The newest wave of whale accumulation helped Bitcoin get near its all-time excessive, surpassing $92,000.

Giant Bitcoin (BTC) addresses recorded a web influx of 21,470 BTC on Monday, Nov. 18, in line with information from IntoTheBlock.

The quantity of whale transactions, price a minimum of $100,000 in BTC, additionally doubled to $78.37 billion in virtually 23,000 distinctive transactions on the identical day, ITB information reveals. Bitcoin registered a complete of over $228 billion in whale transactions during the last seven days.

One of many largest Bitcoin holders bought the asset on Binance and transferred it to a custodial pockets with $2.2 billion in BTC, per information from Arkham Intelligence.

The rising whale exercise often develops the worry of lacking out amongst market individuals, bringing excessive volatility to the cryptocurrency sector. This might ship combined alerts all through the market as buyers eye the $100,000 mark.

Bernstein Analysis has raised their expectation of the Bitcoin value rally from $150,000 to $200,000 by 2025. The funding analysis firm stated that the expectations of regulatory modifications and elevated institutional demand are the primary components behind the asset’s value rally.

You may also like: BIT Mining settles with SEC for $4m amid bribery allegations in Japan

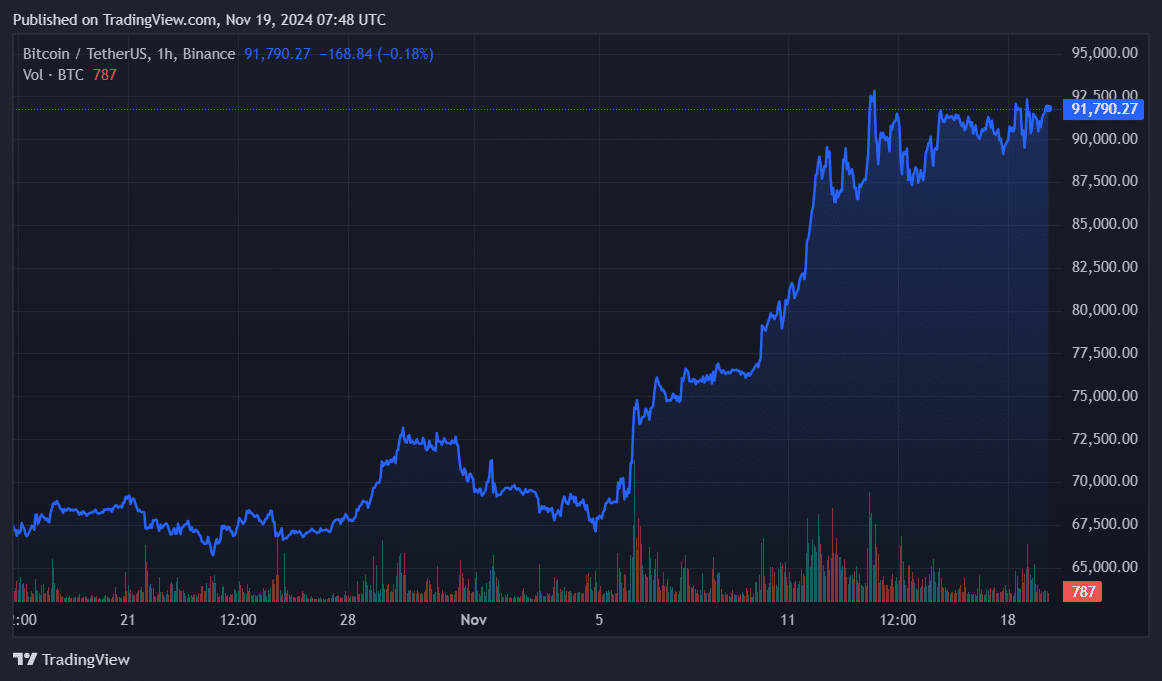

Bitcoin is buying and selling at $91,800 on the time of writing. Its market cap is sitting at $1.82 trillion.

BTC value | Supply: crypto.information

Furthermore, the variety of Bitcoin each day lively addresses additionally elevated by 13%, reaching 818,910 wallets, in line with ITB.

This momentum means that retail buyers have already began making strikes on the blockchain as its each day buying and selling quantity elevated by 63% to $75.2 billion.

MicroStrategy, one of many main enterprise intelligence corporations within the U.S., added 51,780 BTC, price $4.6 billion, to its reserves yesterday. The corporate now holds over 331,200 BTC.

Quickly after the huge accumulation, MicroStrategy introduced plans to lift $1.75 billion — by the non-public providing of convertible senior notes — to purchase extra Bitcoin.

One other wave of institutional adoption might set off FOMO amongst retail buyers to probably assist Bitcoin break the $100,000 barrier.

Nevertheless, it must be famous that the Federal Reserve’s hawkish stance — probably elevating the rates of interest — might change the market route and impression the Bitcoin value.

Learn extra: Bitcoin ETFs resume with $254.82m, ETH funds lag