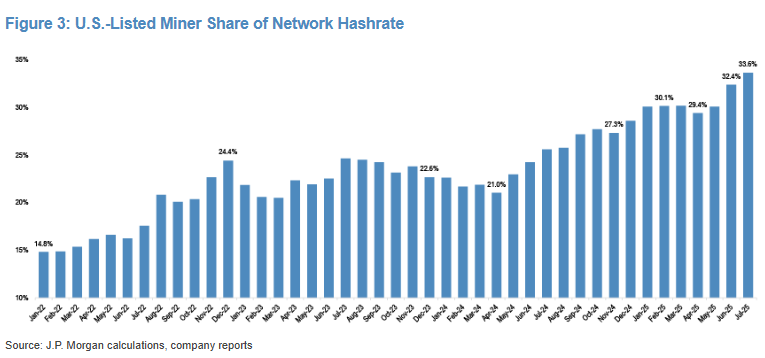

The share of Bitcoin’s complete community hashrate attributed to publicly listed US miners has surged to almost 34%, in accordance with latest knowledge shared by analysts at banking large JPMorgan.

Notably, their hashrate dominance has greater than doubled since January 2022 (when it stood at roughly 15%).

Nevertheless, this development was reasonably uneven. Their share of worldwide hashrate stored fluctuating between 20% and 23%.

They lastly reached the 30% milestone by November, and this development has steadily continued all through 2025.

“Entry to US capital markets is a significant differentiator for miners,” Matthew Sigel, head of digital property at VanEck, stated whereas commenting on the newest milestone.

Final month, JPMorgan analysts revealed that publicly listed miners managed to attain one in all their greatest quarters to this point with roughly $2 billion value of gross income.

MARA Holdings (previously Marathon Digital) stays the main US Bitcoin miner. Final month alone, the corporate produced 950 BTC. Its complete holdings at the moment are near surpassing the 50,000 BTC milestone.

The US share of worldwide hashrate

In response to the Hashrate Index, the U.S. presently accounts for a complete of 36% of worldwide hashrate. The estimate is predicated on mining pool knowledge and ASIC buying and selling flows.

China, which used to get pleasure from absolute dominance within the Bitcoin mining sector with almost 75% of worldwide hashrate attributable to low-cost coal and hydro energy, misplaced its lead after its authorities initiated a full-fledged mining ban in 2021.

Regardless of the ban, China nonetheless accounts for 17% of worldwide hashrate, which places it in third place.