The Virtuals Protocol (VIRTUAL) is the trending token on CoinGecko, after posting notable positive aspects over the day and within the final month.

Nonetheless, heads flip amid considerations that whale management, weak fundamentals, and AI hype could also be fueling a risky rally.

VIRTUAL Whale Holdings Elevate Crimson Flags

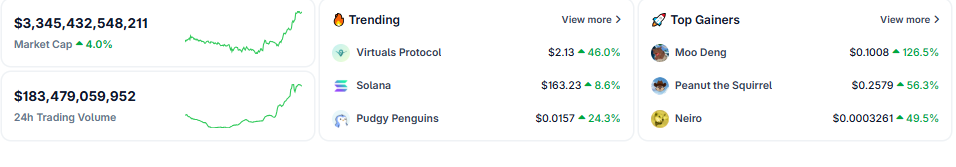

VIRTUAL, a fast-rising AI-themed token, has skyrocketed almost 300% in Might, gaining 46% up to now 24 hours alone. Trending on CoinGecko, knowledge exhibits it was buying and selling at $2.13 on the time of writing.

VIRTUAL worth efficiency. Supply: CoinGecko

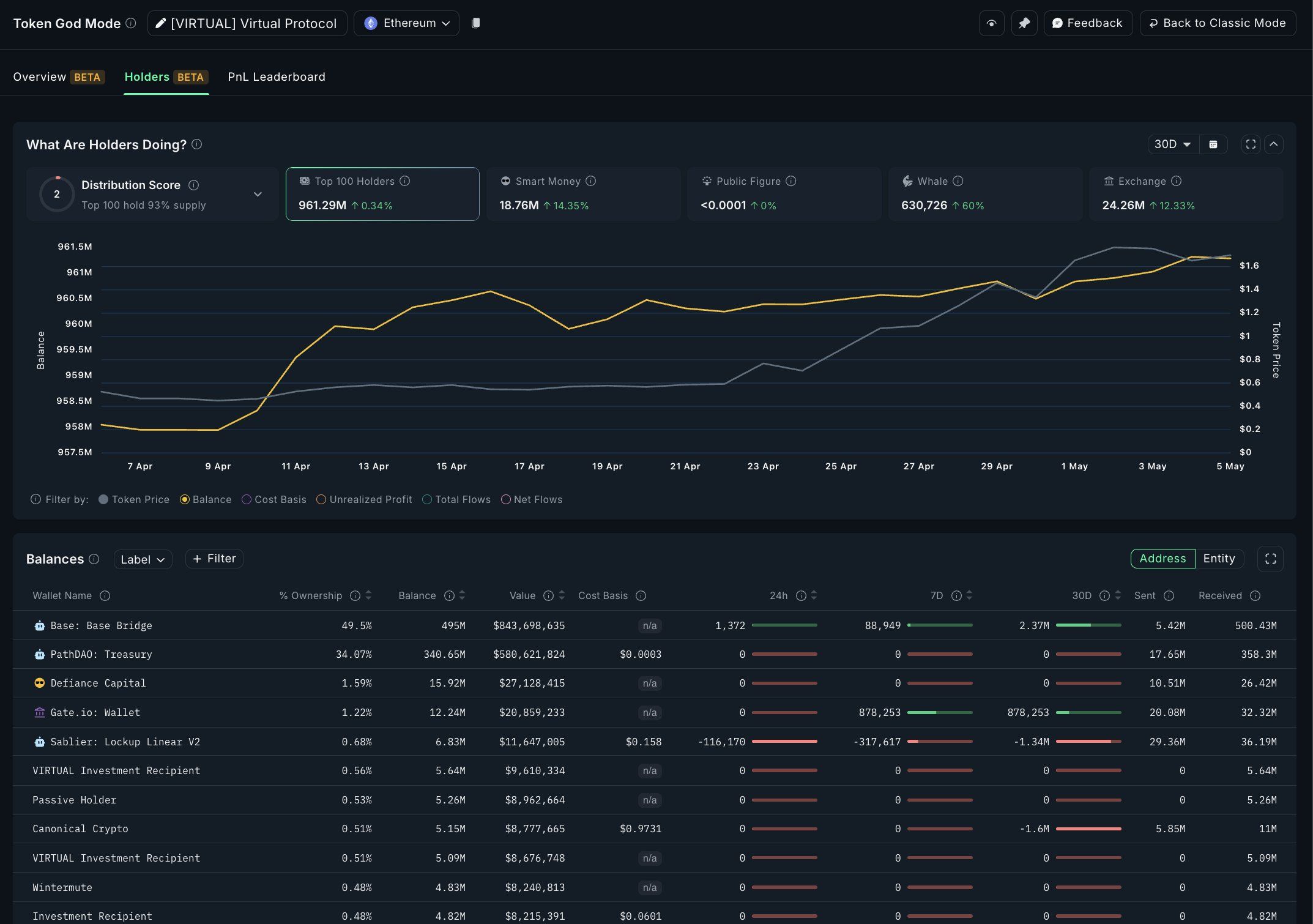

But behind the meteoric worth motion lies a troubling focus of energy. In keeping with blockchain analytics agency Nansen, the highest 100 wallets now maintain 93% of VIRTUAL’s complete provide.

“This isn’t simply concentrated — it’s vacuum-sealed…and Sensible Cash holdings? Up +14.35%,…Somebody is positioning. Quietly,” Nansen wrote in a put up on X (Twitter).

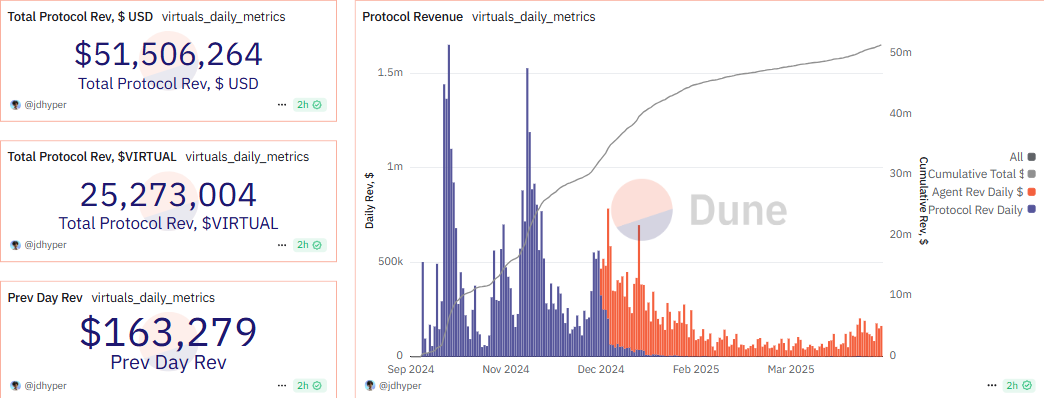

Regardless of the hype, buying and selling income from VIRTUAL’s underlying protocol tells a special story. In keeping with Dune Analytics, income peaked at simply $163,279 on Thursday, which is comparatively low for a token that has surged over 300% within the final 30 days.

Virtuals Protocol income. Supply: Dune dashboard

The sharp disconnect between worth appreciation and precise income era has raised considerations about sustainability, notably as a handful of enormous holders dominate the provision.

“VIRTUALS’ worth pumped by 3x since April twentieth, whereas its protocol income seems like this,” one person remarked.

Primarily based on sentiment on X, speculative curiosity in Digital Protocol’s AI agent platform could affect the VIRTUAL worth surge. Some analysts are calling the “second wave” of decentralized AI, with crypto analyst Hitesh Malviya explaining the rising traction on the protocol.

“The 2nd wave of AI brokers is right here, and it’s taking place on Virtuals Protocol in a brand new type. Higher lineup of brokers, truthful launch mechanism… and a brand new mechanism referred to as Virgin Factors,” Malviya famous.

Virgin Factors Generate Recent Demand for VIRTUAL Token

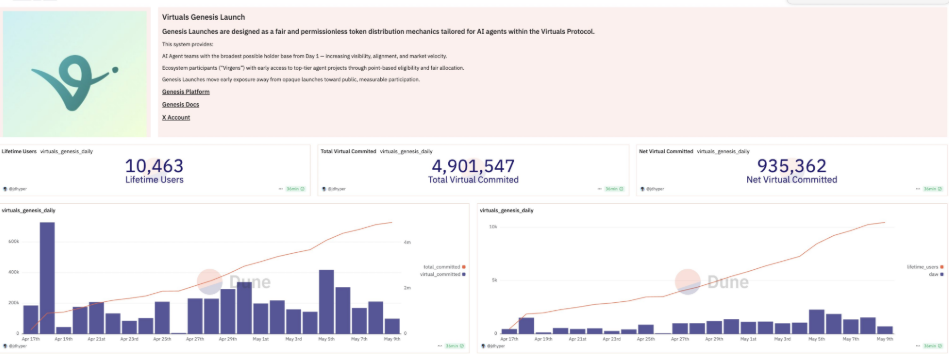

Virgin Factors is a brand new loyalty-based allocation system that permits retail customers to entry early-stage token launches. These factors permit customers to pledge tokens in return for capped allocations, theoretically creating extra equitable participation.

“By changing the bonding curve, it makes use of a Proof of Contribution system to reward customers based mostly on ecosystem participation by way of Virgen Factors and $VIRTUAL tokens. It has pushed vital person engagement, with 8,300 distinctive addresses and 18,900 transactions recorded by early Might, peaking at 2,274 transactions on Might 5,” DWF Ventures defined.

In keeping with knowledge on Dune, over 4.9 million VIRTUAL tokens have been dedicated throughout these launches by over 10,000 contributors. The info additionally exhibits a every day common dedication of 250,000 tokens. This mechanism seems to be producing contemporary demand for VIRTUAL.

“VIRTUAL worth can be going up these days with this new demand rising for the token — the token worth went up by 3.7x up to now 30 days,” Malviya added.

Virtuals genesis launch. Supply: Malviya on X

Nonetheless, the mix of whale dominance, tepid income, and sharp worth will increase raises questions in regards to the long-term viability of the token’s valuation.

Whereas the elevated Sensible Cash exercise is notable, it might simply as simply symbolize opportunistic hypothesis reasonably than deep conviction.

VIRTUAL’s rally aligns with a broader rebound in altcoins amid improved market sentiment. Nonetheless, the token could face heightened volatility with such a tightly held provide and comparatively low protocol utilization. That is very true if bigger holders start to take earnings.

Whereas the narrative of AI innovation and decentralized participation is compelling, the information behind VIRTUAL’s meteoric rise requires warning.

As consideration intensifies, the approaching weeks will check whether or not this worth surge displays actual utility or simply one other speculative bubble within the making.