Crypto markets stay cautious because the broader advanced cools, and the Dogecoin value sits pinned close to latest lows whereas volatility quietly compresses beneath the floor.

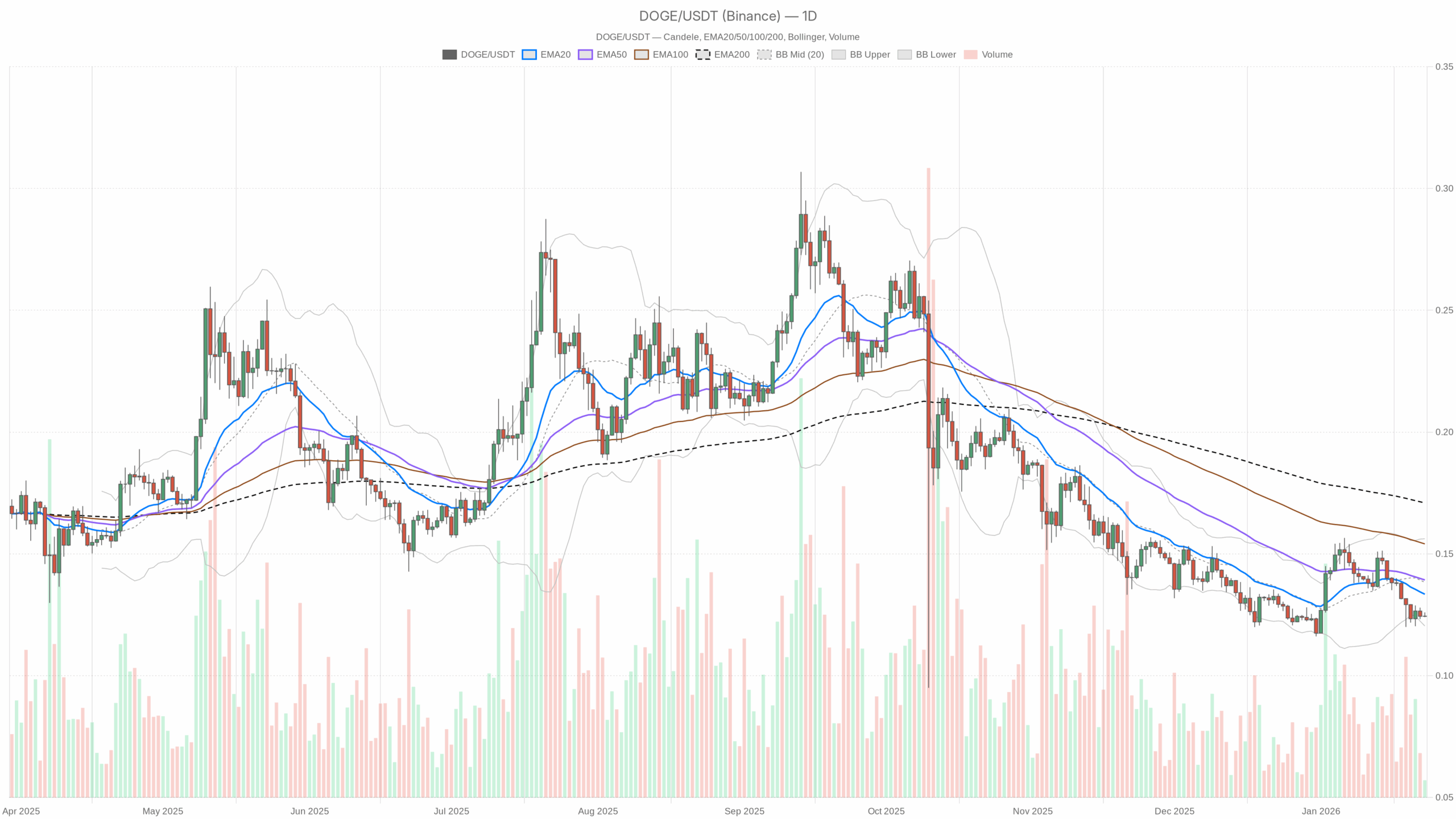

DOGE/USDT each day chart with EMA20, EMA50 and quantity”

DOGE/USDT each day chart with EMA20, EMA50 and quantity”loading=”lazy” />

Dogecoin close to vary lows as sellers maintain management

Dogecoin is sitting round $0.12, pinned close to the decrease fringe of its latest vary whereas the broader crypto market cools off and sentiment sits in Excessive Worry. Every day construction is clearly bearish, however volatility is getting so compressed that the following significant transfer is more likely to be sharp. The important thing query now is just not whether or not the transfer is everlasting in a single course, however which aspect wins the following squeeze.

With Bitcoin dominance above 57% and complete crypto market cap down over 1% in 24 hours, capital is defensive and crowd urge for food for meme threat is low. That’s normally not when Dogecoin leads. Nonetheless, it’s when short-term mean-reversion rallies might be vicious if shorts get crowded close to apparent lows.

Every day bias: bearish pattern, weak momentum, low volatility

On the each day timeframe, the primary situation is bearish. Value is buying and selling under all the important thing shifting averages and close to the decrease fringe of its Bollinger Bands, with momentum depressed however not but washed out. That’s traditional managed downtrend habits, not capitulation.

Development construction: EMAs

Every day EMAs:

- Value (shut): $0.12

- EMA 20: $0.13

- EMA 50: $0.14

- EMA 200: $0.17

Value is under the 20, 50, and 200-day EMAs, and the system already labels the regime as bearish. That could be a textbook downtrend stack: shorter EMAs below longer EMAs, value below all of them. It tells you rallies into $0.13–0.14 are more likely to be handled as promoting alternatives until patrons can power a sustained reclaim.

Momentum: RSI and MACD

Every day RSI 14: 38.65

RSI is sitting within the excessive 30s, under the midpoint however not but oversold. That’s the form of studying you see in a grinding downtrend the place sellers are dominant however not panicking. It leaves room for each a short-covering bounce and one other leg down. It doesn’t sign an exhausted, blow-off low.

Every day MACD: line ≈ 0, sign ≈ 0, histogram ≈ 0

MACD being basically flat round zero signifies momentum is muted in each instructions. The pattern is down by construction, however there isn’t a highly effective draw back acceleration proper now. Bears are in management by place, not by uncooked momentum.

Volatility and bands: Bollinger Bands and ATR

Every day Bollinger Bands:

- Center band: $0.14

- Higher band: $0.16

- Decrease band: $0.12

Dogecoin is hugging the decrease band at $0.12 whereas the band width is comparatively tight. Value driving the decrease band in a slender channel means a managed downtrend with compressed volatility. That’s usually the calm earlier than a variety enlargement transfer.

Every day ATR 14: $0.01

An ATR of roughly one cent on a 12-cent coin is modest. Every day swings are comparatively contained, which aligns with the tight bands. When meme cash sit in a low-ATR setting for some time, they normally don’t remain quiet ceaselessly. The following breakout might be abrupt.

Every day pivot ranges

- Pivot level (PP): $0.12

- R1: $0.13

- S1: $0.12 (successfully overlapping present value)

The each day pivot cluster round $0.12 reinforces this space as a short-term equilibrium zone. Buying and selling proper on the pivot, with R1 up close to $0.13, suggests the market is deciding whether or not $0.12 turns into a launchpad for a bounce or a staging space for a breakdown.

Intraday image: bearish bias however with stabilizing indicators

Each the 1H and 15m timeframes are additionally flagged as bearish, however the tone is barely totally different. Value is flatlining, volatility is sort of lifeless, and intraday EMAs are tightly bunched. That’s extra of a coiling sample than an energetic dump.

1-hour chart: compressed and indecisive below resistance

1H value: $0.12

- EMA 20: $0.13

- EMA 50: $0.13

- EMA 200: $0.13

On the hourly, value sits slightly below a decent EMA cluster round $0.13. That is typical lid habits. Intraday rallies run right into a wall close to the identical stage. So long as Dogecoin stays capped under that cluster, short-term management stays with sellers and vary scalpers.

1H RSI 14: 44.72

RSI just under 50 on the hourly reveals gentle bearish stress however stronger steadiness than on the each day. Intraday, the market is extra two-sided, with neither aspect absolutely committing.

1H MACD: line ≈ 0, sign ≈ 0, hist ≈ 0

MACD is flat on the hourly as properly, confirming the lack of directional push. Bears have the structural edge from increased timeframes, however intraday momentum is impartial to tender reasonably than aggressively brief.

1H Bollinger Bands:

- Center band: $0.12

- Higher band: $0.13

- Decrease band: $0.12

Hourly bands are extraordinarily tight, with value sitting close to the center. It is a pure consolidation look, a coiled spring below higher-timeframe resistance.

1H ATR 14: ~0

ATR successfully at zero on the hourly tells you what you already really feel: nothing is shifting. Any such lifeless volatility usually precedes a variety break. The course is normally determined by the upper timeframe, which at present factors down.

15-minute chart: for execution, not for bias

15m value: $0.12

- EMA 20: $0.13

- EMA 50: $0.13

- EMA 200: $0.13

Quick-term EMAs above value on the 15m echo the intraday ceiling round $0.13. For execution, that is the place short-term merchants will look ahead to both rejection to fade or a clear reclaim to step apart or flip short-term bias.

15m RSI 14: 38.85

RSI on the 15m sits close to 39, leaning extra bearish than the hourly. That hints at native promoting stress inside a broader consolidation. Nonetheless, on this small timeframe it might probably flip shortly.

15m MACD: line ≈ 0, sign ≈ 0, hist ≈ 0

Once more, MACD is flat. Very short-term momentum is uneven and weak, becoming the concept of a market ready for a catalyst.

15m Bollinger Bands:

- Center band: $0.13

- Higher band: $0.13

- Decrease band: $0.12

Value hanging between the center and decrease bands on the 15m confirms a slight draw back drift inside a decent intraday vary.

Bullish situation for Dogecoin value

The bullish case is actually a mean-reversion squeeze in opposition to a bearish backdrop, establishing a attainable countertrend transfer.

For a reputable bullish situation, Dogecoin must:

- Maintain and defend $0.12 as help on the each day shut, avoiding a clear breakdown under the decrease Bollinger Band.

- Reclaim the 1H and 15m EMA cluster round $0.13 and begin closing a number of hourly candles above it, turning that stage from a lid right into a ground.

- Push towards the each day center Bollinger Band and EMA 20 close to $0.13–0.14. A each day shut above $0.14 could be the primary actual signal that the downtrend is loosening its grip.

- Drag each day RSI again towards or above 50, signaling that patrons are lastly matching sellers on the upper timeframe.

In that path, first upside checkpoints are $0.13 (R1 and intraday ceiling) after which the $0.14 area across the each day EMA 20 and BB mid. Stronger follow-through might then goal the $0.16 higher band, however that might require a broader enchancment in threat urge for food throughout the market.

What invalidates the bullish case?

A decisive each day shut under $0.12 with increasing quantity and a transparent experience outdoors the decrease band would invalidate this mean-reversion thought and open the door for continuation to the draw back.

Bearish situation for Dogecoin value

The bearish situation is simply the upper timeframe pattern doing its job: continuation decrease after a low-volatility pause and renewed stress on help.

For bears, the best path appears to be like like:

- Dogecoin fails to reclaim $0.13. Each try into that stage on 1H and 15m is bought.

- Value begins to shut each day candles below $0.12, turning the present pivot into resistance.

- Every day RSI drifts from about 39 down into the low 30s, exhibiting contemporary draw back stress with out but reaching a full capitulation excessive.

- ATR and Bollinger Band width start to increase on a break decrease, confirming an precise pattern leg, not only a small intraday fake-out.

In that situation, the market would discover decrease help zones under $0.12. These are usually not offered on this dataset, however structurally suppose by way of prior swing lows and psychological ranges like $0.11 and $0.10. With BTC dominance excessive and sentiment in Excessive Worry, a liquidity flush in altcoins would match that image.

What invalidates the bearish case?

If Dogecoin reclaims and holds above $0.14 on the each day, again above the EMA 20 and close to the Bollinger mid, and intraday dips into $0.13 get purchased as an alternative of bought, the easy continuation-downtrend narrative breaks. Bears would then be going through a transition from pattern to vary, and even the early phases of a pattern reversal.

Positioning, threat, and the way to consider this tape

Proper now, the market is sending a transparent message: pattern is down, volatility is low, and sentiment is fearful. That mixture usually rewards endurance greater than aggression. Furthermore, chasing strikes in the course of a decent coil usually means getting chopped up simply earlier than the true break.

For directional merchants, the sensible focus is on the $0.12–0.14 band:

- Above it and held: you’re doubtless coping with a short-covering bounce in a broader bear pattern.

- Beneath it and held: you’re again in pure trend-follow mode, with volatility doubtless increasing decrease.

Intraday charts (1H and 15m) are helpful for timing, however the each day remains to be the anchor. So long as value sits below the 20, 50 and 200 EMAs with RSI below 50, the burden of proof lies with the bulls. On the identical time, flat MACD and ultra-low ATR warn that each side might be caught off guard when the following transfer lastly kicks off, so sizing and threat limits matter greater than normal.

If you wish to monitor markets with skilled charting instruments and real-time knowledge, you possibly can open an account on Investing utilizing our associate hyperlink:

Open your Investing.com account

This part comprises a sponsored affiliate hyperlink. We could earn a fee at no extra value to you.

This evaluation summarizes a managed downtrend with compressed volatility, outlining each bullish mean-reversion and bearish continuation paths whereas emphasizing the significance of threat administration across the $0.12–0.14 space.