A whale misplaced $20.4 million after investing $23 million in AI agent tokens on the Base blockchain, promoting for simply $2.58 million. This 88.77% drawdown stands as considered one of crypto’s largest single commerce losses, with particular person tokens dropping as a lot as 99%.

The acute loss highlights rising fears of speculative bubbles within the AI token market. Right here, hype and unclear use instances gas excessive volatility throughout funding portfolios.

How a Whale Misplaced Over $20 Million on AI Agent Tokens

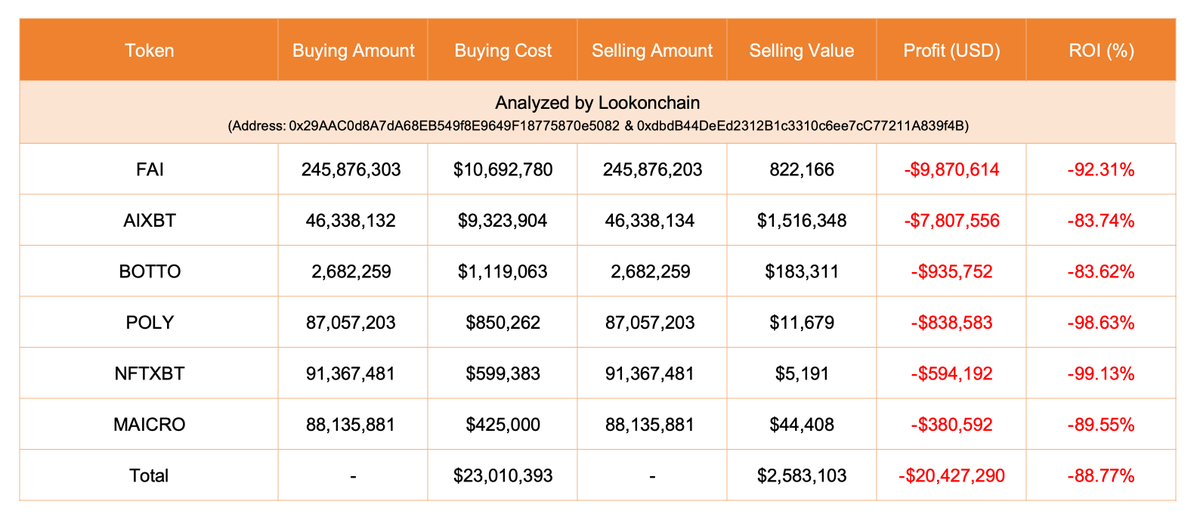

On-chain analytics platform Lookonchain tracked the whale’s portfolio throughout six AI agent tokens. Probably the most vital loss was in FAI, which price $9.87 million, a 92.31% drop. AIXBT resulted in a $7.81 million loss, representing an 83.74% lower from the acquisition worth.

The remaining positions confirmed equally steep declines. BOTTO fell by $936,000, or 83.62%. POLY erased $839,000, plummeting 98.63%.

NFTXBT noticed the steepest share drop, falling 99.13% and dropping $594,000. MAICRO ended with a $381,000 loss, representing an 89.55% decline.

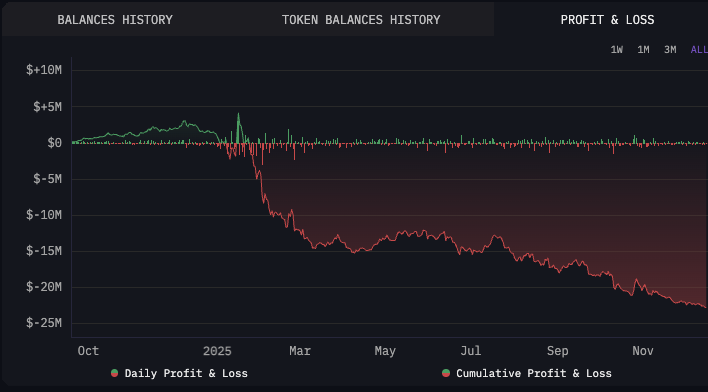

Cumulative revenue and loss chart exhibiting the whale’s sustained drawdown on AI agent tokens. Supply: Coin Bureau on X

The investor’s pockets tackle now holds simply $3,584 in assorted belongings, primarily ETH and small holdings in BYTE, MONK, and SANTA. The dramatic exit highlights near-total losses from AI agent tokens.

AI Agent Token Hypothesis Beneath Scrutiny

The Base blockchain, from Coinbase, is a well-liked launchpad for AI crypto initiatives. Nonetheless, the sector faces criticism for extreme hype and restricted working merchandise.

Many AI agent tokens lack real-world utility, leaving merchants weak to fast beneficial properties and equally quick crashes.

Observers observe that AI agent tokens typically surge on guarantees reasonably than working use instances. Autonomous brokers on the blockchain appeal to investor consideration, however few initiatives ship purposeful outcomes.

As sentiment shifts, token holders face excessive threat attributable to skinny liquidity and shallow utility.

“This may be one of many worst investments ever. A whale/establishment spent $23M shopping for AI agent tokens on #Base and offered every thing as we speak for under $2.58M, leading to a $20.43M(−88.77%) loss,” Lookonchain remarked.

The whale’s exit coincides with waning enthusiasm for AI tokens in early 2025, when the sector plunged 77%.

After a rush of AI-themed investments in late 2024, traders are reassessing as few initiatives meet their objectives. This development fuels additional worth drops, particularly for tokens with concentrated possession and little liquidity.

Threat Administration: Classes for Traders

The whale closely concentrated funds in AI agent tokens on Base, missing diversification and threat administration.

Allocating $23 million throughout six correlated belongings in a single narrative elevated systematic threat. As sentiment turned, all holdings fell, revealing the danger of concentrated positions.

Breakdown of losses throughout six AI agent tokens on Base blockchain. Supply: Lookonchain

Skilled merchants sometimes restrict publicity to keep away from outsized losses from failing narratives. The dearth of stop-losses or disciplined sizing let the whale’s losses spiral.

By the point positions had been closed, regaining even break-even standing would have required extraordinary returns. The state of affairs illustrates how briskly declines happen with out thorough evaluation and threat planning.

With NFTXBT and POLY dropping over 98%, a serious comeback seems unlikely.

It stays unsure whether or not this indicators broader bother for AI agent tokens. Initiatives with robust technical groups and actual growth might climate the storm.

Tokens utilizing AI hype with out stable backing are prone to maintain struggling because the market asks for outcomes and never simply guarantees.

The submit Whale Loses $20.4 Million on AI Agent Tokens in 88% Drawdown appeared first on BeInCrypto.