In a fearful, risk-off crypto market, the Dogecoin value is hovering close to key technical ranges that sign compressed volatility and a possible for sharper strikes forward.

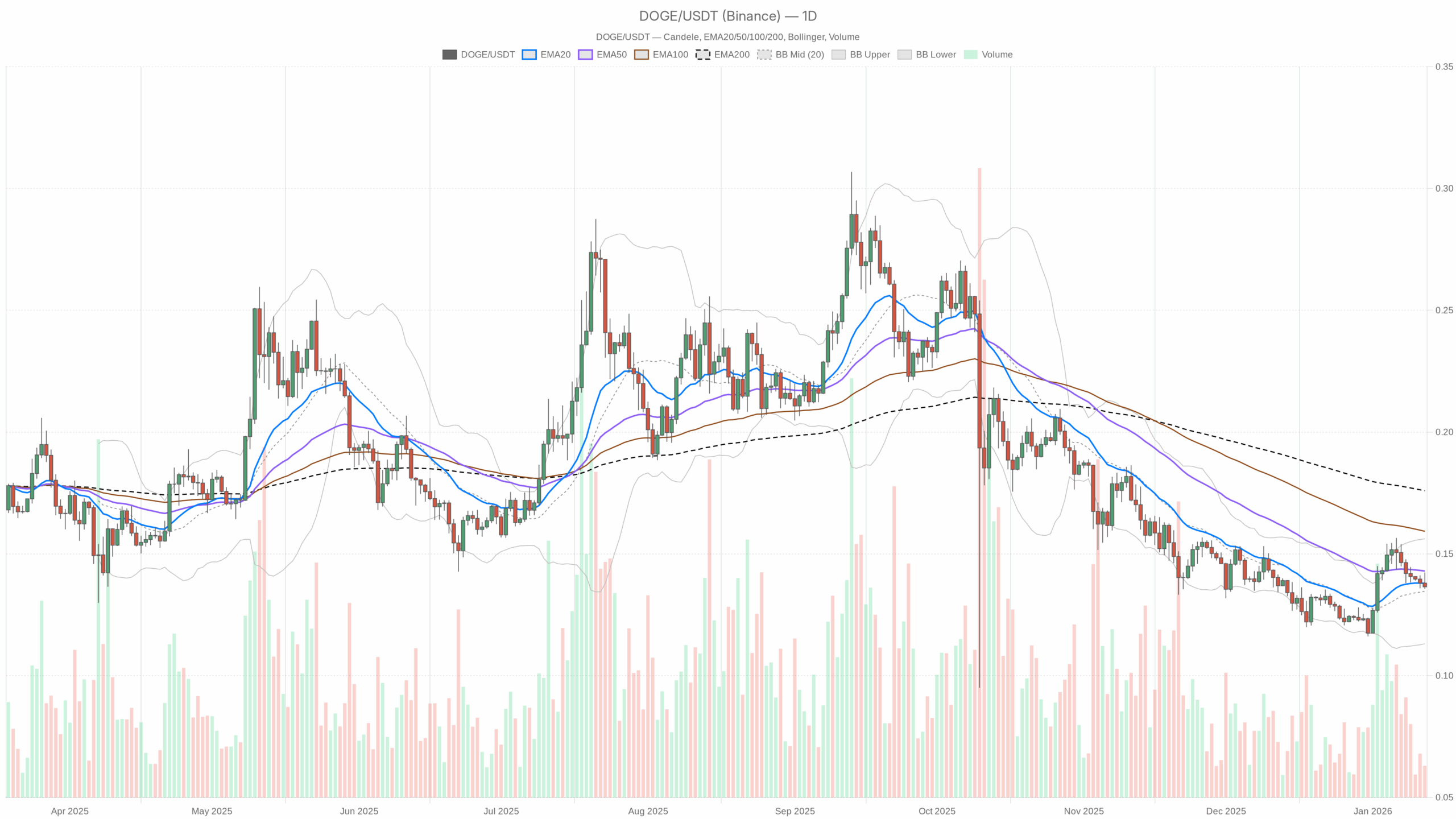

Primary state of affairs on the day by day chart (D1): structurally bearish, tactically impartial

On the day by day timeframe, the bias remains to be bearish, however in a really particular sense: construction is bearish, momentum is impartial. That mixture usually precedes both a mean-reversion bounce into resistance or a pointy flush as soon as liquidity returns.

Development construction – EMAs

– Worth (shut D1): $0.14

– EMA 20: $0.14

– EMA 50: $0.14

– EMA 200: $0.18

– Regime flag: bearish

The 20-day and 50-day EMAs are basically flat and overlapping proper on the present Dogecoin value round $0.14, whereas the 200-day EMA is increased at $0.18. That tells you two issues:

- The long-term pattern remains to be down (value under the 200-day).

- The short- to mid-term pattern has stalled (quick EMAs flat and bunched up).

In plain English, the downtrend has misplaced momentum however has not reversed. It’s extra like Dogecoin is resting below a ceiling than beginning a recent uptrend.

Momentum – RSI & MACD

– RSI 14 (D1): 48.45

– MACD line / sign / histogram (D1): all successfully at 0

Each day RSI slightly below 50 is pure indecision. There isn’t any actual shopping for strain, but in addition no lively capitulation. Dogecoin just isn’t overbought, it’s not oversold, it’s successfully being ignored.

MACD being pinned round zero confirms the identical story: no robust bullish or bearish momentum on the day by day. The earlier pattern has run its course, however a brand new directional leg has not began. That is the sort of backdrop the place information, liquidity shocks, or broader market strikes can punch value out of equilibrium shortly.

Volatility and ranges – Bollinger Bands & ATR

– Bollinger Bands (D1): mid $0.13, higher $0.16, decrease $0.11

– ATR 14 (D1): $0.01

On the day by day chart, value is sitting near the center of the Bollinger Bands. The band unfold ($0.11–0.16) outlines the present medium-term worth space. We’re nowhere close to the extremes, so there is no such thing as a speedy squeeze breakout or band-walk pattern in play but.

ATR round $0.01 on a $0.14 asset is low however not irregular for a cooling section. The important thing studying right here is easy: volatility has compressed in comparison with the prior swings. Traditionally for DOGE, low volatility hardly ever persists and it tends to resolve with sharp strikes as soon as merchants get up once more.

Each day pivot ranges

– Pivot Level (PP, D1): $0.14

– R1 (D1): $0.14

– S1 (D1): $0.13

The day by day pivots clustering proper across the present value present we’re hanging at a short-term stability level. S1 down at $0.13 is the primary line the place dip consumers would possibly react. On the upside, there is no such thing as a clearly outlined speedy pivot resistance above, so the market will possible look to the $0.16 band high after which the $0.18 200-day EMA as the subsequent actual exams.

Macro context and dominance backdrop

The dominant pressure proper now’s macro risk-off and altcoin neglect. Bitcoin is holding over 56% market dominance, the full crypto market cap is flat to barely adverse, and the Concern & Greed Index is sitting within the Concern zone at 27. In that context, Dogecoin at $0.14 and below its 200-day common is a textbook laggard. It isn’t being aggressively bought, however it’s not being bid both, so it stays within the ready room.

Intraday image: intraday promoting strain, however frozen tape

1-hour (H1): weak intraday bid, frozen volatility

– Worth (shut H1): $0.14

– EMA 20 / 50 / 200 (H1): throughout $0.14

– RSI 14 (H1): 37.95

– MACD (H1): round 0

– Bollinger Bands (H1): squeezed tightly round $0.14

– ATR 14 (H1): 0

– Pivots (H1): PP / R1 / S1 all clustered at $0.14

The hourly chart appears to be like nearly synthetic, with value caught at $0.14, ATR successfully at zero, Bollinger Bands collapsed on high of value, and all EMAs overlapping. That could be a basic micro-liquidity freeze. There may be little or no two-way commerce, spreads are possible tight however with low depth, and no one is pushing the tape.

RSI down round 38 tells you that, beneath the nonetheless floor, the strain has leaned barely to the promote aspect on this timeframe. It isn’t a crash, only a mild grind that has now run into inactivity. With MACD flat, there is no such thing as a actual momentum construction to lean on intraday, solely the data that when volatility comes again, the primary directional push can prolong earlier than mean-reverting.

15-minute (M15): very quick time period stretched to the draw back

– Worth (shut M15): $0.14

– EMA 20 / 50 / 200 (M15): all close to $0.14

– RSI 14 (M15): 28.9

– MACD (M15): round 0

– Bollinger Bands & ATR (M15): extraordinarily tight, ATR at 0

– Regime (M15): bearish

The 15-minute RSI under 30 flags a domestically oversold situation, though value itself barely moved in absolute phrases. What this actually means is that within the tiny strikes that did happen, promoting dominated, however volatility is so compressed that the market has not been allowed to specific a correct response but.

For execution, this can be a reminder: shorting right into a low-volatility, domestically oversold intraday tape carries poor reward/threat until a recent catalyst hits. Any small constructive shock can set off a fast snap-back on this timeframe, even whereas the broader day by day pattern stays fragile.

Dogecoin value eventualities

Bullish state of affairs: imply reversion into resistance

The constructive path from right here just isn’t speedy moon, however a mean-reversion bounce from a depressed, low-liquidity surroundings.

What the bullish path appears to be like like:

- Dogecoin holds above $0.13 on a day by day closing foundation, protecting the present vary intact.

- RSI on D1 pushes decisively again above 50–55, marking a shift from apathy to lively shopping for.

- Worth begins to climb towards the $0.16 higher Bollinger Band, ideally with increasing ATR, that means volatility comes again on an up-move, not a dump.

- On the way in which up, the quick EMAs (20/50) begin to tilt upward and separate from one another, turning the flat cluster right into a short-term rising construction.

In that case, key upside checkpoints are:

- $0.16: first main resistance according to the day by day band high.

- $0.18: the 200-day EMA and a important pattern inflection zone. Reclaiming and holding above this stage could be the primary critical sign that the bigger downtrend is ending and a brand new medium-term uptrend is in play.

What would invalidate the bullish state of affairs?

A clear day by day shut under $0.13, particularly if accompanied by a drop in RSI towards the low 40s or under and an growth in ATR to the draw back, would inform us consumers have didn’t defend the present vary. That will transfer the main target from imply reversion to continuation of the broader bearish construction.

Bearish state of affairs: vary breaks and pattern resumes

The bearish aspect respects the present macro setup: fearful sentiment, Bitcoin dominance excessive, and altcoins largely sidelined. On this surroundings, Dogecoin is susceptible if liquidity leaves alts once more or if BTC rolls over.

What the bearish path appears to be like like:

- Dogecoin loses $0.13 assist on quantity, turning the present flooring into resistance.

- Each day RSI sinks into the low 40s or 30s, confirming a shift from neutrality to sustained promoting.

- ATR expands because the vary lastly breaks, however this time the growth comes on a downward transfer.

- EMAs on D1 begin to fan downward once more, with the 20-day rolling under the 50-day in a extra pronounced style.

In that state of affairs, the market will seek for a decrease worth space, possible someplace nearer to the $0.11 decrease Bollinger Band as an preliminary magnet. If worry within the broader market deepens, a fast stab by these band lows wouldn’t be stunning earlier than a extra significant bounce.

What would invalidate the bearish state of affairs?

A robust push again above $0.16 with rising quantity and day by day RSI reclaiming and holding above 55 would argue that the draw back break was a bear lure. From there, any sustained commerce above the 200-day EMA at $0.18 would successfully kill the dominant bearish construction and pressure bears to reassess.

How to consider positioning across the present Dogecoin value

Proper now, Dogecoin is in a low-volatility, low-conviction pocket. The day by day pattern remains to be technically bearish, with value below the 200-day, however the lack of momentum and the compressed ranges imply you’re being paid little or no for aggressive directional bets till volatility returns.

For bulls, the tape doesn’t but justify heavy publicity. The upper-probability play is often to look ahead to affirmation, akin to a break towards $0.16 with rising quantity and an uptick in day by day RSI and ATR. Shopping for deep right into a frozen, fearful market earlier than that occurs means you’re betting on timing, not construction.

For bears, the danger is nearly the mirror picture. Shorting a coin that’s already below its 200-day, with intraday RSI oversold and volatility useless, is usually late within the transfer. The macro context favors warning on meme property, however the speedy reward/threat just isn’t compelling until Dogecoin clearly loses $0.13 with vitality behind the break.

Volatility, by definition, will return. The bottom line is to not confuse a quiet market with a protected one. When ranges compress this difficult, the subsequent leg tends to be sharp, and being unsuitable on route can damage shortly. Sizing, stops, and time horizon matter greater than typical in this kind of regime.

If you wish to monitor markets with skilled charting instruments and real-time information, you possibly can open an account on Investing utilizing our associate hyperlink:

Open your Investing.com account

This part incorporates a sponsored affiliate hyperlink. We could earn a fee at no extra value to you.

This text is a market commentary and displays a technical view on the Dogecoin value based mostly on the information obtainable on the time of writing. It isn’t funding recommendation, and it doesn’t have in mind your particular person circumstances, threat tolerance, or monetary goals. Cryptoassets are extremely unstable and may transfer sharply in both route; by no means threat capital you can not afford to lose.