BVNK has secured backing from Visa Ventures, marking the funds big’s newest transfer to combine stablecoin know-how into its world community.

Stablecoin funds infrastructure supplier BVNK has secured a strategic funding from Visa, deepening the standard funds big’s push into blockchain-based settlement applied sciences. The funding, made by means of Visa Ventures, was introduced Tuesday by BVNK CEO Jesse Hemson-Struthers.

Though the monetary phrases weren’t disclosed, the transfer follows BVNK’s $50 million Sequence B spherical in December 2024, which was led by Haun Ventures and included backing from Coinbase Ventures, Scribble Ventures, DRW Enterprise Capital, Avenir, and Tiger World.

Hemson-Struthers described the partnership as “greater than capital,” calling it a “highly effective validation of our imaginative and prescient to improve world funds with stablecoin know-how.”

Crypto.information reached out to each BVNK and Visa a number of occasions, however neither responded by the point of publication.

You may additionally like: Meta could also be eyeing stablecoin funds for Instagram creators

Within the announcement, Visa’s head of progress merchandise and partnerships, Rubail Birwadker, famous that stablecoins “are quick changing into part of world fee flows, and Visa invests in new applied sciences and builders like BVNK, staying on the forefront of what’s subsequent in commerce to raised serve our purchasers and companions.”

BVNK claims to course of $12 billion in annualized stablecoin fee quantity and says it constructed its platform from the bottom as much as help automated, high-volume transactions. The agency positions its service as an alternative choice to the standard correspondent banking system, which it says is just too sluggish and costly for a lot of fashionable enterprise wants.

“At BVNK, we acknowledged early that stablecoins would emerge as an on the spot world fee rail and a viable different to the standard correspondent banking system. That’s why we’ve constructed our infrastructure from the bottom as much as automate and orchestrate stablecoin funds at scale, making these new rails accessible to companies of all sizes.”

Hemson-Struthers

Chasing stability

The Visa funding comes at a time when the stablecoin sector is displaying indicators of broader institutional curiosity. In late April, Visa partnered with Stripe-acquired Bridge startup to allow fintechs to situation Visa playing cards that draw straight from stablecoin balances.

The brand new product, initially launching in six Latin American international locations, permits customers to fund playing cards with stablecoins, that are then transformed to native fiat on the level of sale. Retailers obtain funds of their native currencies, with no publicity to crypto volatility.

Bridge CEO Zach Abrams described the collaboration as a “large unlock for builders,” including that everybody “will be capable to use stablecoins with only a faucet.” Visa’s chief product and technique officer, Jack Forestell, emphasised that the corporate goals to “combine stablecoins securely into its world community,” giving shoppers and builders extra monetary choices.

BVNK seems to be a part of this broader strategic path. In its announcement, the corporate famous that its stablecoin rails might assist redefine how companies function within the digital economic system, notably in areas with restricted entry to environment friendly cross-border banking.

The agency has additionally been increasing into the U.S. market, opening places of work in San Francisco and New York earlier this yr. Its U.S. operations are being led by former BlockFi govt Amit Cheela and former Cross River govt Keith Vander Leest.

‘Trillion-dollar alternative’

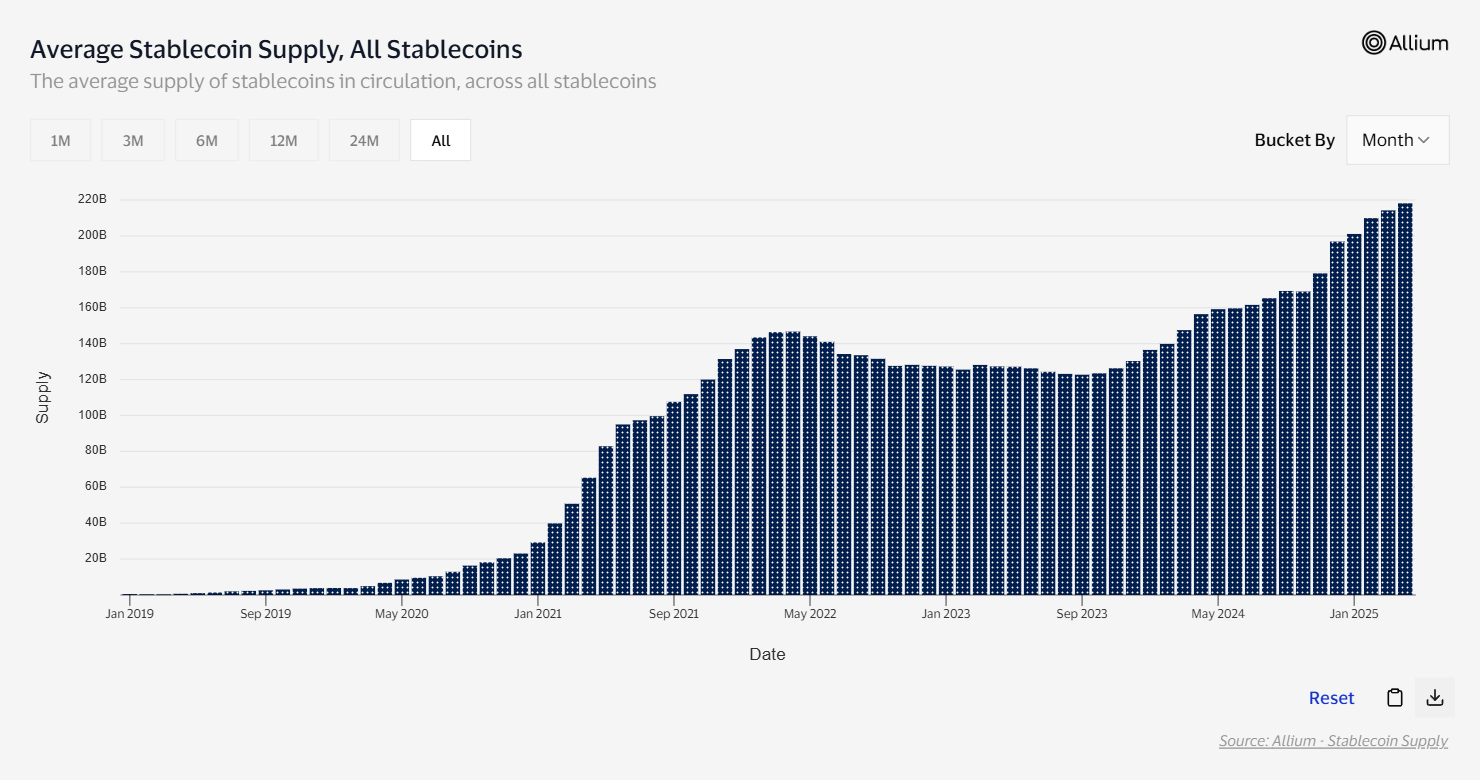

Stablecoin fee volumes have surged in latest quarters. Visa’s Onchain Analytics platform experiences $33.4 trillion in world stablecoin quantity throughout 5.5 billion transactions, indicating rising traction past buying and selling use circumstances.

Common stablecoin provide | Supply: Visa

Citi Wealth additionally famous that stablecoins “might find yourself reinforcing the U.S. greenback’s dominance,” notably as stablecoin infrastructure scales globally.

https://twitter.com/hosseeb/standing/1874288532686295058

Dragonfly Capital’s managing associate Haseeb Qureshi has earlier additionally projected that 2025 might mark a turning level for stablecoins, saying they might develop into key instruments for small and medium-sized companies, transferring past speculative crypto buying and selling into real-world funds and settlement.

“Stablecoin utilization will explode, notably amongst SMBs. Not simply buying and selling and hypothesis — actual companies will begin utilizing on-chain {dollars} for fast settlement.”

Qureshi

He additionally added that effectivity and accessibility would permit stablecoins to outpace conventional techniques, particularly as regulatory readability improves.

Pantera Capital, one other distinguished crypto enterprise agency, has referred to as stablecoins a “trillion-dollar alternative,” noting that they now account for over 50% of blockchain transaction exercise, in comparison with simply 3% in 2020.

For BVNK, the Visa deal can also be a reputational milestone. Hemson-Struthers framed it as a return to first rules in funds innovation.

“I’m notably enthusiastic about what it means to associate with Visa—the unique funds innovator,” he mentioned, including that Visa’s experience in constructing world fee networks, mixed with BVNK’s stablecoin infrastructure, would create “highly effective prospects.”

Learn extra: Stablecoins account for practically 50% of South Korea’s crypto outflows in Q1, officers say