-

Wall Avenue’s institutional curiosity in Ethereum is rising, with staking set to drive long-term community progress.

-

FSInsight’s Tom Lee says ETH may hit $60K if it turns into the spine of world monetary markets.

Wall Avenue’s curiosity in Ethereum is heating up. In response to a prime strategist, institutional adoption may ultimately push ETH’s value to $60,000.

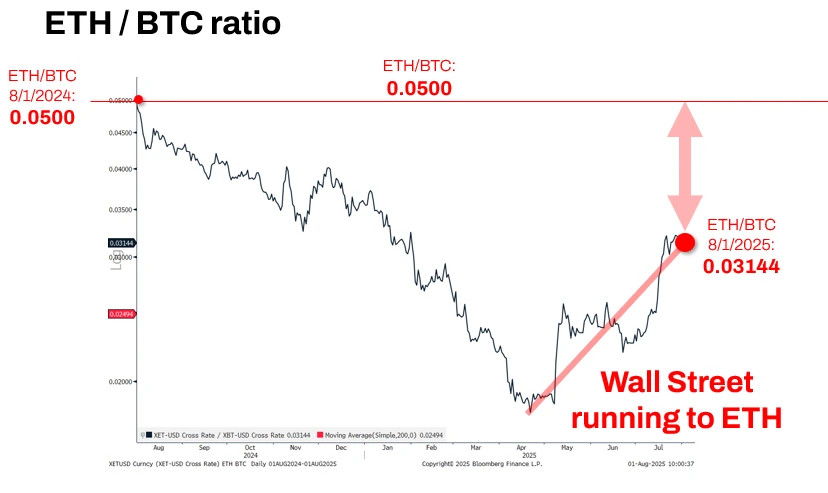

In an in depth thread on X, Thomas (Tom) Lee, Managing Associate at FSInsight and a well known Wall Avenue strategist, laid out why institutional buyers are quickly gravitating towards Ethereum ($ETH). His remarks come as ETH continues to commerce round $3,600, far beneath its implied worth primarily based on historic ETH/BTC ratios.

Why Wall Avenue Is Shopping for Ethereum?

In response to Lee, a number of key components are making Ethereum the go-to blockchain for conventional finance:

- Authorized readability within the U.S.: ETH is broadly thought of essentially the most compliant sensible contract platform within the U.S.

- Impeccable uptime: Ethereum has skilled zero downtime in its 10-year historical past.

- Community impact: Main establishments like JPMorgan and Robinhood are constructing or tokenizing property on Ethereum.

“Wall Avenue is working to ETH,” Lee stated, noting that Ethereum’s narrative is stronger at present than it was a 12 months in the past.

Wall Avenue Will Stake ETH

Lee emphasised that Wall Avenue isn’t simply utilizing Ethereum; it is going to stake ETH to take part within the community’s worth layer.

This pattern is an element of a bigger shift the place real-world property (RWAs) are being tokenized on Ethereum.

Lee famous, “As Wall Avenue financializes the world onto the blockchain, they are going to stake ETH to be concerned in Ethereum’s progress.”

- Additionally Learn :

- Visa and Mastercard Say Stablecoins Are Not a Menace

- ,

Is Ethereum Worth Undervalued?

Lee pointed to the ETH/BTC ratio as a key indicator. A 12 months in the past, the ratio stood at 0.0500. With Bitcoin at the moment round $114,000, this means an ETH valuation of roughly $5,707 a big premium to the present market value.

“This argues the ETH/BTC ratio ought to get better,” Lee acknowledged, emphasizing the disconnect between present pricing and Ethereum’s rising dominance.

“The ETH story is stronger at present than August 2024,” stated Lee.

ETH Worth to $60,000?

Lee predicted that if Ethereum turns into the muse for monetary markets, the ETH value could possibly be value $60,000 or extra sooner or later.

He’s clear that this isn’t a forecast, only a chance. However given the way in which establishments are aligning with Ethereum, it’s a situation that’s all of the sudden not so far-fetched.