Throughout Friday’s U.S. buying and selling hours, the crypto market witnessed a surge in promoting strain, evidenced by a long-wick rejection candle in Bitcoin. The overhead provide has plunged most main altcoins, together with ETH, which teases a breakdown under $2,500. Whereas the market sentiment reveals no indicators of bottoming, the historic development of Ethereum value indicators restoration potential in February

Key Highlights:

- The Ethereum value correction might prolong one other 14% earlier than the resistance key assist trendline close to $2,200.

- A bearish crossover between the 50-and-100-day exponential shifting common ought to speed up the market promoting strain.

- An ascending trendline within the day by day chart marks the uptrend trajectory in ETH.

Ethereum Worth Historical past Indicators Optimism for Holders

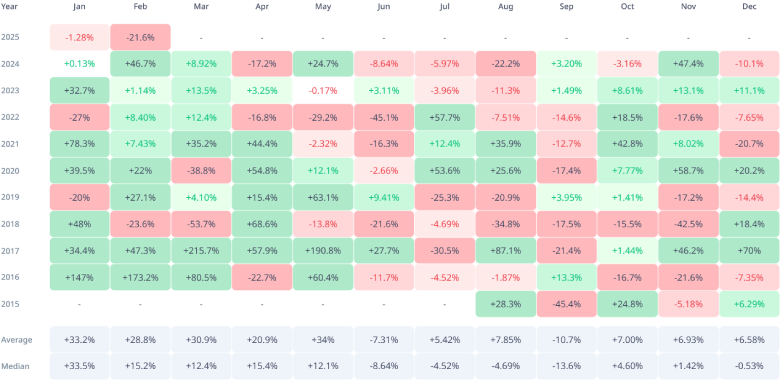

Ethereum’s historic efficiency in February has typically been sturdy, with notable good points in years like 2024 (+46.7%), 2023 (+1.14%), 2022 (+8.41%), and 2017 (+47.3%). This means that February has historically been a restoration month for ETH, at present exhibiting a mean return of 28.8%, in accordance with Cryptorank information.

Nevertheless, the Ethereum value has recorded a 20.84% decline thus far in February 2025, indicating the previous efficiency doesn’t assure an uptrend. Thus, the ETH holders should additionally take into account broader market sentiment earlier than committing a view solely primarily based on historic information.

Ethereum Month-to-month returns | Cryptorank

That being mentioned, the Ether value reveals increased odds of being profitable in February. If historical past repeats, the coin value might rechallenge the $4,000 resistance.

ETH Correction Nearing a Main Assist Check

Within the final two months, the Ethereum value has showcased an aggressive downfall from $4,108 to the $2,572 stage, registering a lack of 38%. The falling value has just lately breached a key assist of $2,800, paving the way in which for sellers to extend this present correction.

If the bearish momentum persists, the altcoin might plunge one other 14% to check the long-coming assist trendline at $2,200. This dynamic assist has acted as an acceptable assist for dip patrons since June 2022, sustaining a sustained uptrend in ETH.

ETH/USDT – 1 Chart

If historical past repeats, the coin value stalls its downtrend on the aforementioned trendline and prepares for the subsequent restoration leap.