United States President Donald Trump has floated the thought of utilizing import tariff income for one more stimulus bundle, signaling one other tailwind for crypto markets, alongside the continuing authorities shutdown.

President Trump mentioned that he’s contemplating giving Individuals as much as $2,000 in stimulus checks funded by income generated from import tariffs, in response to an interview on the One America Information Community revealed on Thursday.

Whereas the income from tariffs is simply “beginning to kick in,” they’ll finally generate “over a trillion {dollars} a yr,” mentioned Trump in the course of the interview, including that one other a part of the income can be used to pay the nation’s $37 trillion federal debt.

The proposed “dividend” plan would distribute between $1,000 and $2,000 per particular person, pending congressional approval.

President Trump’s interview with One American Information Community. Supply: YouTube

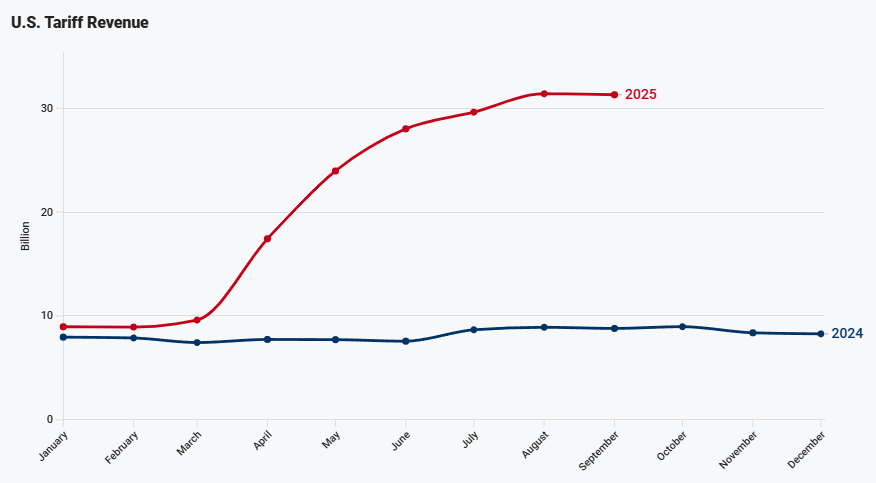

The US authorities has collected roughly $214 billion in tariff income to date in 2025, in response to information from the Treasury Division reviewed by Fox Enterprise.

US tariff income. Supply: Division of the Treasury, Fox Enterprise

Associated: French central financial institution’s deficit is ‘nice’ for Bitcoin: Arthur Hayes

Stimulus checks may function liquidity catalyst

Paired with the uncertainty of an ongoing authorities shutdown, the potential stimulus bundle could sign one other catalyst for the crypto market, akin to the 2020 market cycle.

The event could act as an “further liquidity catalyst,” in response to analysts from Bitfinex alternate, who pointed to an analogous state of affairs after the COVID-19 stimulus checks introduced new retail investor liquidity that catalyzed Bitcoin’s (BTC) rally in the course of the pandemic.

“An identical dynamic performed out following the COVID-era stimulus, which injected substantial liquidity into each conventional and digital markets, contributing to Bitcoin’s explosive rally on the time,” the analysts wrote in a analysis report launched Tuesday.

In March 2020, Trump signed a $2 trillion stimulus bundle to fight the financial influence of the pandemic, distributing as much as $1,200 to eligible people with an adjusted gross earnings of as much as $75,000.

BTC/USD, one-week chart, 2020–2021. Supply: Cointelegraph/TradingView

Bitcoin’s value rose by over 1,050%, from simply $6,000 in March 2020 to $69,000 by November 2021. Nonetheless, this rally additionally coincided with a interval of quantitative easing (QE), which noticed the US Federal Reserve announce a $4 trillion bond-buying program on March 23, 2020.

QE refers to central banks shopping for bonds and injecting cash into the financial system to decrease rates of interest and stimulate spending throughout difficult monetary circumstances.

Associated: Bitcoin value can hit $250K in 2025 if Fed shifts to QE: Arthur Hayes

In the meantime, the US authorities shutdown entered its seventh day on Tuesday, with lawmakers failing to cross a key invoice to maintain the federal government funded.

The Senate is ready to reconvene on the funding invoice afterward Tuesday, with no clear decision in sight after the 2 sides did not agree for the fifth time on Monday.

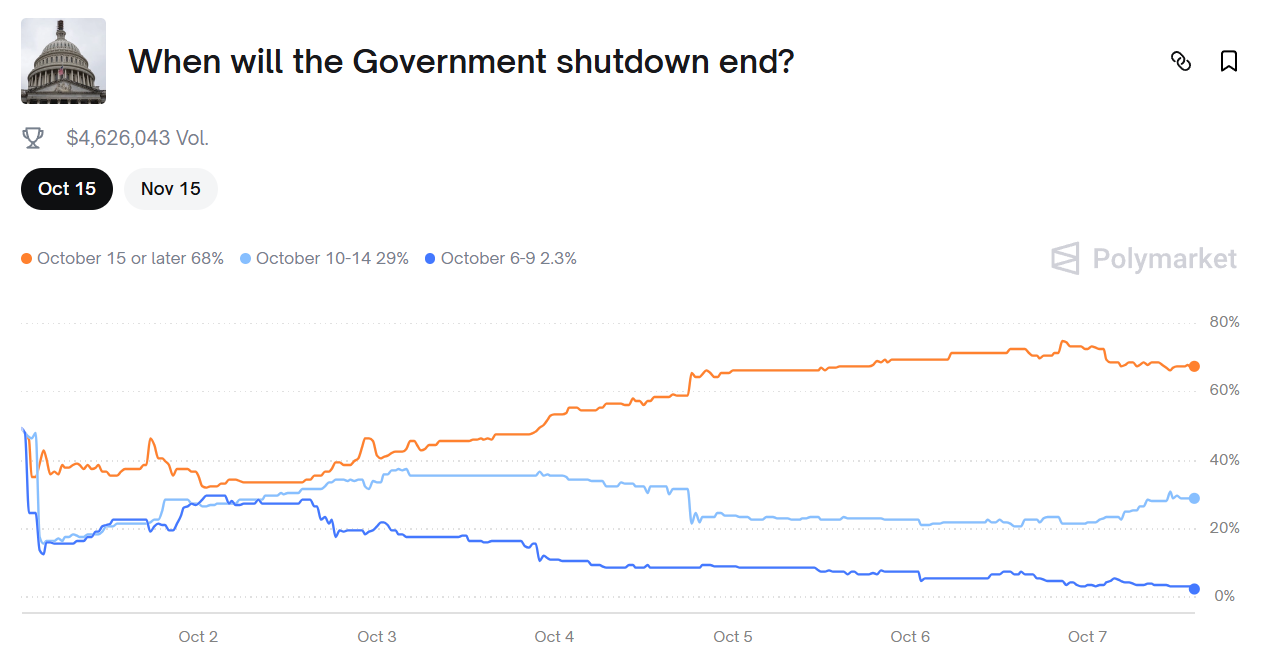

Odds of the federal government shutdown ending by Oct. 15. Supply: Polymarket

Merchants see a 68% likelihood that the shutdown will finish on Oct. 15 or afterward the prediction market platform Polymarket.

Journal: Bitcoin to see ‘another large thrust’ to $150K, ETH strain builds