Trump’s new tariff coverage is poised to disrupt the U.S. Bitcoin mining trade, as China—the world’s greatest provider of mining tools—faces a steep 34% export tariff, placing strain on American miners’ ROI.

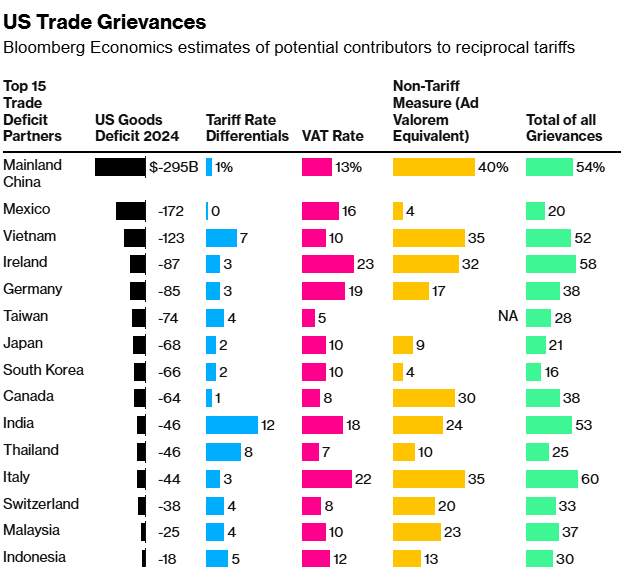

On April 2, Trump signed a sweeping govt order to impose reciprocal tariffs on each nation that has tariffs on U.S. items. The bottom tariff charge was set at 10%, with implementation slated for April 5. Some nations have been hit with a lot greater charges, with Thailand and Malaysia dealing with 36% and 24% tariffs respectively, starting April 9.

Supply: Bloomberg

The announcement despatched shockwaves via monetary markets, with the crypto sector among the many first to react. Bitcoin (BTC) fell from $85,238 to $82,526 by the day’s shut, marking an 3.18% drop. The broader crypto market adopted go well with, with the whole crypto market cap shedding round 4% between April 2 and April 3.

U.S.-listed crypto shares have been additionally hit onerous. Coinbase International slid by 7.7%, whereas MicroStrategy‘s inventory declined by 5.6% on the day of the announcement.

You may additionally like: Crypto markets recoil within the wake of Liberation Day tariffs

Past crypto costs and shares, the tariffs threaten to trigger an enormous disruption to the Bitcoin mining trade. China, nonetheless the main producer of Bitcoin mining {hardware}, now faces a 34% reciprocal tariff on its exports to the U.S. This poses a problem for U.S. Bitcoin mining firms, particularly contemplating America has grow to be a worldwide hub for crypto mining since China’s 2021 blanket ban on the observe.

“In recent times, the US emerged as a most well-liked vacation spot—not merely because of vitality prices, however as a result of it supplied authorized, regulatory, and financial stability,” Gadi Glikberg, CEO of CodeStream advised Bloomberg. “The newly imposed tariffs are unlikely to set off a mass exodus. Nonetheless, they might decelerate or redirect future growth plans, as miners reassess the long-term cost-efficiency of scaling operations throughout the US.”

With the tariffs set to take impact tomorrow, Bitcoin mining tools suppliers are speeding to ship their final shipments earlier than the upper duties are enforced. Taras Kulyk, CEO of mining machine brokerage Synteq Digital, advised Bloomberg that his firm is scrambling to expedite the supply of 1000’s of mining items from Southeast Asia, together with Indonesia, Malaysia, and Thailand.

Amid this turbulence, mining {hardware} producers have been getting ready for a longer-term shift in operations. Bitmain Applied sciences, the world’s largest producer of Bitcoin mining tools, introduced plans in December to open a facility within the U.S. One other producer MicroBT has struck a purchase order settlement with Riot Blockchain, one of many largest U.S. miners, to leverage its American manufacturing presence.

Traders are already pricing within the long-term results of Trump’s tariff transfer, with shares of a number of U.S.-listed mining firms, together with MARA Holdings and CleanSpark Inc., tumbling round 10% after the announcement.

You may additionally like: Opinion: Why Trump’s ‘Liberation Day’ tariffs could damage crypto’s world future