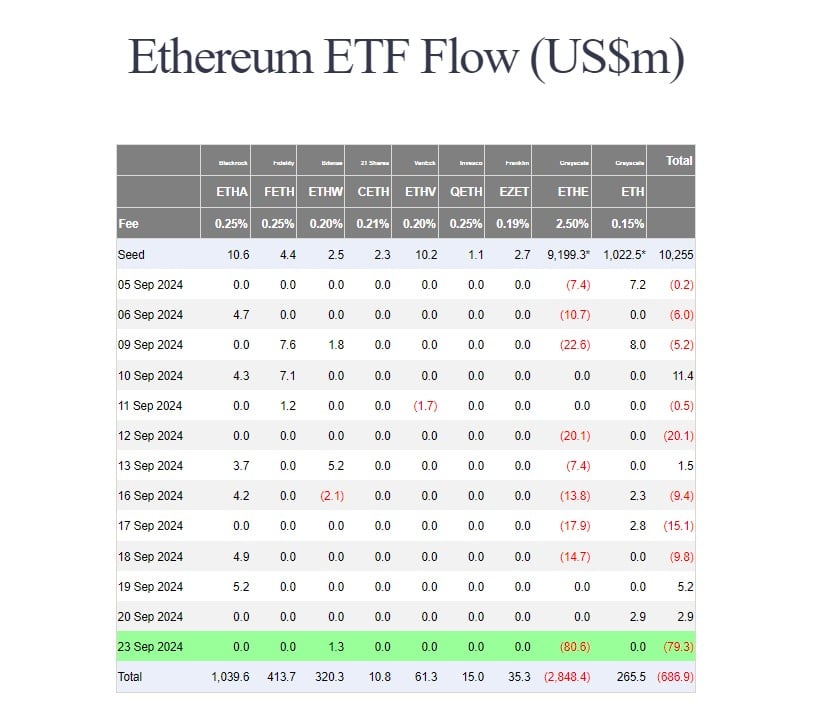

Over $79 million was withdrawn from 9 US spot Ethereum ETFs on Monday, the most important single-day outflow since July 29, in line with information tracked by Farside Buyers. The Grayscale Ethereum Belief, or ETHE, led redemptions, with traders pulling over $80 million from the fund.

Since its ETF conversion, the ETHE fund has seen web outflows of over $2.8 billion. Regardless of continued bleeding, it’s nonetheless the most important Ether fund on the earth with round $4,6 billion in property beneath administration.

Monday’s outflows ended a short two-day achieve for these ETFs. In distinction to ETHE, the Bitwise Ethereum ETF (ETHW) was the only gainer on the day with zero flows reported from most competing funds. Buyers purchased over $1 million price of shares in Bitwise’s ETHW providing.

As of September 23, ETHW’s web shopping for topped $320 million, whereas its Ether holdings exceeded 97,700, price round $261 million at present costs.

The sluggish demand for US-listed Ethereum ETFs has continued since their market debut on July 23. BlackRock’s iShares Ethereum Belief (ETHA) at the moment leads in web inflows and was the primary to succeed in $1 billion in web capital. It’s adopted by Constancy’s Ethereum Fund (FETH) and Bitwise’s ETHW.

Whereas Ethereum ETFs confronted a downturn, their Bitcoin counterparts loved a 3rd consecutive day of features, collectively including $4.5 million, Farside’s information reveals.

Good points from Constancy’s Bitcoin Fund (FBTC), BlackRock’s iShares Bitcoin Belief (IBIT), and Grayscale’s Bitcoin Mini Belief (BTC) offset substantial outflows from Grayscale’s Ethereum Belief.