This can be a phase from the Provide Shock publication. To learn full editions, subscribe.

It’s good to think about a world the place the worth of bitcoin didn’t matter. Sadly, it may by no means be so.

Maybe in a vacuum, perhaps, in an alternate dimension the place human brains are hardwired — like an ASIC miner — to solely ever transact in bitcoin and nothing else. Not with shells, gold or livestock. Solely bitcoin and barter, ceaselessly.

Hyperbitcoinization or bust.

In boring actuality, bitcoin wants reference factors. Those we at present have might be trending to zero, however Bitcoin may by no means fulfill its true calling — funds and storing worth — with out figuring out precisely how a lot it’s price relative to one thing else at any given second.

Monitoring alternate charges rapidly turns into an obsession, and for good cause: That’s how fortunes are made.

Few know that higher than Mark Cuban, my muse for right this moment’s retrospective.

Cash Is Speech

It’s been eight years precisely since this banger tweet about Bitcoin from the previous majority Mavs proprietor Cuban:

“I believe it’s in a bubble. I simply don’t know when or how a lot it corrects. When everyone seems to be bragging about how simple they’re making $=bubble.”

It was June 2017, and bitcoin had been rallying for about six months straight to cap off a 10x run over two years — from $250 to $2,800 across the time of Cuban’s submit.

Bitcoin would push 600% greater over the following six months till the cycle’s peak in December, earlier than retracing by greater than 80% throughout the next 12 months.

Was {that a} bubble? It actually depends upon how free your definition is, however for what it’s price, bitcoin by no means returned to $2,800 once more after Cuban’s submit.

So, anybody who purchased bitcoin as he despatched that tweet would have by no means misplaced cash, and would right this moment be up by 3,600%.

Loading Tweet..

Nods in Jack Nicholson: “Until everybody drops fiat, nobody drops fiat.”

Cuban’s opinion about bitcoin and crypto has certainly developed over time — the identical man who stated “I’d somewhat have bananas than bitcoin” in October 2019 (when bitcoin was at $8,000) has extra not too long ago stated “btc might be a greater purchase proper now” over shares, even amid the buyback craze and with bitcoin at $84,000.

It’s not completely truthful to surmise Cuban’s private views from simply his tweets and media spots. However I’ll do it anyway.

Cuban’s tendency is to eat Bitcoin by way of the very slender lens of costs and earnings, and he has definitely agreed with bitcoin’s potential as a retailer of worth, even when it’s actually a euphemism for “quantity go up.”

His most telling tweet is that this, from August 2021, peak bull market: “BTC is a superb SOV. Much better than gold. I personal a bunch. However it’s what it’s. It doesn’t have all of the particular powers Maxis attempt to assign to it.”

Calling it now: If Bitcoinization is something just like the Apocalypse — 15 indicators and all — then let the second Cuban lastly sees the magic of Bitcoin, past its value, be plain.

— David

A Historian’s View

To drag a quote from Harry Suddock, in relation to Bitcoin — “value is the product,” however I’ll add my very own twist. It’s additionally the advertising and marketing.

Since David has regaled us with a story of simply how late Mark Cuban has been to Bitcoin, I assumed it will be good to offer a reminder that we’re nonetheless early.

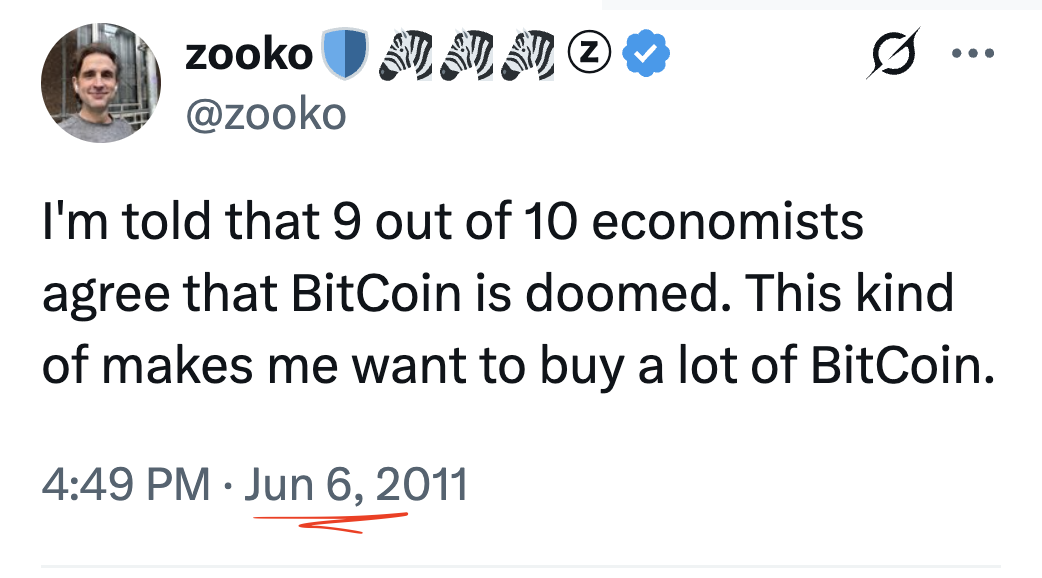

Take this quote from Zooko Wilcox, written 14 years in the past: