In an interview with BeInCrypto, Johnny Garcia, Managing Director of Institutional Progress and Capital Markets at VeChain Basis, addressed the rejection of Bitcoin (BTC) reserve payments. He emphasised that the core problem goes past legislative resistance—highlighting the necessity for larger training for each the general public and policymakers.

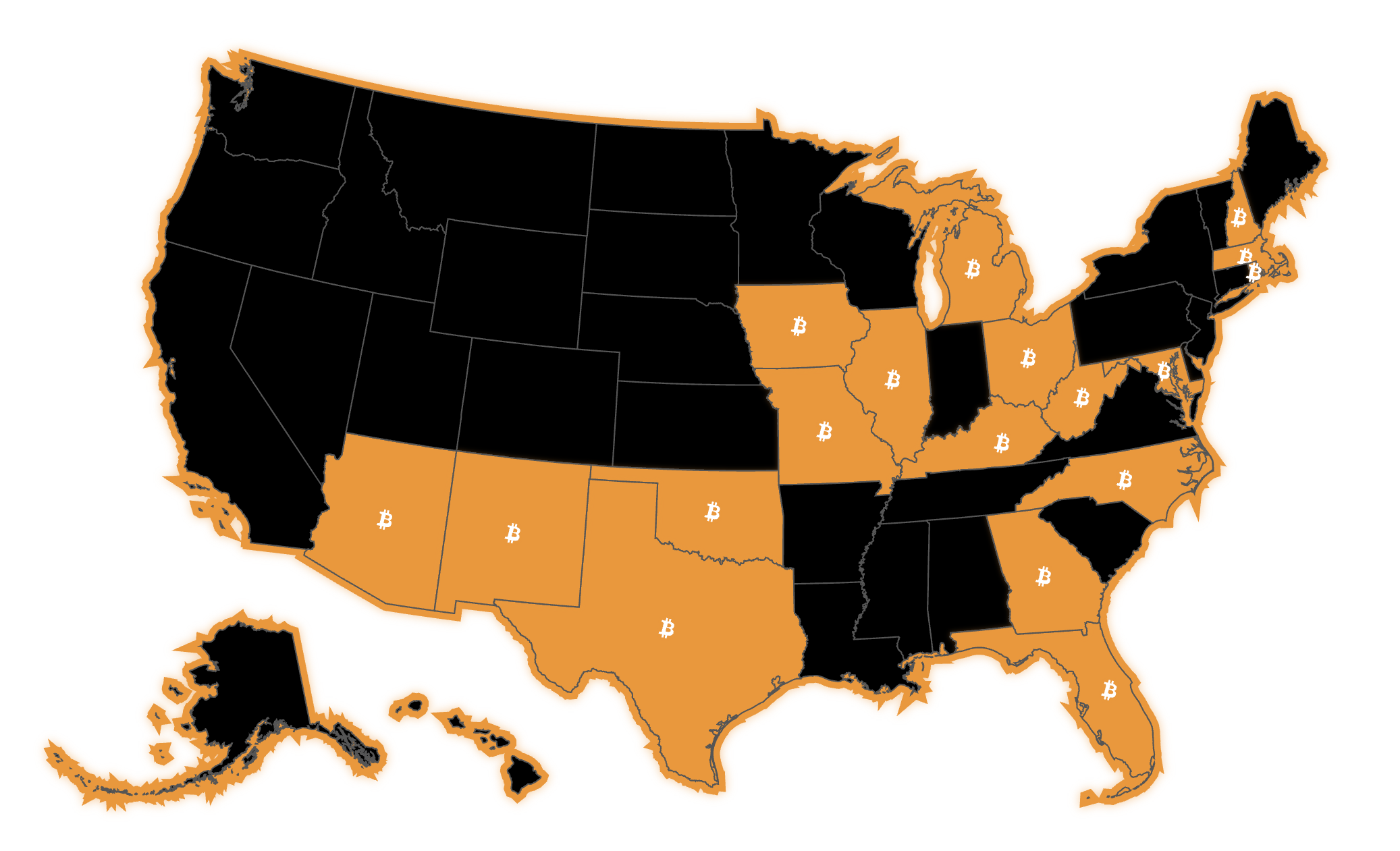

His remarks come as 5 states have already dismissed the laws. As of now, solely 18 states are nonetheless contemplating the opportunity of integrating digital property like Bitcoin into their monetary programs.

VeChain’s Govt Weighs In on Bitcoin Reserve Invoice Rejections

Garcia identified that establishing federal or state Bitcoin reserves may drive innovation by modernizing funding frameworks and enhancing operational capabilities.

“This might deliver all the advantages we in crypto are fairly aware of: transparency, quick settlement, managing counterparty dangers—to call a number of,” Garcia advised BeInCrypto.

But, he acknowledged that skepticism persists. Garcia famous that many are nonetheless unconvinced a few Bitcoin reserve’s utility and financial sense. The controversy turns into much more complicated when contemplating funding sources.

“Not each citizen in a given state will agree with their taxes financing crypto purchases—one thing they may simply do themselves,” he commented.

Thus, Garcia emphasised that states would wish to concentrate on educating their residents concerning the objective and goals of together with Bitcoin of their reserve portfolios. He burdened that whereas regulatory frameworks are essential, success hinges on demonstrating real-world worth past hypothesis.

“The blockchain/DeFi trade must step up and present that it might probably ship confirmed options that transcend speculative funding and provide real-world worth,” Garcia remarked

He added that to actually change the minds of political and governmental stakeholders, particularly those that are instinctively skeptical of crypto, the options should prolong past monetary issues. The exec emphasised that blockchain know-how must reveal its potential to handle a broader vary of issues.

Garcia highlighted VeChain as a chief instance of how blockchain can deal with each new and ongoing points. He drew consideration to VeChain’s use of blockchain to confirm sustainability efforts. Garcia famous that such functions make it tougher for lawmakers to disregard the know-how’s real-world worth past finance.

Cryptocurrency Reserve Invoice Rejections Don’t Symbolize a Unified View on Crypto

In the meantime, Garcia cautioned towards viewing the rejections on the state stage as blanket opposition to cryptocurrency.

“I wouldn’t say this essentially displays deeply ingrained opposition to the idea of crypto within the type of reserves, stockpile, or simply one other various funding possibility,” he shared with BeInCrypto.

Based on Bitcoin Legal guidelines, a complete of 33 Bitcoin reserve payments have been launched in 23 states. Nonetheless, Montana, Wyoming, North Dakota, Mississippi, and Pennsylvania have rejected the laws that will have allowed state investments in digital property, together with Bitcoin.

States Pursuing a Strategic Bitcoin Reserve. Supply: Bitcoin Legal guidelines

Presently, there are 27 energetic payments in 18 states. Importantly, Utah, which was as soon as on the forefront of the Bitcoin reserve race, just lately dropped out on a technicality. The Utah invoice remains to be progressing however with out the ‘Bitcoin Reserve’ provisions, which have been eliminated.

Garcia provided a extra nuanced view of the legislative resistance. Based on him, though a number of states have voted towards reserve payments, the opposition usually comes by small margins.

He inspired assessing the precise causes behind the rejections somewhat than generalizing. Gracia additionally welcomed that states are taking the time to think about the difficulty fastidiously.

As states navigate their very own approaches to cryptocurrency, momentum is rising on the nationwide stage. Senator Lummis has reintroduced the BITCOIN Act. This got here shortly after former President Trump signed an govt order to create a strategic Bitcoin reserve funded with seized Bitcoins.

Initially launched in July 2024, Lummis’ BITCOIN Act did not move out of Committee within the Senate.

“I’m proud to reintroduce landmark laws that can codify President Trump’s daring imaginative and prescient to ascertain america Strategic Bitcoin Reserve and strengthening our nation’s financial basis for generations to come back,” Lummis wrote on X.

The invoice goals to create a US Strategic Bitcoin Reserve, backed by as much as 1 million BTC acquired over 5 years. Furthermore, the holdings can be maintained for not less than 20 years.