Main Wall Avenue Bitcoin miners reported assorted manufacturing outcomes for November 2024, as community problem elevated by 7% through the month, impacting mining effectivity and output throughout the business.

Though final month the worth of BTC reached document ranges and almost approached $100,000, competitors, together with the time and prices required for cryptocurrency mining, additionally jumped visibly.

CleanSpark (NASDAQ: CLSK) maintained its place as one of many business chief’s in November, producing 622 BTC, whereas Riot Platforms (NASDAQ: RIOT) adopted with 495 BTC. Bitfarms (NASDAQ: BITF) and Cipher Mining (NASDAQ: CIFR) reported related outputs of 204 and 202 BTC respectively, showcasing the tight competitors within the mid-tier section. TeraWulf (NASDAQ: WULF) rounded out the group with 115 BTC mined through the month.

Zach Bradford, CEO of CleanSpark

“Our groups have been relentlessly executing, making progress in the direction of our year-end hashrate purpose of 37 EH/s whereas enhancing our effectivity,” mentioned CleanSpark CEO Zach Bradford.

Argo Blockchain (LSE: ARB, NASDAQ: ARBK), listed on each the London Inventory Change and Wall Avenue, additionally reported its outcomes, producing 39 BTC in November—a decline from the 46 BTC mined the earlier month. Nevertheless, mining revenues elevated by $0.4 million, reaching $3.4 million.

How does this examine to October? For many of the talked about firms, the result’s worse. Final month, TeraWulf produced 150 BTC, Riot 505, and CleanSpark 655. The manufacturing decline noticed throughout most miners displays the difficult setting created by the community problem improve.

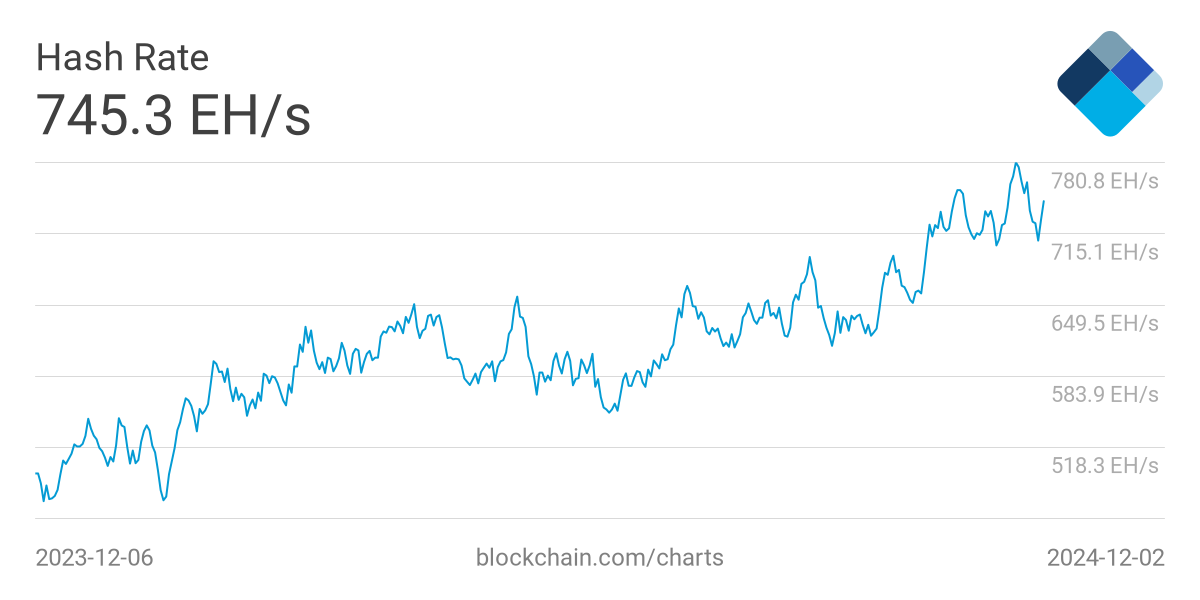

Complete Hash Fee (TH/s) was up in November. Supply: Blockchain.com

The day earlier than, hover, MARA Holdings (NASDAQ: MARA), the most important publicly listed cryptocurrency mining firm, reported a document Bitcoin manufacturing, with its output rising by 26% to 907 BTC in November.

Fred Thiel, CEO, MARA, Supply: LinkedIn

“November was a record-breaking month for MARA, with our mining operations attaining unprecedented ranges of manufacturing. These outcomes spotlight the numerous strides we have made in scaling operations and optimizing efficiency,” Fred Thiel, MARA’s chairman and CEO, famous.

Regardless of mining fewer tokens, miners earned extra. In accordance with the newest report from JPMorgan, other than the fifth consecutive month of declining manufacturing, revenues elevated by 24%. In the meantime, the mixed market capitalization of the 14 largest Bitcoin miners on Wall Avenue rose by 52%, reaching $36.2 billion.

Operational Developments and Hash Fee Growth

Riot Platforms demonstrated seen development in different areas than variety of mined tokens, attaining a complete deployed hash fee of 30.8 EH/s, marking a 148% improve year-over-year. The corporate’s growth throughout a number of places, together with Rockdale, Corsicana, and Kentucky amenities, has strengthened its market place.

Jason Les, CEO of Riot Blockchain

“Stability in our manufacturing is a mirrored image of the continuing operational enhancements we proceed to make, as demonstrated by our working hash fee rising 13% month-over-month in comparison with a 5% improve in our hash fee capability,” commented Jason Les, the CEO of Riot. “Our work just isn’t but full, and onsite groups proceed deploying new miners and enhancing operations to extend our hash fee utilization additional.”

Bitfarms additionally made notable progress in its North American growth, with almost 75% of its hashrate anticipated to return from North American knowledge facilities by the primary half of 2025. The corporate’s working hashrate reached 12.8 EH/s, representing a 100% improve from the earlier 12 months.

Cipher Mining continued its improvement on the Black Pearl knowledge middle, sustaining a gentle operational hash fee of 12.0 EH/s. The corporate’s acquisition of the 100 MW Stingray web site positions it for future development, with a complete potential energy capability exceeding 2.6 GW throughout 11 websites.

Tyler Web page, CEO of of Ciper Mining

“By year-end, we anticipate to finish the Odessa improve, giving Cipher one of the environment friendly fleets of mining rigs within the business,” mentioned Tyler Web page, CEO of Cipher.

Mining firms are more and more centered on fleet effectivity enhancements. TeraWulf led the pack with a formidable 19.2 J/TH effectivity ratio, whereas Riot reported 22.3 J/TH. Bitfarms introduced the improve of almost 19,000 T21 miners to extra environment friendly S21 Professional miners, anticipating to attain a 19 w/TH effectivity fee, representing a ten% enchancment.

Treasury Administration and Monetary Technique

Bitcoin holdings methods assorted considerably amongst operators. Riot maintained the most important treasury place with 11,425 BTC, representing a 55% improve year-over-year. Cipher Mining held 1,383 BTC, whereas Bitfarms reported 870 BTC in its treasury after transferring 351 Bitcoin to Bitmain as a part of its miner improve settlement.

Miners additionally continued to optimize energy prices by means of varied methods. Riot reported all-in energy prices of three.8c/kWh throughout its amenities, benefiting from $1.4 million in whole energy credit. Bitfarms maintained its dedication to renewable power, with 256 MW of hydropower capability supporting its operations.

Ben Gagnon, Supply: Bitfarms’ Web site

The aggressive panorama is driving miners to discover diversification alternatives. Bitfarms famous rising demand for fast capability in each HPC/AI and BTC mining, positioning itself to leverage its power portfolio of over 950 MW in 2025 for strategic alternatives in each sectors.

“By redirecting our miners to be deployed in the US, we’ve got greatest matched our miners with the underlying electrical energy economics throughout our giant portfolio of versatile MWs,” commented Ben Gagnon, the CEO of Bitfarms. “With demand for fast capability for each HPC/AI and BTC mining surging and based mostly on discussions with strategic companions, I’m assured that our power portfolio of over 950 MW in 2025 provides us unparalleled flexibility to make the most of strategic alternatives in each HPC/AI and BTC mining.”

A number of firms introduced management adjustments and strategic initiatives. Bitfarms appointed Andrew J. Chang as an Impartial Director and introduced the departure of its Chief Infrastructure Officer, whereas looking for new management with HPC/AI expertise to assist its evolving technique.