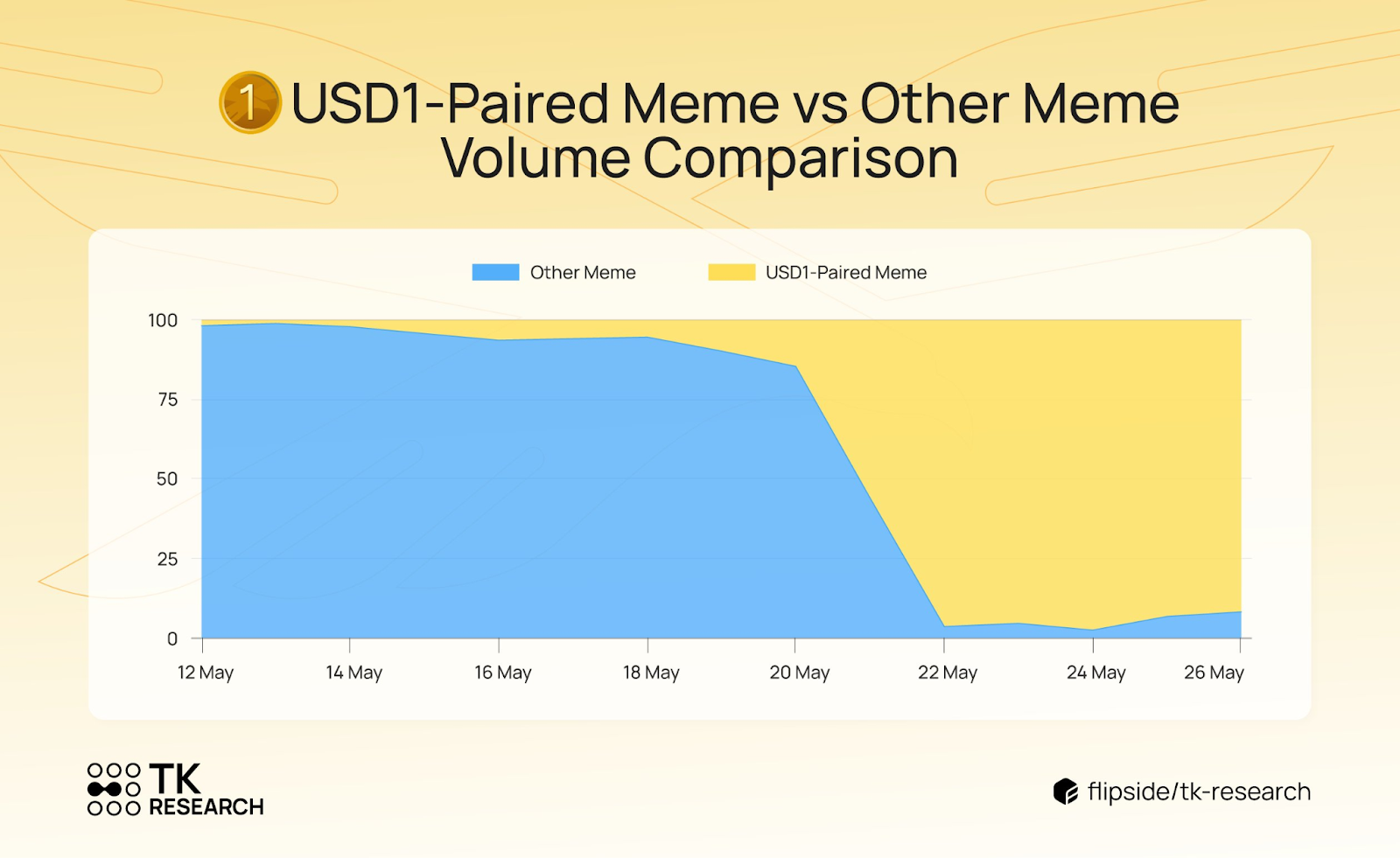

USD1-paired meme tokens have surged in recognition on the BNB Chain, dominating the majority of their buying and selling exercise. Between Might 20 and 24, these tokens have accounted for practically 90% of all meme token buying and selling quantity on the community.

In keeping with on-chain knowledge and TK Analysis, CapitainBNB, TUT, and CA have been essentially the most lively on this motion, drawing hundreds of wallets and hundreds of thousands in quantity.

USD1: The Stablecoin Behind the Meme Token Surge

In what analysts name the “USD1 Meme Growth,” the third week of Might noticed an increase in USD1-paired meme coin exercise on BNB Chain. A tweet by TK Analysis confirms that beginning Might 21, USD1-backed tokens made up greater than 50% of all meme buying and selling quantity. By the top of the week, this share had risen to virtually 90%.

This development exhibits how USD1, a part of the World Liberty Monetary ecosystem, is quick changing into the stablecoin of alternative for speculative meme property buying and selling on the BNB Chain. With tighter value stability, improved buying and selling depth, and now, better visibility by way of listings and integrations, USD1 offers meme tokens with a extra dependable buying and selling base.

CapitainBNB, TUT, CA Prime Quantity Charts, Appeal to Bulk of New BNB Chain Meme Token Wallets

The surge in USD1-paired meme buying and selling was not pushed by a single token, however by a wave of exercise throughout a number of initiatives. Nevertheless, CapitainBNB led the cost, logging $285 million in buying and selling quantity previously day. CA adopted with $13 million, whereas TUT rounded out the highest three in quantity and pockets progress.

These tokens noticed not solely the very best liquidity but additionally a disproportionate share of pockets exercise. CapitainBNB, for instance, has greater than 27,000 distinctive holders, adopted by TUT with 18,924, and CA with roughly 16,400. Collectively, these three tokens account for almost all of all wallets holding USD1-paired meme property.

Associated: Trump-Linked USD1 Stablecoin Reaches $2.1 Billion Cap, Lands Binance Itemizing

Revenue-Taking Danger Will increase as Extra Merchants Sit on Beneficial properties

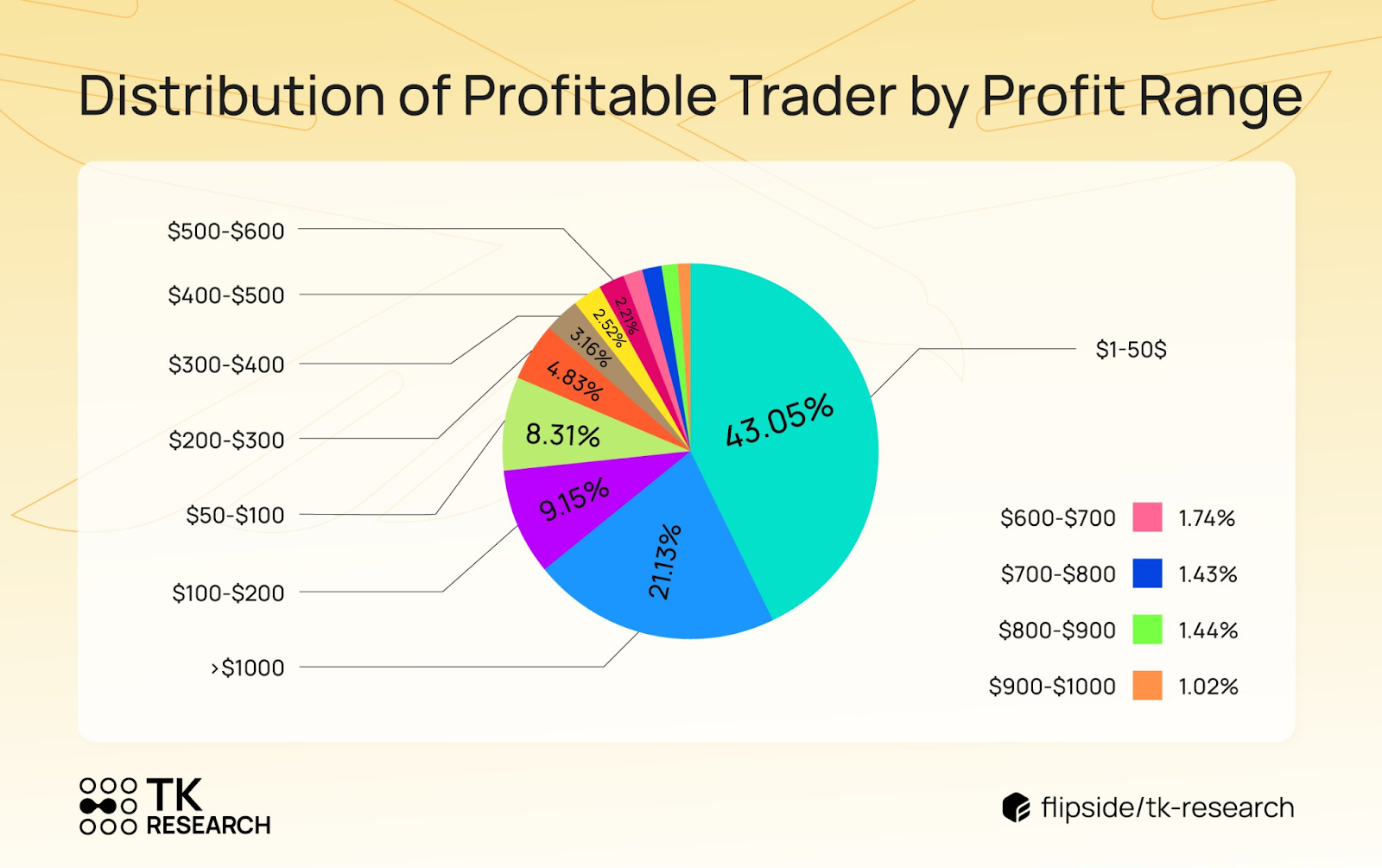

Most holders of USD1 meme tokens are actually in revenue, in response to TK Analysis. Most merchants fall into the $1 to $50 revenue vary, suggesting many made small early good points. Nevertheless, 21% of worthwhile wallets have gained greater than $1,000.

This creates circumstances for short-term volatility as early buyers might start to take earnings. Tasks like CA, TUT, and VIBT have greater than 54% of holders in revenue, which can result in value pullbacks if many determine to promote.

CapitainBNB posted among the most balanced dealer profitability stats amongst its friends. Roughly 49.34% of decentralized change (DEX) merchants who traded CapitainBNB in the course of the interval made a revenue, whereas 50.66% incurred losses.

This near-even break up is notable within the context of meme tokens, which frequently exhibit extra skewed outcomes attributable to speedy pumps and dumps.

Associated: MEXC Lists USD1, Accelerating International Stablecoin Innovation with World Liberty Monetary

In the meantime, CapitainBNB’s lead might be attributed to a number of elements, together with latest listings, viral campaigns, or a centered neighborhood effort.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t answerable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.