What’s the true price of manufacturing one Bitcoin? A recent report from Coinshares revealed some fascinating findings, underscoring the rising mining issue and the potential influence on miners.

Bitcoin halving occasions carry a variety of important and this 12 months’s having was notably notable. It’s because it was characterised by a surge in mining issue which can scale back the profitability. In consequence, many miners are pressured to close down their operations because of the incapability to breakeven.

Probably the most notable influence of the upper mining issue noticed not too long ago is a surge in manufacturing prices. The Coinshares experiences estimated that the present price of manufacturing one Bitcoin was $49,500, which implies BTC mining is quickly turning into much less accessible to particular person miners.

CoinShares’ newest report reveals that primarily based on second quarter money price knowledge, the common price of manufacturing one bitcoin for all listed miners is now $49,500, and if depreciation and inventory compensation are included, this common price will rise to $96,100. Mining corporations are…

— Wu Blockchain (@WuBlockchain) November 3, 2024

– Commercial –

Bitcoin mining dangers turning into extra centralized as issue soars. It’s because institutional members within the BTC mining phase will finally be capable to sustain with the rising prices.

Bitcoin Miner Reserves Drop as Uncertainty Soars

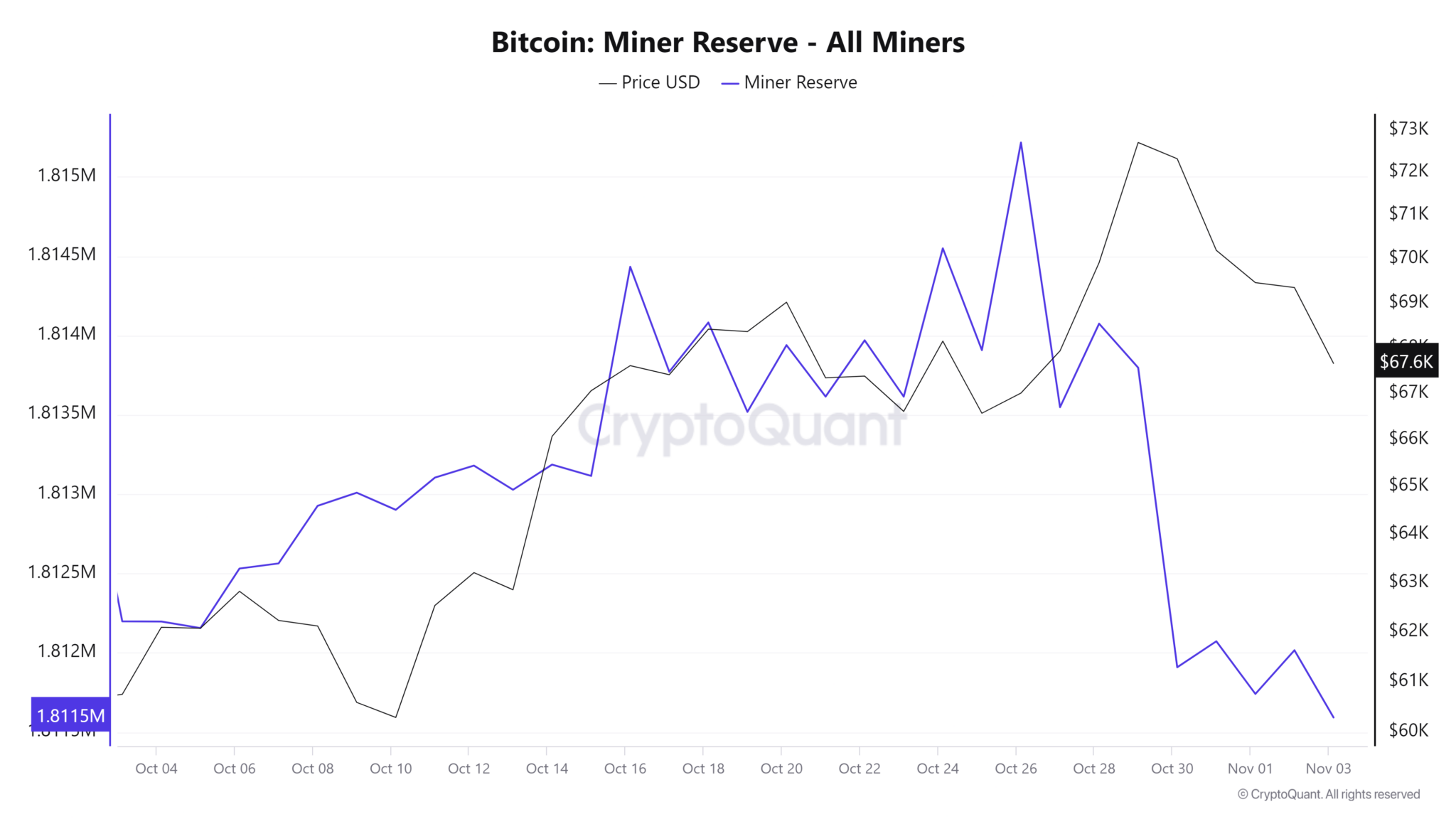

Bitcoin miner reserves keep an fascinating relationship with the value of Bitcoin and the prevailing market sentiment. Miner reserves are inclined to develop when miners anticipate greater costs and dip throughout instances of uncertainty.

October was an total bullish month for BTC and sentiments have been in favor of extra upside within the coming months. This led to a surge in Bitcoin miner reserves to a 4-week peak of 1.815 million BTC on 26 October. have been declining 26 October and have since dropped to 1.811 million BTC.

Bitcoin miner reserves | Supply: CryptoQuant

The distinction was equal to 40,000 BTC which equated to roughly $2.6 million at current market worth on the time of writing. In different phrases, miner reserve inflows and outflows contribute considerably to BTC’s worth motion.

The decline in miner reserves was largely due to a surge in uncertainty in regards to the U.S elections. An increase in miner reserves signifies that miners decide to carry in anticipation of upper costs.

Will BTC Revisit the $60,000 Vary?

Only a few days in the past it seemed like Bitcoin was headed in the direction of worth discovery. Nevertheless, the return of uncertainty has had a detrimental influence on worth. BTC had already tanked as little as $67,208 within the final 24 hours on the time of writing.

The cryptocurrency was within the purple for the final 6 consecutive days, demonstrating a excessive degree of promote stress. Sustained uncertainty through the week might result in extra draw back. Fibonacci retracement means that worth might discover the underside of the present pattern between $60,500 and $63,100.

Bitcoin worth motion | Supply: TradingView

Word that this was primarily based on the bottom worth in September which was the beginning of its newest uptrend, and the current peak on the finish of October. Bitcoin had a $67,829 worth on the time of writing which was solely a 6.92% dip away from the Fibonacci accumulation vary.