The main altcoin, Ethereum, skilled a difficult month in March, marked by a collection of bearish developments that mirrored a broader market slowdown.

Nonetheless, because the market begins to indicate indicators of restoration, the important thing query for April stays: Can Ethereum regain its bullish momentum?

Ethereum’s March Woes: Value Crash, Exercise Stoop, and Rising Provide Stress

On March 11, Ethereum plummeted to a two-year low of $1,759. This prompted merchants to “purchase the dip,” triggering a rally to $2,104 by March 24.

Nonetheless, market individuals resumed profit-taking, inflicting the coin’s value to fall sharply for the remainder of the month. On March 31, ETH closed beneath the important $2,000 value stage at $1,822.

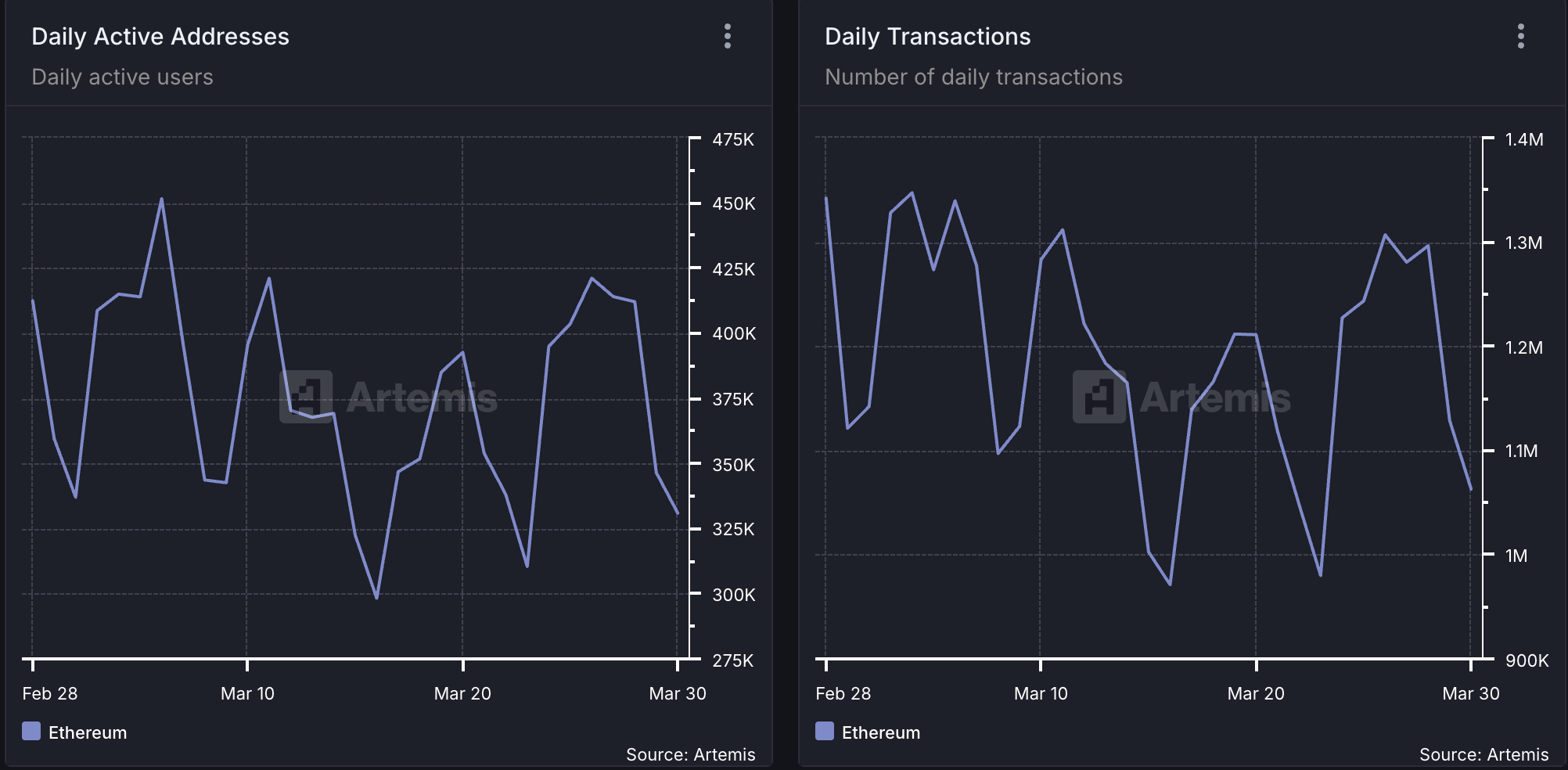

Amid ETH’s value troubles, the Ethereum community additionally skilled a extreme decline in exercise in March. Per Artemis, the each day rely of lively addresses that accomplished at the very least one ETH transaction fell by 20% in March.

Because of this, the community’s month-to-month transaction rely additionally plummeted. Totaling 1.06 million through the 31-day interval in overview, the variety of transactions accomplished on Ethereum fell by 21% in March.

Ethereum Community Exercise. Supply: Artemis

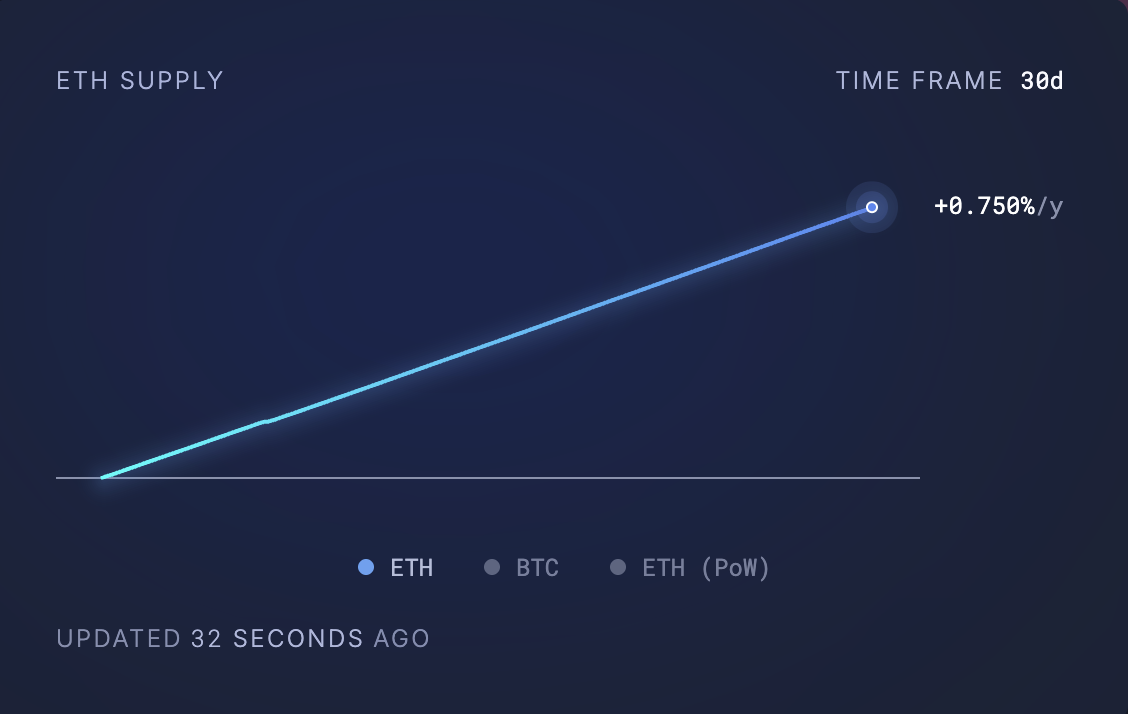

Usually, as extra customers transact and interact with Ethereum, the burn fee (a measure of ETH tokens completely faraway from circulation) will increase, contributing to Ether’s deflationary provide dynamic. Nonetheless, when person exercise drops, ETH’s burn fee reduces, leaving many cash in circulation and including to its circulating provide.

This was the case for ETH in March when it noticed a spike in its circulating provide. In response to information from Ultrasound Cash, 74,322.37 cash have been added to ETH’s circulating provide prior to now 30 days.

Ethereum’s Circulating Provide. Supply: Ultrasound Cash

Normally, when an asset’s provide spikes like this and not using a corresponding demand to soak up it, it will increase the downward strain on its value. This places ETH susceptible to extending its decline in April.

What’s Subsequent for Ethereum? Skilled Says Inflation Might Not Be a Main Concern

In an unique interview with BeInCrypto, Gabriel Halm, a Analysis Analyst at IntoTheBlock, famous that ETH’s present inflationary developments “might not be a serious pink flag” to be careful for in April.

Halm stated:

“Regardless that Ethereum’s provide has not too long ago stopped being deflationary, its annualized inflation fee continues to be solely 0.73% over the past month, which continues to be dramatically decrease than pre-Merge ranges and decrease than that of Bitcoin. For traders, this reasonable stage of inflation might not be a serious pink flag, supplied that community utilization, developer exercise, and institutional adoption stay sturdy.”

Furthermore, relating to whether or not Ethereum’s declining community exercise has performed a big position in its latest value struggles, Halm prompt that its affect could also be overstated.

“Traditionally, from September 2022 to early 2024, Ethereum’s provide remained deflationary, but the ETH/BTC pair nonetheless trended decrease. This means that macroeconomic and broader market forces can play a much more vital position than token provide adjustments alone.”

ETH/BTC Market Cap Comparability. Supply: IntoTheBlock

On what ETH holders ought to anticipate this month, Halm stated:

“In the end, whether or not Ethereum dips or rallies in April will probably rely extra on market sentiment and macro developments than on its short-term provide dynamics. Nonetheless, it’s important to control community developments that would spur renewed exercise and reinforce ETH’s main place within the broader crypto panorama.”