Ethereum (ETH) is as soon as once more displaying indications of spot shopping for. Nameless whales are nonetheless energetic, however this time, a number of the shopping for could be traced to the US market primarily based on the ETH Coinbase premium.

Ethereum (ETH) confirmed accelerated accumulation, with US-based whales driving the development. The Coinbase premium, which remained vital in Q2, shot as much as ranges not seen since January.

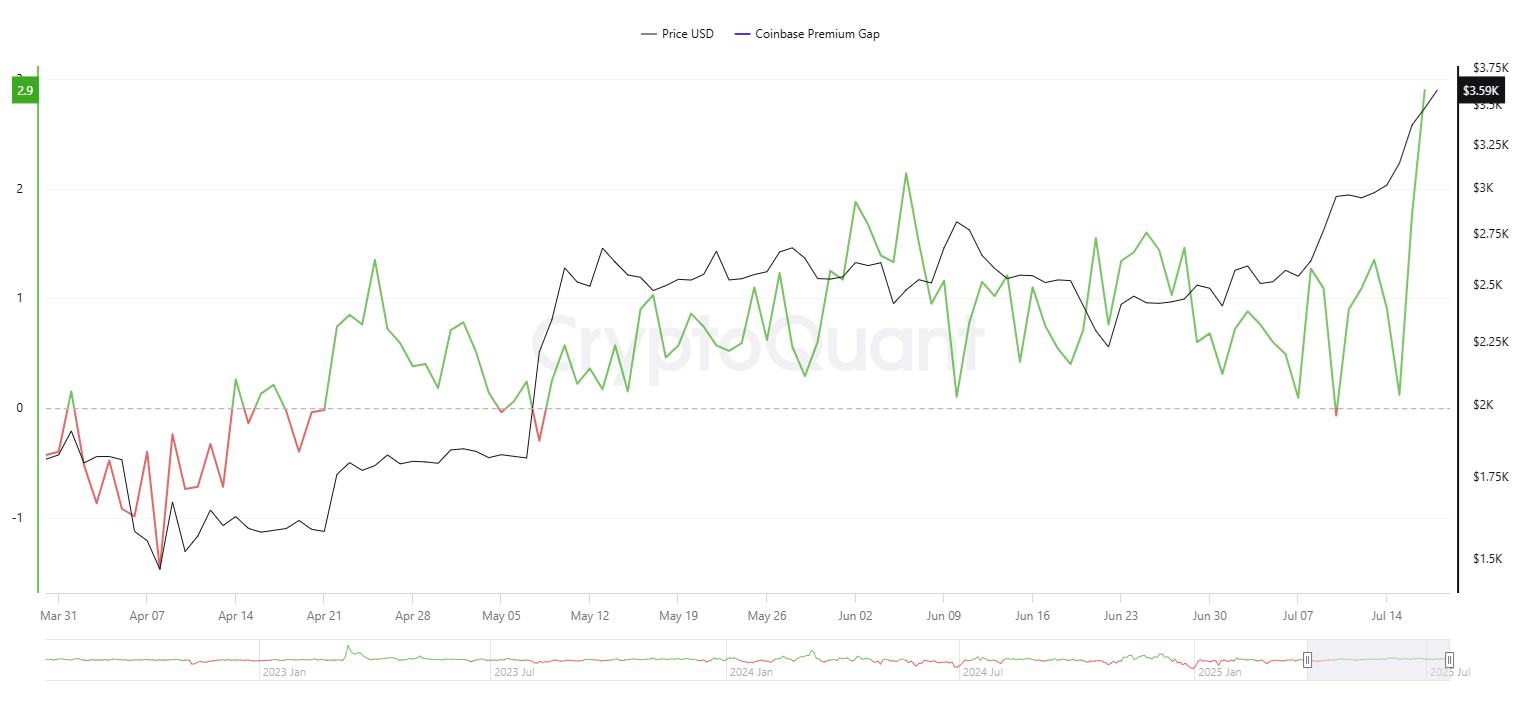

The Coinbase premium spiked up to now day, rising to its highest degree in months, as US-based whales accelerated their shopping for. | Supply: Cryptoquant

As ETH moved to a better worth vary, whale accumulation continued. Based mostly on CryptoQuant information, the ETH rally coincided with extremely energetic shopping for from Coinbase, rising the ETH premium.

ETH has not but reached premium ranges similar to the final quarter of 2024, when US-based buying and selling was additionally pushed by hype and the impact of the Presidential elections. Normally, the Coinbase premium is short-lived, taking a number of weeks to revert to baseline. This time, ETH held a slight premium for the previous few months, coinciding with a interval of silent whale accumulation.

ETH change reserves keep close to lows

The current shopping for retains the reserves on Coinbase Superior close to their all-time lows. Round 4.8M ETH is out there on Coinbase for whale consumers, whereas all spot exchanges carry round 9M ETH. The depleted reserves observe a current assertion from Wintermute that the market maker had depleted its OTC desk.

The low reserves are as a result of elevated spot demand, as ETH is now seen as a retailer of worth. Extra demand could come from the requirement for ETH collaterals on exchanges or lending protocols. Demand for overlaying leveraged positions elevated as ETH by-product open curiosity expanded up to now week.

Whereas the provision of ETH isn’t scarce, sellers might not be prepared with adequate, freely accessible provide. A major a part of ETH isn’t freely accessible, as it’s locked for staking, liquid staking and different DeFi vaults or liquidity swimming pools.

Particular person whales return for extra ETH

ETH shopping for continues, with some notable whales making strikes up to now 24 hours. On-chain information reveals two whales acquired greater than 13,000 ETH, getting into the market at $3,448.

Whales Are Accumulating $ETH

– Whale,”0x52e,” has spent $36.5M $USDT to purchase 10,587.4 $ETH at $3,448.

– Whale, “0xdfc,” has spent $9.98M $USDT to purchase 2,895 $ETH at $3,448.

Addresses:

– 0x52e02f0a43ea757d3c8b78745c99d8ddc33bfa26

– 0xdfcaf20a17521a761036af8a3a758fcdd91dfc07… pic.twitter.com/3bECoQCwZG— Onchain Lens (@OnchainLens) July 18, 2025

Whale strikes like this are related in worth to company consumers’ actions. The nameless whale demand adopted SharpLink Gaming, which added one other 18,712 ETH to its treasury.

Whales are additionally not absolutely absorbing all accessible ETH, with some wallets sending tokens to exchanges to lock in earnings. Whale accumulation was notable in Could and June, as whales had been shopping for at a decrease common worth. Over the previous months, whale sentiment was additionally extra bullish on ETH, whereas retail merchants had largely deserted the community.

Ethereum additionally shifted its use case, after meme tokens shifted to different networks whereas gaming and NFTs misplaced their person base. At present, Ethereum carries high-value DeFi exercise and is without doubt one of the greatest lending and liquidity hubs. Ethereum’s community can be key in carrying stablecoins, supporting probably the most liquid variations of USDT and USDC.

Previously few hours, whales despatched again tokens to OKX and Coinbase Institutional, with the most important transaction for 20,908 ETH.

On by-product markets, whales are additionally taking sides. Hyperliquid counted 321 large-scale ETH positions, with 301 whales taking lengthy trades and 319 trying to quick ETH.