The publicly-listed Bitcoin (BTC) miner from Wall Road, BitFuFu (NASDAQ: FUFU), introduced right this moment (Tuesday) its plans to accumulate a majority stake in an 80-megawatt (MW) crypto mining facility in Ethiopia. The US firm is looking for entry to cheaper vitality in East Africa on account of more and more decrease margins within the BTC mining trade.

The issue lies within the rising prices. For BitFuFu, they elevated by 170% over the previous yr, shrinking web revenue by 75%.

The acquisition will increase BitFuFu’s whole internet hosting capability to over 600 MW, with roughly 13% now beneath direct possession and operation by the Nasdaq-listed firm. This represents a departure from BitFuFu’s earlier asset-light method, the place third events hosted all of its 522 MW capability as of June 30, 2024.

When outfitted with the most recent Bitmain S21-series miners, the Ethiopian facility is predicted so as to add potential mining capability of 4.6 EH/s. Notably, the location’s energy prices common under $0.04 per kilowatt-hour, which BitFuFu anticipates will decrease its total Bitcoin manufacturing bills.

Leo Lu, CEO and Chairman of BitFuFu

“This acquisition is a crucial milestone as we work to vertically combine and transition in direction of a extra diversified and resilient portfolio of Bitcoin mining websites,” Leo Lu, CEO and Chairman of BitFuFu, commented. “As we combine this facility into our world infrastructure, we will capitalize on decrease vitality prices to scale back Bitcoin manufacturing bills, increase our operational capability, and improve profitability.”

Crypto Miners Are Slicing Prices

BitFuFu’s determination to accumulate the Ethiopian facility comes as a part of a broader technique to strengthen its aggressive place within the mining market. With nearly all of its present mining infrastructure primarily based in the US, this acquisition may assist increase mining profitability.

The corporate plans to implement technological upgrades on the new plant to reinforce vitality effectivity and mining capability. The most recent report from BitFuFu, together with the overall developments within the BTC mining trade, exhibits that this transfer is crucial. In Q2 2024, the corporate earned $129 million, which is a 70% improve in comparison with final yr. Nonetheless, web revenue dropped nearly fourfold, from $5.1 million to $1.3 million, on account of considerably greater mining prices.

“We’ve already begun planning for technological upgrades to enhance vitality effectivity and mining capability at this web site,” Lu added. “Transferring ahead, we intention to strengthen our world place by buying or constructing further amenities and drive additional innovation within the digital asset mining sector whereas delivering long-term worth to our shareholders.”

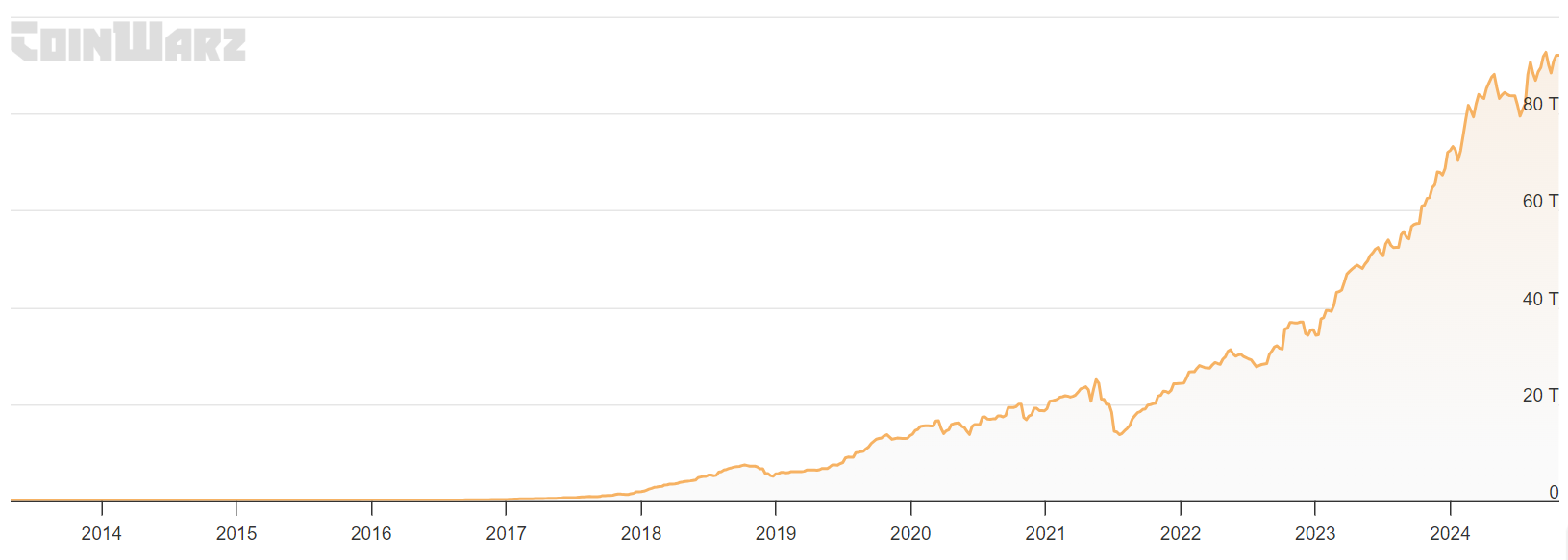

As Finance Magnates reported final month, Bitcoin miners income fell to $827.56 million, the bottom since September 2023. It additionally marked a 57% drop from March’s peak, highlighting rising challenges within the mining sector, together with all-time excessive issue of the mining course of.

Bitcoin mining issue is at present at ATH. Supply: CoinWarz

To combat this unfavorable pattern, BTC mining corporations are diversifying into AI and high-performance computing to spice up revenues. VanEck’s head of digital property analysis, Matthew Sigel, estimates that this strategic pivot may unlock $38 billion in worth for mining corporations by 2027.