Berachain is in every single place! On X, in your DMs, and possibly in your desires at this level. Regardless of sounding related, it’s not concerning the bear market (your portfolio is secure — for now). Berachain is a layer-1 blockchain that runs on a novel proof-of-liquidity (PoL) mannequin. This mannequin ensures that capital stays energetic within the ecosystem quite than sitting idle like in proof-of-stake (PoS) chains. This fast information covers what you must know in 2025.

What’s Berachain?

Berachain is a layer-1 blockchain constructed utilizing the Cosmos SDK. It options an EVM-identical surroundings and a proof-of-liquidity (PoL) consensus mechanism.

Word: This setup ensures Ethereum-based DApps can migrate with out bother whereas liquidity suppliers play a central position in securing the community.

Berachain is constructed on the Cosmos SDK. This implies the platform advantages from a modular construction for straightforward upgrades and optimizations.

Berachain homepage: Berachain

Why Cosmos SDK issues?

Most blockchains are inflexible; as soon as they’re constructed, they’re exhausting to alter. Berachain, however, is ready to swap out elements as wanted, due to Cosmos SDK. Consider it as a modular dwelling; if you wish to improve the kitchen, you don’t have to tear down the entire home.

How does Berachain work?

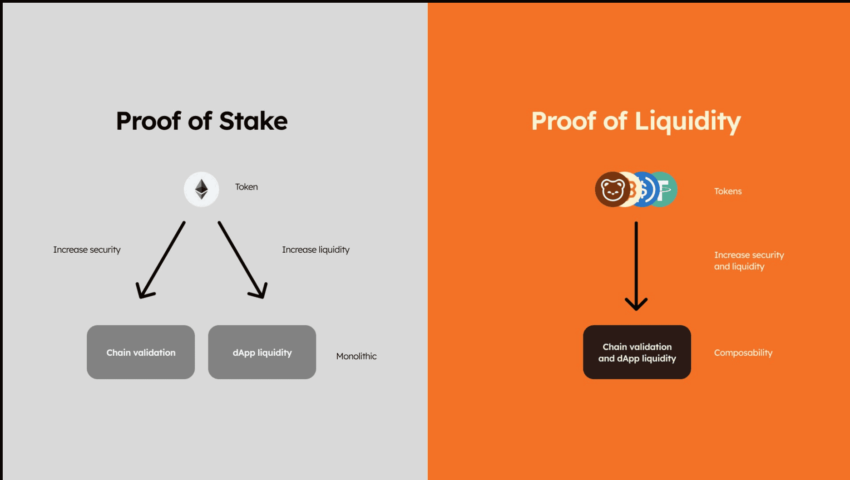

Berachain runs on proof-of-liquidity (PoL), a mechanism the place validators stake liquidity as a substitute of simply locking tokens to safe the community.

What’s proof-of-liquidity (PoL)?

Proof-of-liquidity (PoL) is Berachain’s distinctive consensus mechanism, the place validators safe the community by staking liquidity supplier (LP) tokens as a substitute of locking native tokens.

This ensures that liquidity stays energetic in DeFi quite than being faraway from circulation.

PoS vs. PoL: Weblog

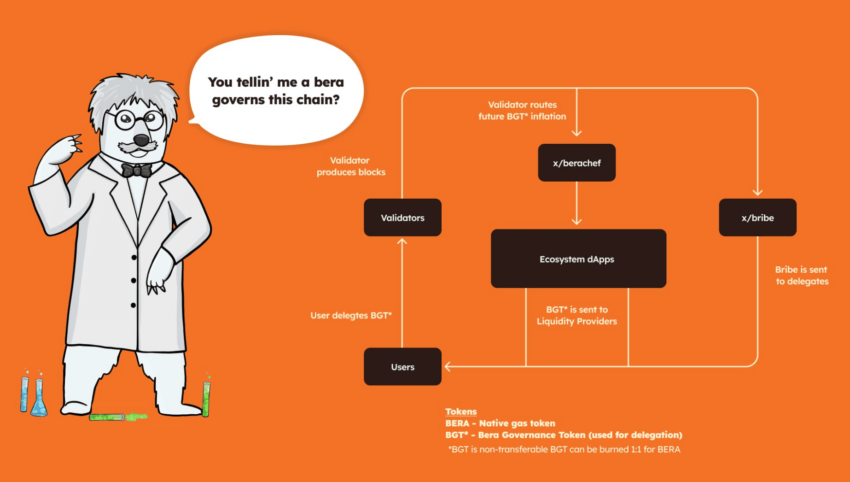

Here’s a fast overview of how that works:

- Customers deposit property (e.g., BERA, USDC, HONEY) into liquidity swimming pools and obtain LP tokens representing their share.

- Customers stake LP tokens in Reward Vaults to earn BGT (Berachain Governance Token) as an incentive.

- Validators want BGT to direct emissions, which means they need to entice BGT delegations from customers to achieve affect.

- Protocols need extra liquidity, so they provide incentives to validators to direct BGT emissions towards their liquidity swimming pools.

- Customers comply with the best BGT emissions, making certain that liquidity strikes effectively throughout the ecosystem.

- BGT could be burned to mint BERA, making certain a self-sustaining token circulate.

Berachain validator circulate: Berachain weblog

What’s being constructed on Berachain?

The Berachain mainnet went stay on Feb. 6, 2025. The ecosystem already encompasses 80+ initiatives throughout domains. Listed below are a number of notable parts:

DeFi platforms

- BEX (Berachain Trade): BEX is Berachain’s native decentralized change (DEX), which facilitates safe token swaps. BEX options the widest potential array of DeFi choices: liquidity swimming pools, yield farming, and low transaction charges.

- Apiarist Finance: A DeFi platform providing yield farming, staking, and lending companies, leveraging Berachain’s excessive transaction speeds and low charges to offer environment friendly monetary operations.

- Honeypot Finance: A community-run DeFi hub with a novel flywheel mannequin that churns out twin incentives.

Gaming

- Boink: A Berachain-native blockchain sport providing $BERA prizes and fun-filled gameplay.

- Honey Jar: An unofficial community-driven mission that mixes NFTs with gaming, centered across the Bong Bears theme.

SocialFi

- Berally: A platform exploring the intersection of social media and decentralized finance inside the Berachain ecosystem.

NFTs

- Bera Monks: A cultural NFT mission mixing artwork, lore, and neighborhood with distinctive hand-drawn characters.

- BAO BAO: An NFT assortment providing unique NFTs, occasions, play-to-earn choices, and DAO advantages.

Berachain tokenomics

Berachain runs on a three-token system, the place every token has a definite however interconnected position.

$BERA (gasoline & utility token)

- Powers all community transactions (gasoline charges).

- Used as a base buying and selling asset in Berachain DeFi protocols.

- Earned by validators as a part of block manufacturing rewards.

$BGT (governance token)

- Earned solely by offering liquidity in Berachain DApps.

- It can’t be transferred however could be burned to mint BERA (giving liquidity suppliers an exit).

- Used to vote on governance selections, directing protocol emissions and incentives.

$HONEY (liquidity token & stablecoin)

- It may be minted by depositing collateral.

- Used as the principle secure medium of change inside the Berachain ecosystem.

- Backed by reserve property to take care of value stability.

Collectively, these three tokens create a balanced financial flywheel, making certain that community safety, liquidity provision, and governance are all taken care of.

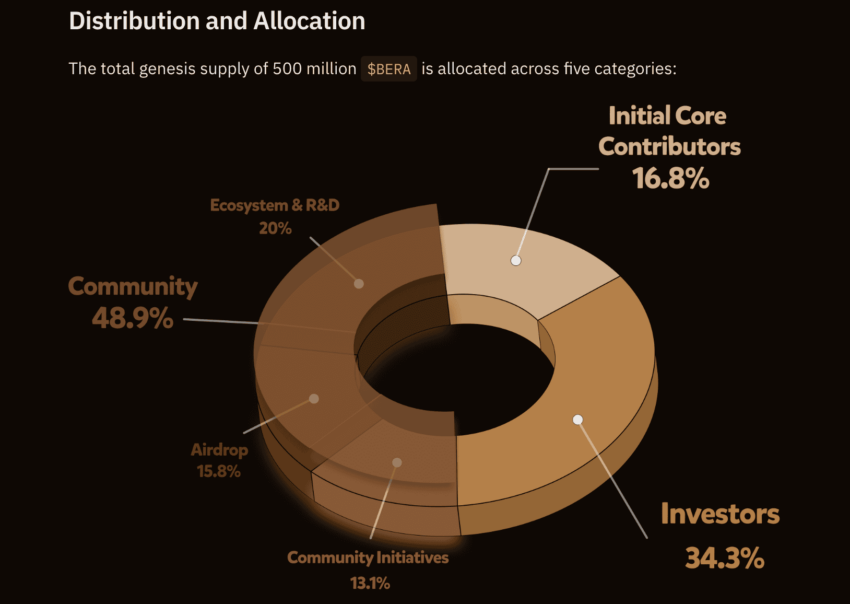

Whereas Berachain operates with three tokens, the first focus of tokenomics discussions revolves round $BERA as a result of it’s the fixed-supply asset (500 million BERA at Genesis). Moreover, BERA is the principle token used for transactions, staking, and protocol rewards. And eventually, it’s instantly affected by the burning of BGT, which influences its circulating provide.

Berachain tokenomics: Berachain docs

At Genesis, 500 million BERA tokens had been allotted as follows:

After a one-year cliff, 1/sixth of allotted tokens turn out to be liquid. The remaining 5/6ths vest linearly over the following 24 months.

Berachain vs. different layer-1 blockchains

Berachain provides a capital-efficient different by conserving liquidity energetic, in contrast to conventional PoS fashions. Here’s a fast desk that can assist you find the variations:

Can Berachain change the L1 sport?

Berachain is redefining how layer-1s deal with liquidity, governance, and safety. As a substitute of locking tokens, it retains capital shifting. As a substitute of passive staking, it rewards energetic participation. Realistically, it gained’t substitute Ethereum. Nevertheless, it might drive different L1s to rethink their liquidity fashions. Whereas it’s early days, if proof-of-liquidity scales, the bear-themed blockchain might set a brand new commonplace for layer-1s.