Circle, the corporate behind the USDC stablecoin, launched a brand new worldwide funds community in April 2025, aiming to make international funds sooner, cheaper, and extra clear. This information breaks down how the Circle Funds Community (CPN) works, its key options, real-world use circumstances, and the place it stands within the broader cross-border funds area.

On this information:

- CPN vs. conventional cross-border funds

- What’s Circle Funds Community (CPN)?

- Key options and improvements of CPN

- Circle Funds Community: Actual-world use circumstances

- How CPN works?

- Regulatory and compliance positioning throughout key areas

- Challenges and limitations of CPN

- Will CPN revolutionize cross-border funds?

- Often requested questions

CPN vs. conventional cross-border funds

What’s Circle Funds Community (CPN)?

Sending cash abroad shouldn’t ideally take days or break the bank. Nonetheless, it virtually at all times does should you use conventional cross-border banking routes.

Worldwide financial institution transfers can — and normally do — take greater than a day to settle and infrequently contain excessive charges as a result of intermediaries, foreign money conversions, and compliance layers. These inefficiencies hit creating economies hardest.

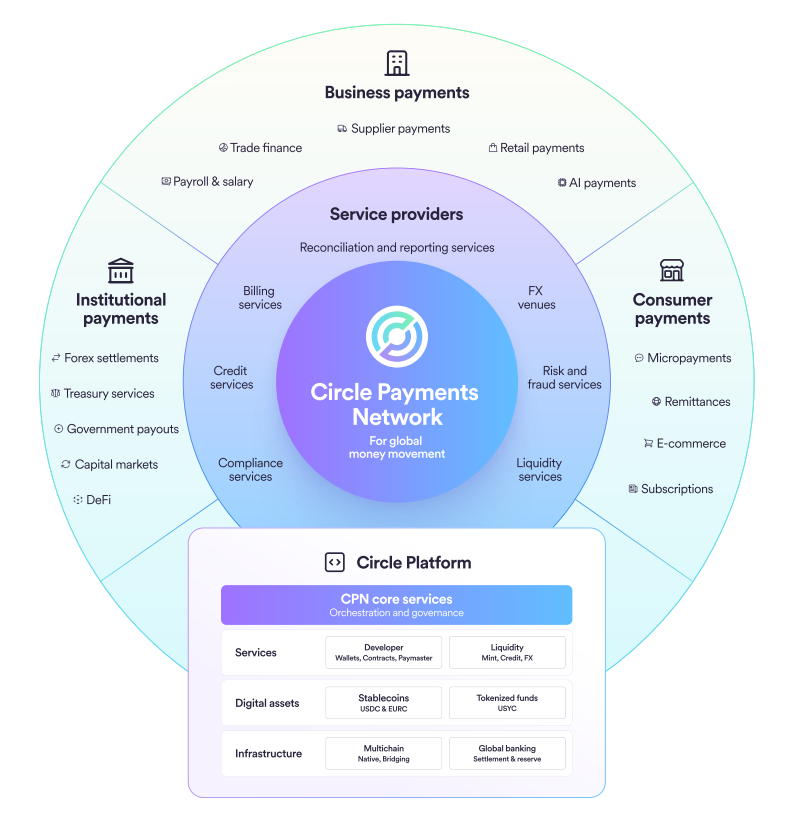

Circle’s new platform — the Circle Funds Community (CPN) — goals to supply a viable various to conventional banking routes. It’s designed to attach monetary establishments for near-instant cross-border funds utilizing stablecoins like USDC and Euro Coin (EURC).

The result’s quick, clear, programmable funds that really feel as on the spot as home transfers. For Circle, this can be a step towards making a living transfer as simply as an e-mail.

“Since our founding, Circle’s imaginative and prescient has been to make shifting cash as easy and environment friendly as sending an e-mail. CPN is a big step in making that imaginative and prescient a actuality for companies worldwide.”

— Jeremy Allaire, co-founder, chairman, and CEO of Circle (through Circle press launch)

Circle Funds Community overview: CPN whitepaper

Key options and improvements of CPN

CPN introduces a number of promising options that intention to remodel cross-border funds:

➤ Stablecoin-powered transfers: CPN makes use of regulated stablecoins like USDC and EURC because the medium of change. These cash are absolutely backed by fiat reserves and preserve a 1:1 peg to their respective currencies. This helps get rid of foreign money volatility throughout transit and gives on-chain transparency.

➤ Integration with conventional finance: CPN connects banks, neobanks, cost processors, and wallets with native cost techniques. It acts as a bridge between blockchain networks and conventional rails like ACH, SEPA, and others. Establishments can plug in through a single interface and keep away from constructing a number of bilateral relationships.

➤ 24/7 real-time settlement: Transactions settle inside seconds, no matter weekends or banking hours. This reduces liquidity danger and improves money movement by eliminating the necessity to pre-fund international accounts.

➤ Decrease prices: CPN reduces charges and FX spreads by changing a number of intermediaries and utilizing blockchain. Transactions involving stablecoins can keep away from double conversions, which additional improves transparency whereas reducing per-transaction prices.

➤ Transparency and compliance: All transfers are recorded on public blockchains, which ensures auditability. Solely vetted establishments take part, with strict guidelines on licensing, AML/CFT controls, and safety protocols.

➤ Programmability: CPN is constructed on good contract infrastructure, and it helps superior options like escrow, auto-splitting funds, and condition-based transfers. Circle affords APIs to assist fintechs and builders combine with CPN.

➤ Safety: Establishments retain management of their belongings utilizing their very own wallets or trusted custodians. The system avoids centralized factors of failure and incorporates bank-grade cybersecurity requirements.

Circle Funds Community: Actual-world use circumstances

The launch of Circle’s worldwide cost community might considerably reshape how cash strikes globally, notably for underserved areas.

For those who’ve ever tried sending cash overseas, you understand the ache: delays, excessive charges, and unclear monitoring. Circle’s CPN goals to unravel these points and enhance entry to monetary companies. Its doubtless affect consists of:

Sooner and cheaper remittances

Remittances typically carry charges above 6%, draining earnings for households. With CPN, migrants might ship cash that arrives in minutes at a lot decrease prices, even on weekends. This might assist enhance help to low-income households and meet UN targets of lowering remittance charges.

Wider entry through cell wallets

Many individuals with out conventional financial institution accounts nonetheless use smartphones. CPN connects to cell apps like Cash.ph (Philippines) and Flutterwave (Africa), to permit folks to obtain cash straight in native foreign money while not having to deal with crypto.

Enhance for SMEs

Small companies typically face excessive friction in cross-border funds. With CPN, they might ship or obtain funds shortly, which considerably reduces delays, lowers prices, and eases entry to international suppliers or prospects.

At all times-on funds

CPN operates 24/7. This implies funds might be despatched or acquired throughout time zones and weekends, serving to folks and companies entry funds once they want them most.

Rising market integration

CPN’s associate community spans Africa, Latin America, Southeast Asia, and extra. It might assist join native economies to international monetary techniques by bettering cost corridors in these areas.

How CPN works?

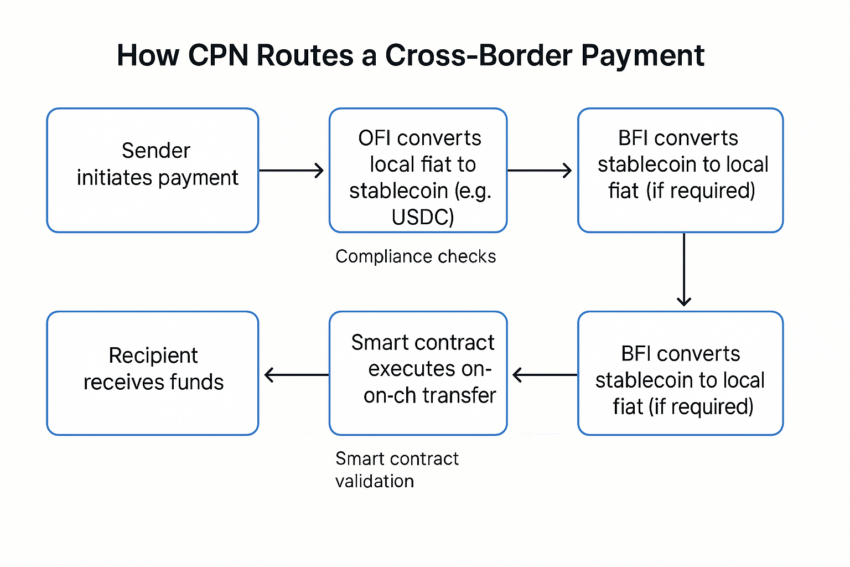

Circle Funds Community (CPN) operates as a coordination protocol that permits licensed monetary establishments to ship, obtain, and settle funds utilizing stablecoins like USDC and EURC.

As an alternative of processing funds straight, CPN orchestrates how worth strikes between events by means of blockchain settlement and offchain APIs. It connects Originating Monetary Establishments (OFIs) and Beneficiary Monetary Establishments (BFIs) whereas sustaining compliance and velocity.

How Circle Funds Community capabilities: CPN

Off-chain orchestration meets on-chain settlement

CPN handles funds by splitting the method into two layers:

➤ Offchain layer: This consists of APIs and SDKs that assist OFIs uncover out there BFIs, question fiat and stablecoin pairings, get hold of FX quotes, and provoke cost requests. All this happens earlier than the transaction strikes to the blockchain.

Establishments use commonplace interfaces supplied by Circle to carry out these steps. Circle additionally facilitates service discovery by letting establishments broadcast their supported currencies and payout capabilities.

➤ Onchain layer: As soon as cost parameters are agreed upon, the system finalizes the transaction by means of good contracts. These contracts validate the OFI’s credentials, match the transaction with a BFI, and ensure that settlement situations are met.

The good contract then executes the stablecoin switch from sender to receiver on a supported blockchain. This hybrid mannequin ensures flexibility whereas permitting programmable, auditable settlement.

Stablecoins and supported blockchains

CPN natively helps USDC and EURC for cross-border transactions. These tokens settle over public blockchains corresponding to Ethereum and others for which Circle has issued USDC.

The system additionally integrates with Circle’s Cross-Chain Switch Protocol (CCTP v2) to permit establishments to maneuver stablecoins throughout completely different chains.

Matching OFIs and BFIs

CPN allows every OFI to search out an applicable BFI that may full a payout within the desired fiat foreign money. The system matches individuals primarily based on liquidity, foreign money help, and repair availability.

For example, if an OFI needs to ship USDC to pay out in Nigerian naira, CPN will route that cost to a BFI in Nigeria that may convert and disburse funds domestically.

These capabilities flip CPN right into a structured market the place establishments uncover the most effective counterparty for a given cost hall.

Compliance and eligibility enforcement

Solely regulated monetary establishments can entry CPN. Each participant should meet minimal licensing and operational standards outlined within the CPN Rulebook and enforceable by means of Circle’s community contracts.

Every transaction undergoes checks corresponding to:

- Sender/receiver KYC

- Journey Rule compliance

- Jurisdictional licensing verification

- Sanctions screening

CPN makes use of a mixture of safe messaging and credential validation to coordinate this with out exposing delicate info.

Establishments change encrypted payloads for required disclosures and preserve audit trails to fulfill native and worldwide legal guidelines. Circle doesn’t contact funds or maintain custody however acts as a coordinator and verifier.

Confidential funds and knowledge dealing with

Some establishments could wish to protect cost particulars from third events. CPN helps confidential transactions by permitting cost metadata to stay non-public whereas nonetheless verifying settlement and credentials.

Members can use zero-knowledge or threshold disclosure protocols (to be launched in later variations) to share knowledge solely with required validators, corresponding to regulators or auditors.

This structure ensures compliance with out leaking pointless info throughout the community.

Good contract performance

The on-chain portion of CPN makes use of good contracts to coordinate last settlement.

These contracts affirm the sender’s and recipient’s credentials, examine FX charges and costs and switch stablecoins accordingly. The identical infrastructure allows value-added logic, corresponding to:

- Time-locked transfers

- Escrow funds

- Multi-party settlement (e.g., pay a number of suppliers from one stablecoin pockets)

- Price automation (break up between OFI, BFI, and Circle)

Establishments may also combine their very own good contracts with CPN flows by constructing on Circle’s APIs and SDKs.

FX conversion and routing logic

CPN permits establishments to transform stablecoins into native fiat by means of whitelisted conversion venues. These venues embody non-public liquidity suppliers and OTC desks in the course of the early phases. Over time, CPN will route conversions by means of onchain protocols corresponding to decentralized exchanges and automatic market makers — topic to compliance approval.

Modular ecosystem integrations

Whereas CPN focuses on core cost coordination, it’s designed to help third-party integrations by means of modular APIs. Future add-ons could embody:

- Lending and credit score scoring

- Bill automation

- Subscription billing

- Yield technology

- Digital id integration

Put merely, Circle acts because the technical and governance layer whereas letting third events construct cost instruments on prime of the bottom protocol.

Regulatory and compliance positioning throughout key areas

Circle assures that CPN follows a strict “compliance-first” method. Solely licensed monetary establishments can take part, and every associate should adjust to native legal guidelines. This method ensures each transaction is topic to oversight and aligned with evolving regulatory frameworks within the U.S., the E.U., and Asia.

United States

CPN aligns with the proposed STABLE Act, which enforces reserve transparency and prohibits curiosity on stablecoins. Circle already meets most necessities, with USDC backed 1:1 and issued through licensed cash transmitters. AML and KYC compliance are constructed into the system.

European Union

Circle obtained an EMI license in France and complies with MiCA laws. USDC and EURC are issued beneath full E.U. oversight. CPN works inside E.U. legal guidelines, enhances SEPA Prompt, and helps full transparency and client safety.

Asia-Pacific

Circle already holds a Main Cost Establishment license from MAS in Singapore. It could legally challenge stablecoins and provide cross-border cost companies. Circle can be partaking regulators in Japan and Hong Kong as these markets evolve.

Center East, Africa, LATAM

Circle companions with regulated entities like Flutterwave and dLocal to make sure native compliance. Enlargement within the UAE and Bahrain is predicted through partnerships. All companions are licensed of their house markets.

Latest partnerships, bulletins, and international growth

Circle is actively constructing out the Circle Funds Community (CPN) by means of partnerships, geographic growth, and infrastructure upgrades. Right here’s a abstract of key strikes:

World companions and design collaborators

Circle introduced 20+ design companions throughout areas to help CPN’s launch and footprint:

- Africa: Flutterwave, Yellow Card, Onafriq — enabling payouts to cell cash and financial institution accounts.

- Asia: Cash.ph (Philippines remittances), FOMO Pay and dtcpay (Singapore).

- Latin America: dLocal (payouts in 30+ international locations), Transfero (Brazil), Inswitch.

- Center East & Europe: CoinMENA, BVNK, Triple-A, OpenPayd, Nilos.

- Remittances: Zepz (WorldRemit, Sendwave) provides CPN attain into 130+ international locations and cell pockets payout rails.

- Infrastructure: Fireblocks permits banks and fintechs to plug into CPN utilizing their current crypto custody stack.

Trusted banking advisors:

Circle has engaged Santander, Deutsche Financial institution, Société Générale, and Customary Chartered as advisors. Whereas not but energetic on CPN, they assist form compliance, knowledge localization, and real-world banking necessities.

Customary Chartered’s previous blockchain collaborations with Circle make it a possible early adopter.

Latest product developments:

- Refund Protocol (April 2025): Provides transaction reversibility to stablecoins, bettering institutional confidence.

- EURC growth: Euro Coin help on a number of blockchains provides flexibility for E.U. corridors.

- Could 2025 comfortable launch: Restricted beta launch will take a look at remittance corridors like U.S.-Philippines or E.U.-Africa.

Bodily and regulatory footprint:

- Singapore HQ for Asia, France for MiCA compliance, regional LATAM group now in place.

- Licenses in U.S., the E.U., and Singapore allow compliant operations throughout main markets.

Cost big collaborations:

- Visa: Present settlement partnership with USDC.

- MoneyGram: Makes use of USDC through Stellar and exhibits rising acceptance of stablecoins in conventional remittance fashions.

IPO and market credibility:

Circle plans to go public in 2025, including investor confidence and enabling bigger institutional adoption.

Aggressive positioning:

- Goals to rival RippleNet and problem Visa/Mastercard in cross-border settlement.

- Indicators a stablecoin-driven various with actual regulatory buy-in and international attain.

Challenges and limitations of CPN

Whereas CPN introduces main enhancements to cross-border funds, it nonetheless faces a number of sensible and regulatory challenges.

The onboarding course of can be complicated, contemplating individuals should cross stringent compliance checks, together with AML, KYC, and sanctions screening.

To chop a protracted story quick, CPN can attain its full potential provided that Circle expands participation, improves developer tooling, and addresses jurisdictional issues throughout completely different regulatory environments.

Will CPN revolutionize cross-border funds?

Circle is constructing infrastructure that would redefine cross-border funds. That mentioned, the success of CPN — or the dearth thereof — will in the end rely upon adoption, belief, and regulatory readability.

If it pulls off doing what it has up to now promised, sending cash overseas would possibly actually change into so simple as sending an e-mail. If that occurs, it’ll undoubtedly open up new doorways to larger inclusion and alternative worldwide.

Often requested questions

What’s the Circle Funds Community (CPN)?

How does CPN work in follow?

What are the principle advantages of CPN?

What are some present limitations or challenges going through CPN?