Over the subsequent week, all eyes will deal with U.S. President Donald Trump’s tariffs after equities and crypto markets rode a curler coaster final week. Trump says China has sought dialogue repeatedly, because the tariff standoff between the U.S. and China reaches unprecedented heights, with all sides levying steep duties on the opposite’s items.

Markets Jittery as Trump Says China Seeks Dialogue on Tariffs

Final week, main U.S. indexes diverged: the S&P 500 rose 0.52% over 5 buying and selling days, the Dow Jones Industrial Common fell 0.89%, the Nasdaq composite slipped 0.44%, and the Russell 2000 gained 2.9% in that span. Likewise, crypto markets exhibited combined developments, with bitcoin ( BTC) posting beneficial properties over the previous week whereas ETH, ADA, and XRP slipped.

In that very same interval, an oz of gold ended about 3.8% increased towards the U.S. greenback. By week’s finish, President Trump said within the Oval Workplace that the U.S. and China had been engaged in talks.

“Yeah, we’re speaking to China. I’d say they’ve reached out various occasions,” he instructed reporters. He even cryptically hinted that Chinese language President Xi Jinping had reached out to talk with him. This weekend, Trump additionally contended that any govt who decries tariffs is successfully confessing a scarcity of monetary knowledge.

“The businessmen who criticize tariffs are dangerous at enterprise, however actually dangerous at politics,” Trump remarked on Fact Social. “They don’t perceive or notice that I’m the best buddy that American capitalism has ever had … The golden rule of negotiating and success: he who has the gold makes the principles,” he added. Finally, to many market gamers, all of it boils all the way down to persistent uncertainty within the markets going ahead.

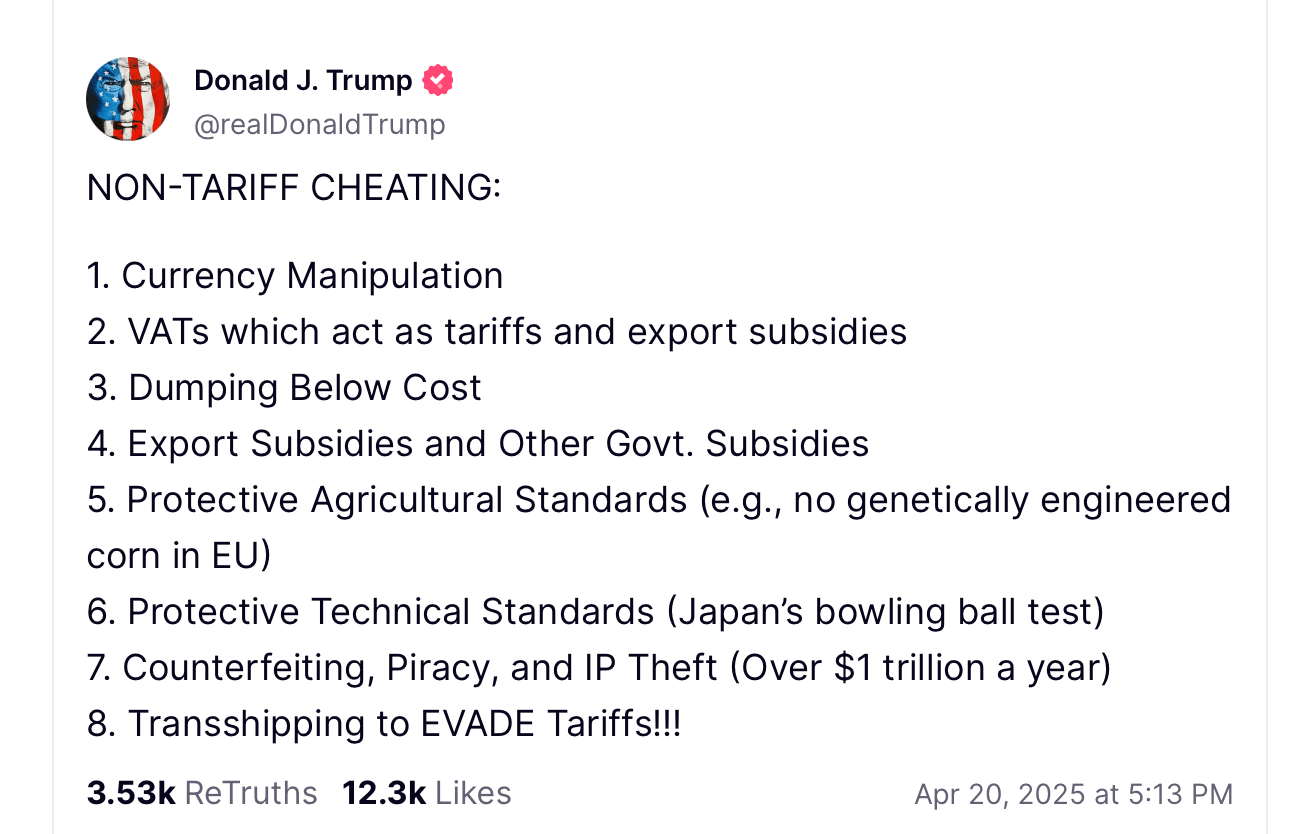

Many detractors bristle at Trump’s tariffs as a result of they consider it would drive up prices for companies and shoppers, threaten jobs, and cut back wages. Some count on it to compress the U.S. economic system and family incomes. Trump argues that tariffs serve the nation by safeguarding U.S. jobs, boosting home manufacturing, fortifying nationwide safety and producing authorities income whereas encouraging shoppers to buy U.S.-made items and curbing dependence on overseas imports.

Bitcoin Crosses $87K, Inventory Futures Slide

Markets have been unsettled by the anomaly these commerce measures engender, their potential financial fallout, and shifting investor sentiment towards secure havens. Gold has registered a noticeable rise amid the commerce frictions, affirming its standing as a basic secure haven. But digital property posted uneven returns, although bitcoin remained steadier than most in the course of the course of the week.

This will likely indicate that some traders, cautious in regards to the commerce conflict’s impact on conventional markets, turned to bitcoin ( BTC) as a decentralized asset much less entwined with tariff-driven financial upheaval. Conversely, some anticipate that bitcoin and crypto markets, on the whole, will mirror fairness developments. Time stays the last word arbiter; nonetheless, you’ll be able to wager confidently that spotlight will stay riveted on Trump’s forthcoming strikes.

On Sunday night, simply forward of Monday’s market open, CNBC reported a modest retreat in U.S. fairness futures: contracts tied to the Dow had been off by 0.5%, whereas futures linked to each the Nasdaq composite and the S&P 500 additionally dipped 0.5%. In the meantime, bitcoin moved decisively previous the $87,000 threshold throughout the identical window reaching $87,236.