Crypto exchanges have change into battlegrounds the place giants anchor liquidity whereas agile challengers race to seize new narratives, and the competitors between CEXs and DEXs intensifies. In all of this, LBank has carved out a novel position as a chief curated market for hidden gems and one of many few exchanges the place retail capital constantly meets early alternative.

The State of Crypto Exchanges in 2025

Crypto exchanges stay the engine room of digital markets. They’re the locations the place liquidity meets hypothesis, the place costs kind, and the place the success or failure of recent property is in the end determined. Within the early 2010s, Mt. Gox launched the primary centralized liquidity hub; nevertheless, by 2025, the panorama has utterly modified.

No single platform controls discovery. As an alternative, a combined world has emerged, the place giants dominate majors whereas specialised challengers seize new narratives. On the identical time, competitors between centralized and decentralized exchanges has change into fierce. Hyperliquid, with its deep on-chain liquidity and CEX-like buying and selling effectivity, has emerged as a direct menace to conventional order books. This rise has blurred the traces between CEX and DEX, forcing incumbents to innovate or danger irrelevance.

The competitors for property inside CEXs themselves is equally intense. The WLFI wave of listings in early 2025 confirmed how frenzied the race has change into: inside hours of token creation, a number of exchanges scrambled to safe first-mover benefit, whereas buyers rushed to seize early worth motion. On this new setting, discovery will not be merely a operate of market share; it’s a contest of velocity, curation, and the flexibility to channel liquidity into rising property.

The stakes in 2025 couldn’t be increased. Establishments anchor liquidity in bitcoin and ethereum, retail merchants flood into meme cash and small caps seeking uneven returns, and regulators are reshaping the foundations that govern listings. Market discovery in 2025 is not assured by dimension alone, however by agility, adaptability, and the capability to seize narratives on the exact second they emerge.

Amid this volatility, one change has quietly constructed a status because the boutique hub of discovery: LBank. Acknowledged as a 100x Gems Hub, LBank is positioning itself because the change the place hidden gems emerge and retail capital meets curated alternative.

Market Discovery Mechanisms: The Coronary heart of Trade Competitors

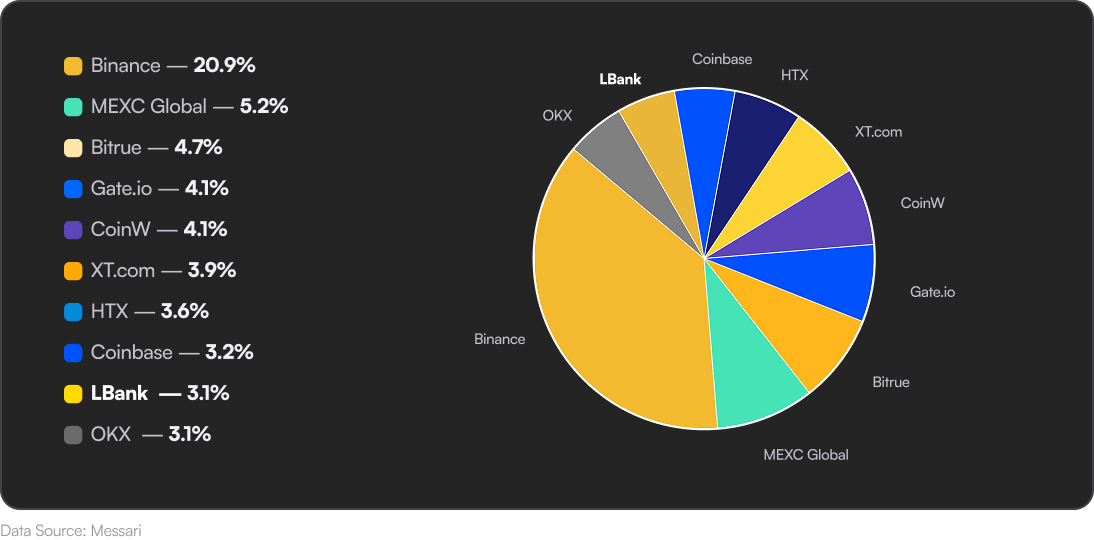

Value discovery has all the time been the lifeblood of crypto, and in 2025, it has change into the important thing battleground for change competitors. Liquidity depth and spreads decide the credibility of a market. When an order ebook is skinny and spreads are vast, merchants hesitate, and worth indicators lose their authority. Binance and OKX stay the first venues for bitcoin and ethereum, however for altcoins and meme tokens, exchanges akin to LBank and MEXC have taken the lead. Their order books, significantly within the first hours of a brand new itemizing, present the reference costs round which the broader market types.

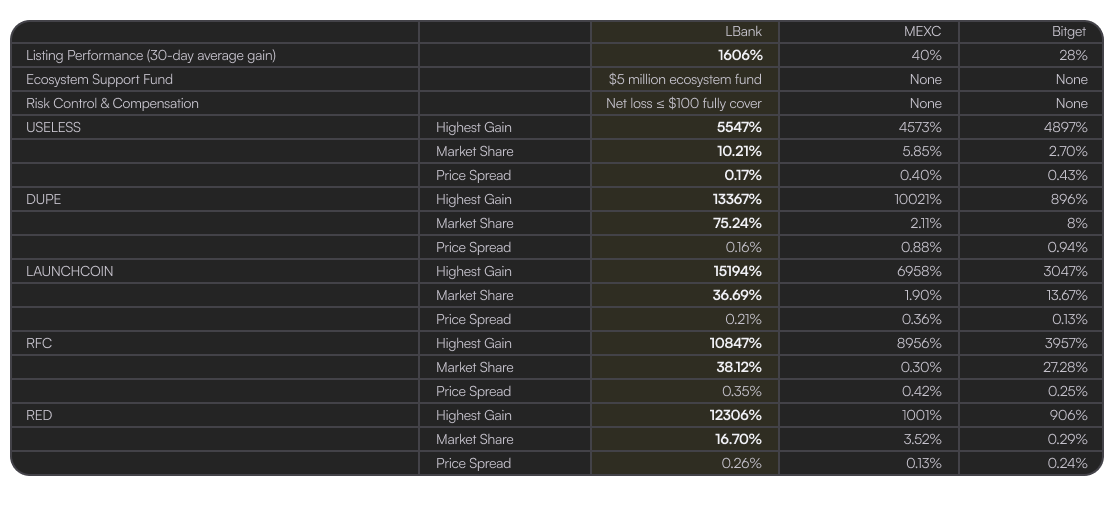

The success of the brand new coin following its debut is probably the most essential issue for buyers in meme cash. There are notable variations within the efficiency of the lately launched meme cash on three major platforms: LBank, MEXC, and Bitget, based mostly on the information comparability of the earlier 30 days. The data contrasts LBank, MEXC, and Bitget’s major efficiency metrics within the spot and contract markets for meme cash, akin to common development, help for ecological funds, danger compensation, and the best development, market share, and worth differential of various widespread meme initiatives.

Supply: Coinmarketcap

LBank exhibits itself as a number one participant within the present pattern with respect to the 30-day common development. The LBANK EDGE sector has produced roughly 1,606% in returns, which is much better than Bitget’s 28% and MEXC’s 40%.

Transparency additionally performs a defining position. Centralized exchanges are criticized for opaque order books, but this very opacity permits them to curate listings, stage liquidity, and filter out among the noise from the on-chain flood. Decentralized exchanges, against this, provide radical transparency however undergo from fractured liquidity and excessive volatility. For many new tokens, discovery begins on-chain, however survival requires migration to a centralized venue the place liquidity can focus.

New fashions are rising as properly. Automated market makers proceed to evolve, whereas intent-based buying and selling and AI-driven circulation optimization have gotten more and more widespread. Bitget, for instance, has launched GetAgent, an AI buying and selling assistant that optimizes order execution, whereas Binance is experimenting with predictive matching. On the identical time, oracles akin to Chainlink and Pyth are bridging information throughout DeFi and CeFi, serving to stabilize worth feeds. But regardless of these improvements, the defining actuality is straightforward: on this planet of small-cap and meme property, it’s specialised exchanges that set the tone, and right here LBank has carved out a definite edge.

Unearthing Hidden Gems: The place Market Discovery is Evolving

Essentially the most putting improvement of 2025 is the shift of discovery away from giants and towards specialised mid-tier exchanges. LBank, MEXC, and Bitget have emerged because the three most necessary gamers on this section, every with a definite technique. LBank has adopted a curated method. Its EDGE sector lists solely a handful of rigorously screened initiatives, but those who go by way of ship staggering outcomes. Throughout early 2025, the common return of EDGE listings reached 1,606%, with standout tokens akin to DUPE and RED climbing a couple of hundred-fold. This selective course of raises the common dramatically, although it means customers could miss the very earliest 0-to-10x stage that happens on-chain.

MEXC has taken the alternative path. It embraces a mannequin of scale and breadth, itemizing tons of of meme cash every month and even aggregating liquidity from decentralized swimming pools by way of its DEX+ product. This flood of tokens dilutes returns, bringing the common 30-day achieve to only 40 p.c. But hidden throughout the noise are gems: the highest ten new cash in April 2025 averaged beneficial properties of over 800%. MEXC, subsequently, appeals to merchants preferring uncooked entry to every part and are keen to filter manually.

Bitget, against this, has pursued conservatism. Its listings usually happen after the preliminary hype subsides, positioning it as a safer however slower venue. Common 30-day returns are decrease, at simply 28 p.c, however its customers profit from stability and mature liquidity. This method is much less about chasing meme mania and extra about constructing a disciplined market supported by instruments akin to social buying and selling, derivatives safety, and AI-driven methods.

Bitcoin and Ethereum: Anchors of Market Discovery

Regardless of the meme coin explosion, BTC and ETH stay the anchor property of the crypto financial system. Bitcoin continues to function the volatility benchmark, the collateral base for derivatives, and the reference asset for institutional inflows by way of CME futures and spot ETFs. Ethereum maintains its central position in DeFi, offering the first liquidity swimming pools for lending, yield farming, and NFT buying and selling. Each meme or altcoin pair is in the end benchmarked towards BTC or USDT, with Ethereum anchoring liquidity throughout Layer 2 ecosystems. Even on exchanges like LBank, the place meme buying and selling dominates, the structural reliance on BTC and ETH stays absolute. With out their stability, worth discovery in small caps would collapse.

Person Profiles: Who’s Driving Discovery?

The drivers of discovery fluctuate extensively throughout consumer teams. Retail merchants stay probably the most seen, chasing early altcoin alternatives with the hope of outsized returns. For them, Solana’s zero-threshold meme coin growth has change into a on line casino of experimentation, the place 1000’s of cash are minted weekly however solely a handful survive. Centralized exchanges, significantly LBank, act because the survival filter, offering secondary markets the place the winners consolidate liquidity.

Establishments and proprietary buying and selling companies play a unique position. Their capital anchors liquidity in majors, whereas they arbitrage spreads between exchanges and hedge throughout derivatives. These gamers hardly ever chase memes straight, however their presence within the system ensures depth in BTC and ETH, which not directly stabilizes the altcoin market. DAOs and DeFi-native protocols additionally contribute, utilizing centralized venues to hedge treasuries or bridge liquidity between on-chain and off-chain markets.

Lastly, regional communities have change into more and more necessary. In nations like Nigeria, Vietnam, Turkey, and Pakistan, retail merchants are coming into crypto by way of fiat ramps that join on to mid-tier exchanges. LBank’s presence in over 160 nations and areas, with help in 18 languages and 50-plus fiat currencies, has given it attain that few opponents can match. For a lot of of those customers, LBank will not be a secondary platform however the major gateway into crypto discovery.

Danger Safety, Liquidity, and Ecosystem Help

The way in which exchanges deal with danger and liquidity has change into a key differentiator. LBank incessantly dominates buying and selling share in scorching memes, at occasions capturing over seventy p.c of a coin’s whole quantity. Spreads are remarkably tight, usually between 0.1 and 0.3 p.c, which retains slippage minimal. This makes LBank the venue of selection for merchants who need each depth and effectivity.

MEXC, against this, struggles with dilution. It’s 1000’s of listings skinny out liquidity, resulting in spreads as vast as 0.9 p.c on long-tail tokens. Its DEX+ integration gives entry to exterior swimming pools, however at the price of reliability. Bitget holds its floor on mainstream memes and particular initiatives it helps, with aggressive spreads on giant caps however restricted depth in smaller cash.

The place LBank stands aside is in its danger safety mechanisms and common liquidity surveillance actions. The EDGE zone compensates merchants for as much as 100 USDT in losses, whereas a $5 million ecosystem fund helps meme initiatives, and a $100 million futures danger fund safeguards towards irregular liquidations. The change has even contributed to broader trade rescue efforts, donating to the SLERF restoration pool and supporting DEXX compensation. This stage of capital dedication reinforces its model as a secure but speculative hub. MEXC depends extra on promotions akin to zero-fee campaigns and frequent airdrops, whereas Bitget emphasizes derivatives insurance coverage and provides worth by way of social buying and selling and AI quant methods.

Regulatory Shifts and the Affect on Discovery

By 2025, the worldwide crypto regulatory setting is finest described as harmonized development layered over persistent regional divergence.

Within the European Union, MiCA establishes a single rulebook for issuance and buying and selling entry, disclosure, and market conduct, thereby elevating admission and compliance thresholds for token issuance and delivering extra systematic investor safeguards; the attendant authorization and technical due diligence necessities, nevertheless, lengthen itemizing lead occasions and sluggish iteration.

In america, starting in 2025, the coverage stance is pivoting from an enforcement-led method towards clearer, rules-based authorization pathways, modestly decreasing incentives for consumer outflow. Throughout Asia, Hong Kong (HKMA/SFC), Singapore (MAS), and Dubai’s DIFC (DFSA) are deploying regulatory sandboxes to run managed pilots, reinforcing Asia’s place as an innovation hub.

Collectively, Europe’s regulatory readability, america’ coverage recalibration, and Asia’s lively piloting are coalescing into regional facilities of gravity. LBank continues to function throughout a number of areas, backed by its compliance framework and licenses in numerous jurisdictions.

Outlook: The Way forward for Trade Discovery

The way forward for discovery is prone to be formed by a number of converging forces. Synthetic intelligence will play a rising position in predictive liquidity flows, automated screening of scams, and customized execution methods. Tokenized real-world property are starting to enter the invention cycle, increasing exchanges past crypto-native initiatives. Cross-chain interoperability is bettering, permitting exchanges akin to LBank, with general liquidity efficiency beneath trade common, to place themselves as hubs for hybrid liquidity. On this setting, area of interest exchanges are usually not a sideshow however a central drive, in a position to dominate narratives that the giants can not transfer on rapidly sufficient.

LBank’s Place within the 2025 Trade Panorama

For LBank, its place as a discovery hub has by no means been clearer. The change has survived a decade with no safety breach, constructed a consumer base of over 15 million throughout 160 nations and areas, and grown right into a top-10 world platform. Its itemizing velocity, usually inside one hour from on-chain to itemizing, is unmatched. Its curation technique has delivered the very best common meme coin returns amongst main exchanges. And its danger protections, together with loss compensation and multi-million-dollar ecosystem funds, have created a belief layer that’s uncommon in a market nonetheless haunted by change collapses.

In an trade the place dimension as soon as dictated energy, LBank has demonstrated that agility, focus, and curation now outline success. Market discovery in 2025 is not monopolized by giants however distributed throughout specialised platforms that join retail demand with rising narratives. For meme cash and altcoins, LBank has change into the definitive proving floor. Its mannequin suggests a discovery rule: it isn’t about grabbing the subsequent coin earlier than anybody else, however about selecting the best change, one which balances alternative with safety, and hypothesis with construction.