Bitcoin mining took a direct hit from January’s U.S. winter storm, with Cryptoquant information exhibiting sharp declines in hashrate, manufacturing, and miner income throughout the community.

Bitcoin Mining Manufacturing Falls to Submit-Halving Lows

In keeping with Cryptoquant researchers, a number of massive U.S.-based mining corporations curtailed operations as extreme climate disrupted energy availability, accelerating a networkwide hashrate drawdown of roughly 12%.

Cryptoquant notes this marks the steepest decline since October 2021, pushing whole hashrate down massively, its lowest stage since September 2025. The researchers emphasize that the climate shock compounded an already fragile setup.

Even earlier than the storm, the agency’s report observes hashrate trending decrease as bitcoin corrected from its $126,000 all-time excessive towards the $100,000 vary, tightening margins for miners working beneath elevated problem situations.

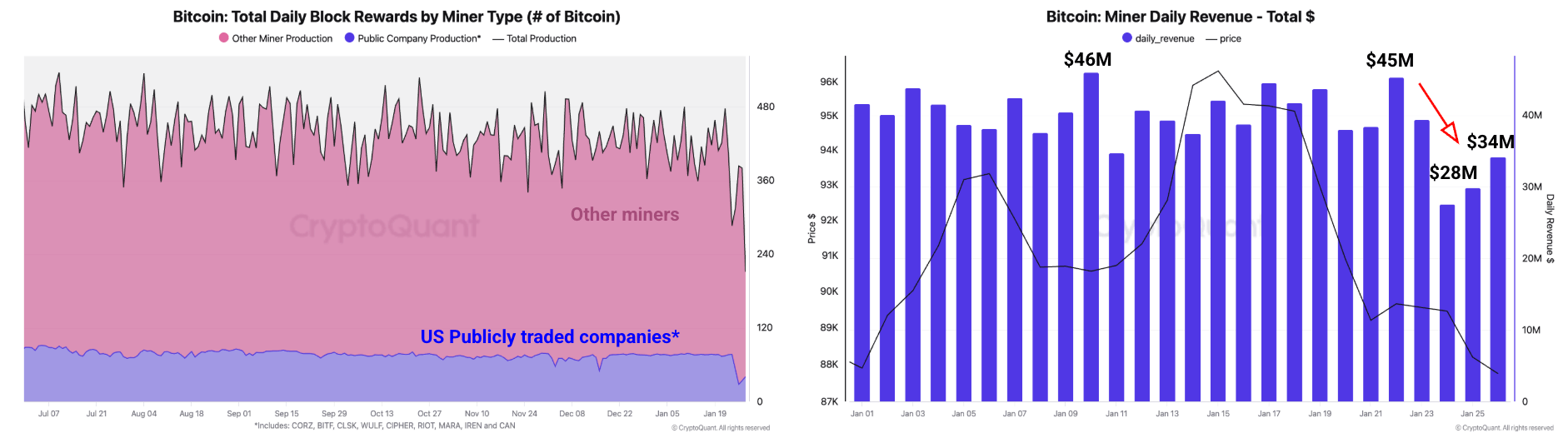

Mining revenues adopted go well with. Cryptoquant information exhibits every day bitcoin mining income fell from roughly $45 million on Jan. 22 to a yearly low close to $28 million simply two days later. Whereas income partially recovered to round $34 million by Jan. 26, the analysts stress that earnings stay nicely beneath pre-storm ranges.

Manufacturing metrics paint an identical image. The report notes that output from the biggest publicly traded mining corporations dropped from 77 $BTC per day to simply 28 $BTC throughout the disruption. On the identical time, manufacturing from different miners slid from 403 $BTC to 209 $BTC, underscoring the broad-based nature of the slowdown.

On a 30-day foundation, Cryptoquant describes the contraction because the sharpest since mid-2024, shortly after the final bitcoin halving. Publicly traded miners noticed manufacturing fall by as a lot as 48 $BTC, whereas different miners collectively misplaced about 215 $BTC over the identical interval, in response to the agency’s on-chain monitoring.

Profitability indicators are flashing deeper stress. Cryptoquant’s Miner Revenue/Loss Sustainability Index fell to 21, the bottom studying since November 2024. The agency interprets this stage as signaling that miners are “extraordinarily underpaid” beneath present value and problem situations.

Notably, analysts level out that this pressure persists even after a number of downward problem changes over the previous 5 epochs. Decrease problem has supplied some aid, however not sufficient to offset weaker costs, decreased block manufacturing, and weather-related outages.

Additionally learn: Crypto Sentiment Falters as Concern Index Lingers Close to Excessive Ranges

From Cryptoquant’s perspective, the episode highlights how exterior shocks, corresponding to excessive climate, can ripple shortly by way of bitcoin’s mining financial system. Focus of large-scale mining operations within the U.S. has elevated the community’s publicity to regional disruptions, a theme the agency has flagged in prior analysis.

Wanting forward, the researchers counsel that sustained restoration in miner profitability will doubtless depend upon a mix of improved value situations, secure vitality availability, and time for problem to recalibrate. Till then, the agency’s information signifies miners stay beneath stress, even because the storm itself clears.

FAQ ⛏️

- Why did bitcoin mining decline in January 2026?Cryptoquant information exhibits a U.S. winter storm pressured miners to curtail operations, reducing hashrate and manufacturing.

- How a lot did bitcoin hashrate fall?In keeping with Cryptoquant, community hashrate dropped about 12%, the biggest drawdown since 2021.

- What occurred to mining income?Cryptoquant studies every day mining income slid from $45 million to about $28 million earlier than a partial rebound.

- Are bitcoin miners worthwhile proper now?Cryptoquant’s Miner Revenue/Loss Sustainability Index exhibits miners are extraordinarily underpaid beneath present situations.