Bitcoin’s value has been step by step rising over the previous few weeks, paving its manner towards a brand new report excessive, which arrived on Monday. Nevertheless, it misplaced some momentum, and the query is what’s going to occur subsequent.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Day by day Chart

On the each day timeframe, the asset rebounded from the $92K help stage a few weeks in the past. The $100K stage has been damaged to the upside not too long ago, resulting in a gradual rise towards the $110K stage and doubtlessly larger.

With the RSI indicating that the momentum continues to be bullish, it is extremely seemingly that the market will rally towards the $120K stage quickly.

The 4-Hour Chart

Wanting on the 4-hour chart, the latest uneven value motion will be clearly witnessed. The asset has been trapped between the $100K and $108K ranges during the last ten days or so.

This has led to loads of uncertainty surrounding the market development within the close to future. But, the general market construction nonetheless stays bullish, and a breakout above the $108K resistance stage is extra possible than a bearish reversal.

On-Chain Evaluation

By Edris Derakhshi (TradingRage)

Bitcoin Alternate Whale Ratio

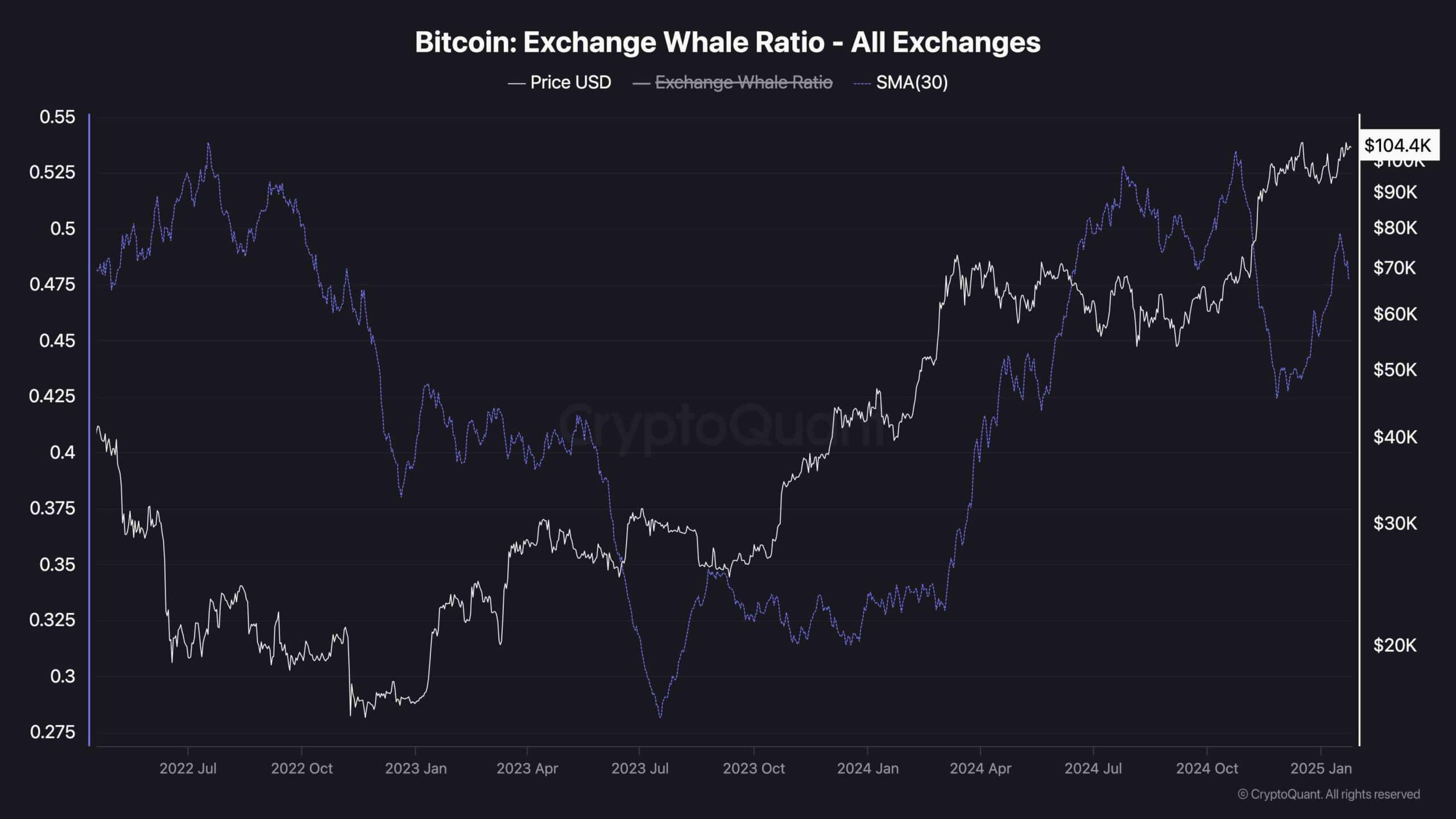

As Bitcoin’s value has been consolidating not too long ago after a major rally prior to now few months, traders are questioning whether or not the bull market is over. Analyzing on-chain metrics can supply helpful clues to succeed in a conclusion in regards to the present state of the market.

This chart presents the alternate whale ratio, which measures the ratio of alternate deposits by whales to complete deposits. Due to this fact, it may be seen as a proxy of promoting strain by massive traders.

Because the chart demonstrates, the whale ratio metric has been rising not too long ago, however it’s nonetheless exhibiting values far lower than these witnessed earlier when BTC was buying and selling round $70K. Due to this fact, extra upside can nonetheless be anticipated if adequate demand is current.