U.S. President Donald Trump’s presidency has been characterised by a steady stream of attention-grabbing statements and actions. Liberation Day is about to seize the eye of not simply the folks however nations and markets as effectively. Here’s what you’ll want to learn about how this extremely anticipated day might form crypto markets.

In This Information:

- What’s Trump’s Liberation Day?

- How did crypto reply to Trump’s Liberation Day?

- How will Liberation Day have an effect on markets?

- Quick-term ache, long-term potential?

What’s Trump’s Liberation Day?

In case you missed it, President Trump plans to implement a number of import taxes on April 2, which has been dubbed Liberation Day.

“Now we have Liberation Day, as , on April 2, as a result of, and I’m not referring to Canada, however many nations have taken benefit of us — the likes of which no person even thought was potential for a lot of, many a long time. And , that has to cease. ” — U.S. President Donald Trump

Trump’s announcement stems from a earlier choice to implement tariffs on choose nations, a lot of which have been postponed till April.

Based mostly on earlier statements, many count on reciprocal tariffs, which is able to match different nations’ charges, whereas the remaining will probably goal key areas of producing, manufacturing, and different sectors. The tariffs set for “Liberation Day” will probably embrace:

- Prescription drugs, semiconductors, copper, and lumber.

- 25% tariff on any nation that imports oil from Venezuela.

- Separate tariffs on Canada and Mexico to “cease drug trafficking.”

- 20% tariffs on high of the present 10% tariffs on China.

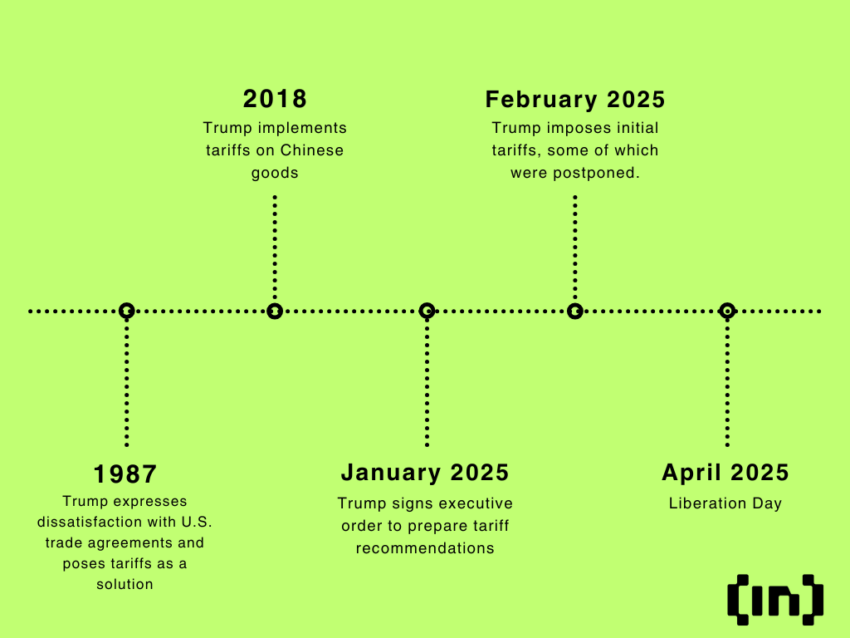

Trump’s historical past of tariffs

President Trump has been red-pilled on tariffs for the reason that Nineteen Eighties when he publicly criticized commerce practices he believed have been dangerous to america.

In a 1987 look on Larry King Stay, Trump remarked, “The very fact is, you don’t have free commerce… Lots of people are uninterested in watching the opposite nations ripping off america.”

On Jan. 20, 2025, Trump signed an govt order to organize tariffs. The primary wave of tariffs was set to debut on Feb. 4, 2025. These included a ten% tax on all Chinese language imports and 25% tariffs on Canada and Mexico.

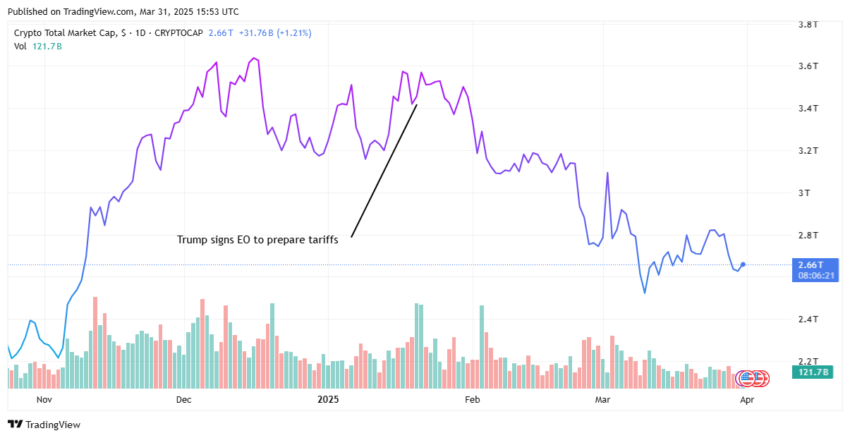

Whole crypto market cap: TradingView

How did crypto reply to Trump’s Liberation Day?

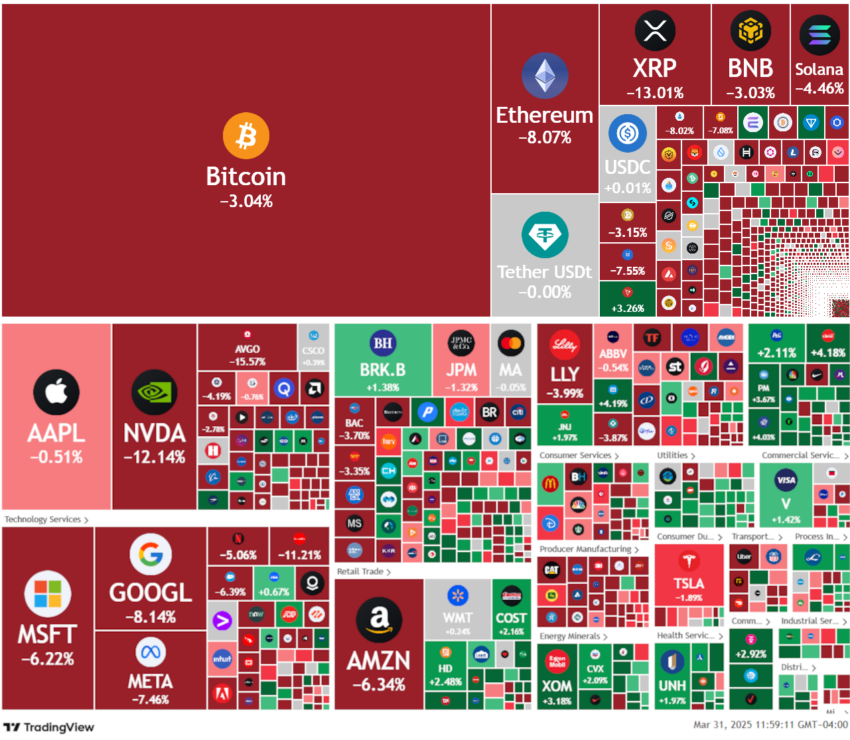

Upon the announcement of Trump’s Liberation Day, crypto and equities markets took an enormous nosedive. Bitcoin (BTC) and Ether (ETH) have been down ~3% and ~8% on the week, respectively, whereas NVDA and GOOGL have been down ~12% and ~8%.

Crypto and shares heatmap: TradingView

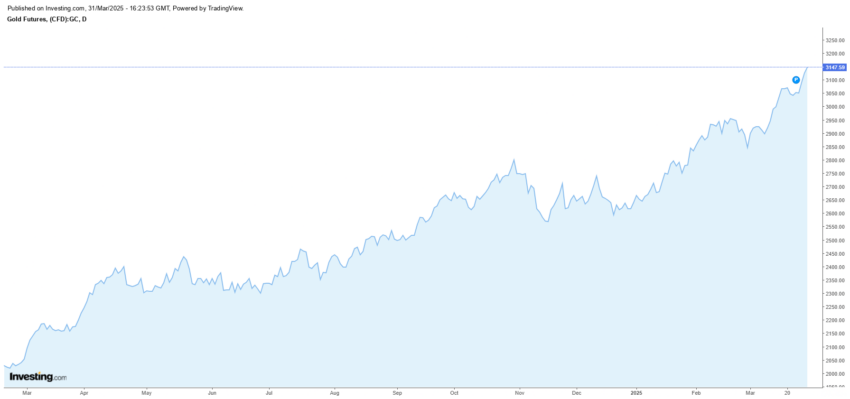

Whereas many markets have taken a success, gold has carried out exceptionally effectively. This might be seen as a potential market flight into safer belongings amidst the looming commerce warfare between main economies.

Gold Futures: investing.com

How will Liberation Day have an effect on markets?

Many individuals have urged that Trump’s tariffs are instruments for negotiating commerce and border safety. Others say the revenues will assist scale back the federal finances deficit.

The Federal Reserve admittedly underestimated the consequences of the tariffs and has additionally revised its expectations for inflation. Throughout its March 2025 assembly, the Fed raised its 2025 core inflation forecast to 2.8%, up from the earlier projection of two.5%.

Trump argues these measures will scale back U.S. reliance on international items and reclaim financial energy. Nevertheless, critics warn of upper shopper prices and potential retaliation efforts from affected nations. Listed here are the potential results Liberation Day might have on crypto and equities markets.

Continued de-risking

Whereas making projections on the potential end result of tariffs on crypto and different markets could be tough, we have already got some knowledge to work with. In Q1 2025, each tariff announcement has triggered a pullback in riskier belongings. Right here’s why:

- Tariffs elevate the price of commerce

- The U.S. imports greater than it exports (by loads)

- Which means larger costs throughout the board — not only for luxurious, however necessities too

If costs rise quick sufficient, folks will spend much less. That, in flip, places stress on company earnings, particularly for multinationals with tight margins or excessive enter prices. Ultimately, large cash will transfer away from danger.

Crypto falls squarely in that risk-on class. It thrives in environments the place liquidity is robust and buyers are chasing the upside.

Various eventualities

Some alternate eventualities might be bullish for crypto, however they’re unsure, particularly contemplating President Trump’s sheer willpower to renegotiate commerce agreements.

Firstly, Trump has been identified to shift course on the drop of a dime. Due to this fact, it’s potential that he might scrap tariffs altogether or not less than some tariffs on sure nations. This might create a short-lived rally.

Nevertheless, given the fragility of world liquidity and even charge cuts from central banks, underlying situations persist. Tariffs is probably not sufficient to offset the larger macroeconomic panorama.

Secondly, if tariffs have an ideal sufficient impression (e.g., diminished liquidity, discretionary spending, and many others.), alongside different situations, this might result in a recession within the U.S.

If a recession have been to happen or is more likely to happen, you possibly can see diminished rates of interest from the Fed and even authorities stimulus and bailouts to backstop the economic system. This might trigger elevated demand for danger belongings, which crypto would probably soak up, resulting in a potential bull market.

Quick-term ache, long-term potential?

Trump’s Liberation Day is a part of an ongoing technique to renegotiate commerce relationships and discount with main U.S. commerce companions. Nevertheless, this “America first” coverage has sparked a commerce warfare with many main economies. In anticipation of continued inflation and a potential recession, many buyers are de-risking from belongings like crypto. Whereas it’s almost certainly that tariffs might not directly negatively impression crypto within the brief time period, in the long run, Bitcoin’s function as a hedge in opposition to such measures might improve, particularly in the event that they set off financial instability. Conversely, this will enhance the crypto market.

Within the brief time period, guarantee your portfolio is well-diversified and that you’ve got solely invested what you possibly can afford to lose. By no means be in a state of affairs the place it’s a must to exit the market at a loss.