Giant ETH holders have been accumulating all through late 2024 and into 2025, whilst retail balances decline, knowledge from Nansen reveals.

Regardless that Ethereum’s (ETH) worth is down over 44% this yr and buying and selling round $1,900, some giant traders are nonetheless including to their holdings, based on on-chain knowledge from Nansen shared with crypto.information.

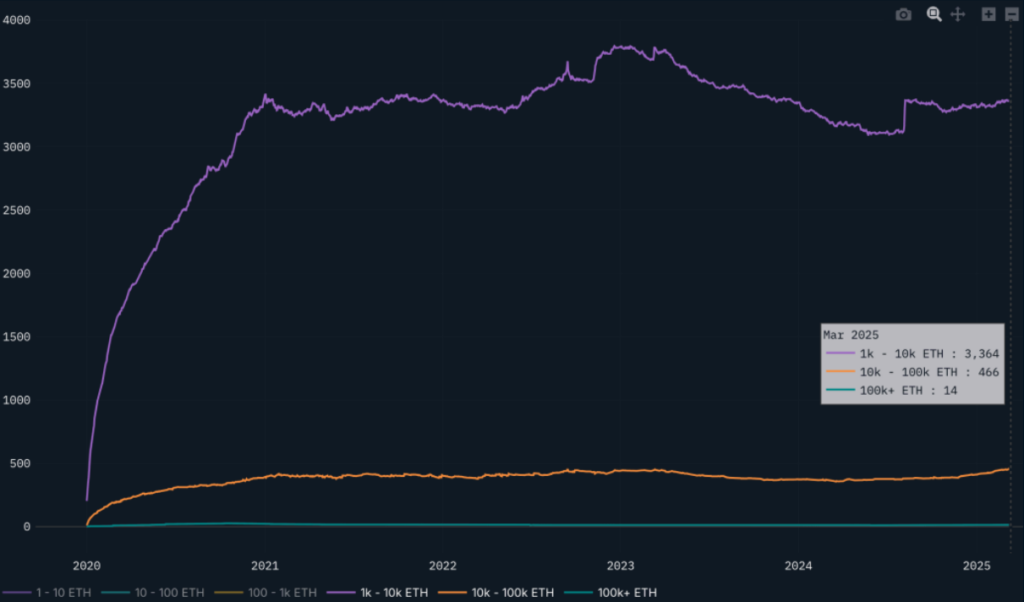

Ethereum whales’ holdings | Supply: Nansen

Whereas smaller ETH holders have been lowering their balances, whales holding between 10,000 and 100,000 ETH have elevated their holdings by over 12% in early 2025.

“The 10k-100k section noticed over a 12% progress in 2025 alone on their complete ETH balances whereas the 1k-10k section noticed a 3% enhance of their holdings YTD.”

Nansen

You may additionally like: Ethereum management now eyes Solana-style progress, Dragonfly’s Qureshi says

On the identical time, Ethereum’s community exercise appears to have slowed, with median fuel costs reportedly dropping practically 50 instances since early 2024, whereas a number of the exercise seems to have shifted to Solana (SOL) and layer-2 networks, the report suggests.

Ethereum additionally faces rising competitors, with Nansen saying that the community is “competing on all fronts and dangers being a ‘jack of all trades however grasp of none’ when put next with BTC, SOL and TIA.”

Regardless of accumulation from some whales, the broader pattern stays unsure as ETH leaves “a lot to be desired throughout most of the onchain metrics,” Nansen notes, including that the asset has “extreme underperformance on each the best way up and the best way down.”

For ETH to reverse its long-term downtrend in opposition to BTC, “vital adjustments would want to happen,” analysts at Nansen declare, although it stays unclear whether or not any near-term catalyst might shift market sentiment.

Learn extra: Ethereum worth on the brisk as Hyperliquid dealer makes $86m revenue