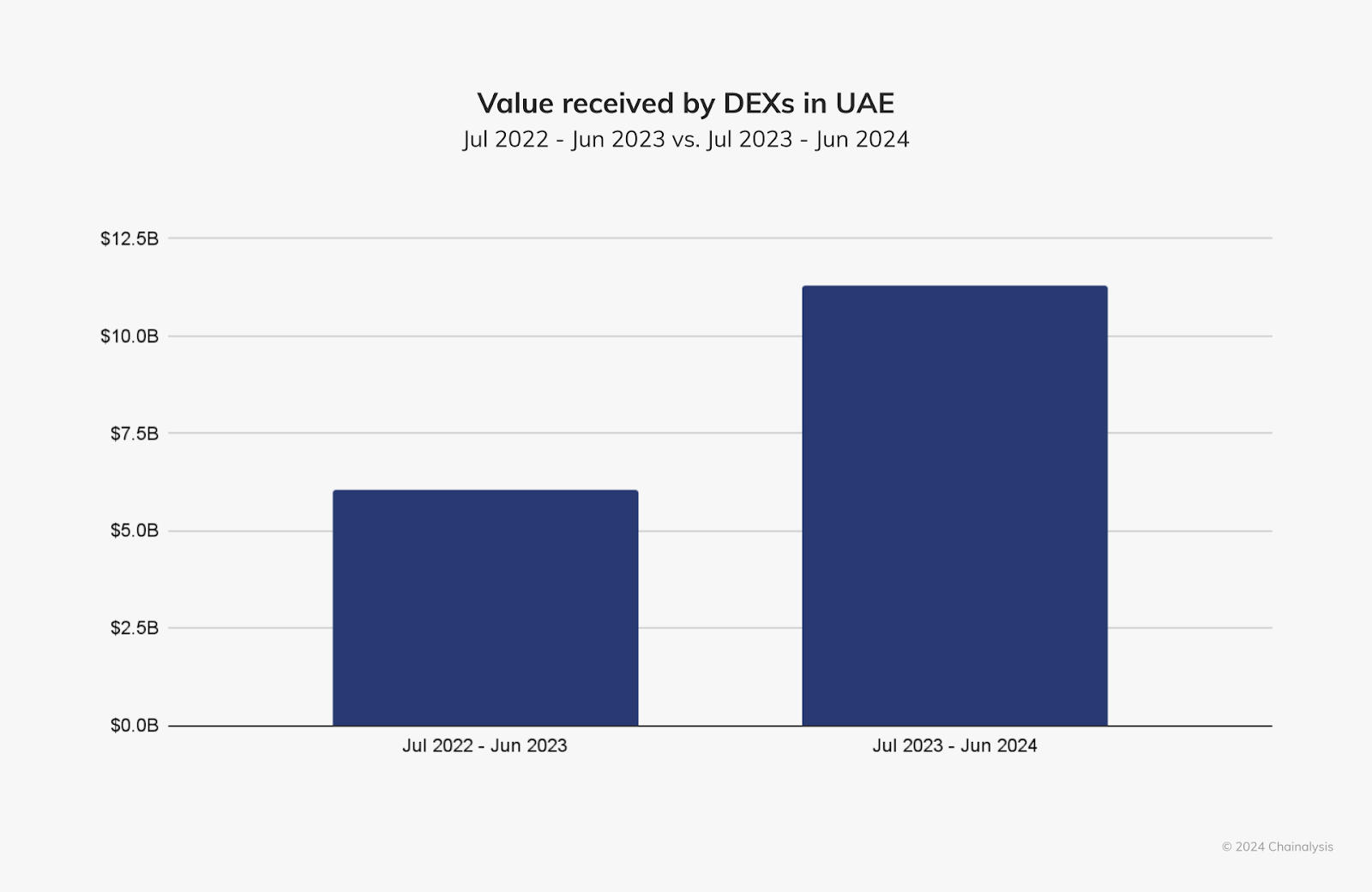

Furthermore, numbers recommend that inside nations just like the UAE and Saudi Arabia, crypto fans have began to shortly transfer past centralized exchanges, with decentralized finance (DeFi) platforms quick gaining vital traction within the area.

Trump’s second time period to catalyze MENA’s crypto ambitions?

From the skin trying in, the return of Donald Trump to the US White Home appears to have re-ignited the worldwide digital asset fray, with implications extending far past America’s borders — particularly into the MENA area.

For starters, Trump’s dedication to establishing clear regulatory frameworks in the US has inspired Center Jap governments to strengthen their very own pointers, making a extra predictable surroundings that draws substantial funding from each regional and worldwide sources.

On the topic, Shafah Bar-Geffen, CEO and co-founder of Israel-based decentralized funds supplier, the Coti Group, believes that Trump’s pro-crypto stance is more likely to ease a number of the uncertainty relating to rules within the Center East, bringing extra readability and, with it, adoption. He additional added:

“America’s stance can typically grow to be a guiding precedent for international regulatory fashions and a extra definitive technique from the US may increase regulators within the Center East in shaping their cryptocurrency rules, which can translate into extra participation in addition to funding.”

On this regard, the response from main monetary establishments has been fairly constructive, with Wall Road giants like Goldman Sachs and JPMorgan quickly revising their cryptocurrency methods to align with the brand new administration’s imaginative and prescient — a shift that appears to have reverberated all through the Center East, prompting regional banks and funding funds to develop extra complete digital asset methods of their very own.

Proof of this accelerating adoption has already materialized in a giant means, with Dubai’s DMCC Crypto Centre reporting a notable 300% improve in blockchain firm registrations since Trump’s re-election. In the meantime, Saudi Arabia has accelerated its central financial institution digital forex (CBDC) initiatives, launching pilot packages in partnership with American know-how suppliers that align with the dominion’s Imaginative and prescient 2030 targets of financial diversification.

The connections between the Trump administration and the Center East’s crypto ambitions have been additional strengthened via high-profile endorsements. For instance, late final yr President Trump’s middle-son Eric, spoke on the Bitcoin MENA convention in Abu Dhabi, explicitly acknowledging the UAE’s management in fostering a blockchain-friendly surroundings and highlighted potential areas for collaboration between American and Center Jap finance entities.

Constructing tomorrow’s monetary oasis

With MENA members processing $338.7 billion in on-chain worth between July 2023 and June 2024 alone, the area appears to have firmly established itself as a pivotal drive within the digital asset enviornment. Significantly noteworthy is that 93% of those transactions had been valued at $10,000 or extra, indicating that institutional {and professional} buyers have been key adoption drivers slightly than retail hypothesis.

Trying forward, MENA’s balanced method to decentralized innovation means that the area is trying to construct a sustainable infrastructure slightly than merely using the overarching market volatility, thus positioning it as a frontrunner within the subsequent part of the worldwide monetary revolution (one the place trad-fi and digital finance methods can converge seamlessly with each other).

Featured picture through Shutterstock