After a bearish begin, Ethereum (ETH) has traded inside a slim vary by October, going through resistance at $2,736 and discovering help at $2,326.

As the brand new buying and selling month begins, analysts anticipate a possible rally — contingent on a key situation: ETH should break by its resistance stage to verify bullish momentum.

Why Ethereum Might Be Held Down

In an unique interview with BeInCrypto, Victor Tan, founder and CEO of TrinityPad — a launchpad empowering buyers to help early-stage firms — shared that Ethereum might take a look at the $3,500 to $4,000 vary by November. Tan attributed this anticipated progress to current developments in Layer-2 options and the increasing integration of decentralized finance (DeFi) on the platform.

“ETH might advance towards $3,500-$4,000 by year-end if DeFi adoption continues increasing. Layer-2 applied sciences have already lowered transaction charges by round 20%, enhancing Ethereum’s attraction,” he stated.

Nevertheless, the current underperformance of Ethereum’s DeFi sector previously month has impressed little confidence. Information from DeFiLlama reveals that the Layer-1 (L1) community noticed solely a modest 2% improve in complete worth locked (TVL) over the previous 30 days. Compared, competing networks gained vital momentum, with “Ethereum killer” Solana attaining a 12% improve in TVL and Aptos surging by a powerful 47% inside the similar interval.

Ethereum DeFi TVL. Supply: DefilLlama

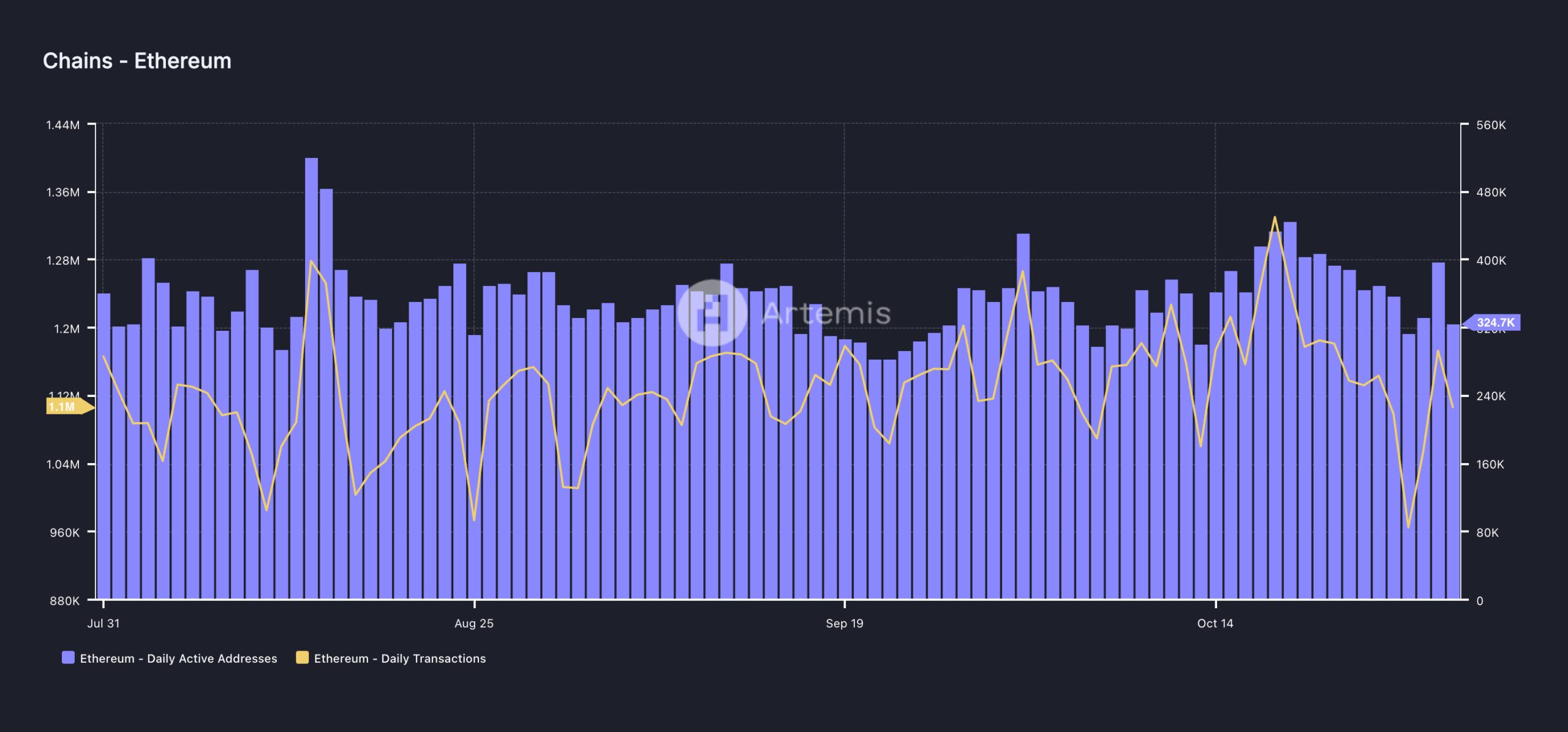

Ethereum’s poor TVL progress displays the community’s low demand over the previous month. Information from Artemis reveals that the every day energetic addresses on the chain have totaled 324,745 previously 30 days, dropping by 25%.

As a result of fall in person rely on the chain, Ethereum’s every day transaction rely has additionally plummeted. Through the interval underneath evaluation, this has dropped by 13%.

Ethereum Community Exercise. Supply: Artemis

Ethereum Cash in Circulation Spike

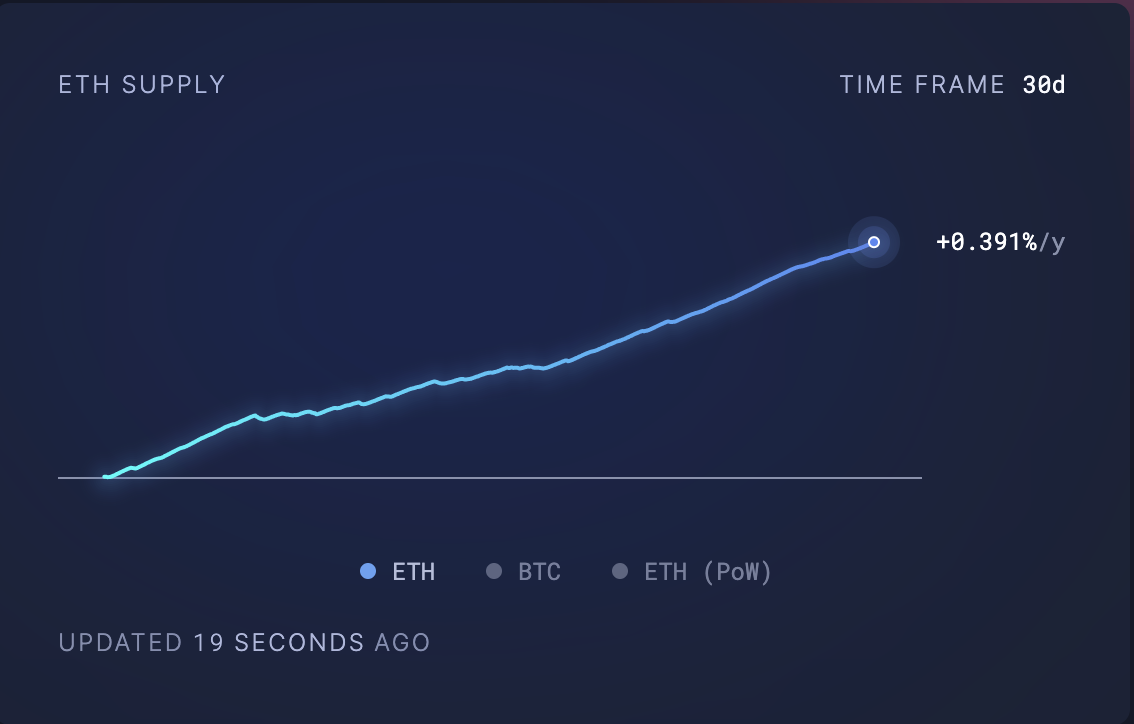

The decline in exercise on the Ethereum community has lowered the altcoin’s burn fee. This has elevated its circulating provide and exerted downward strain on its value.

Information from Ultrasoundmoney reveals that, over the previous 30 days, a further 38,598 ETH — valued at over $98 million at present market costs — has been added to Ethereum’s circulating provide.

Ethereum Provide. Supply: Ultrasoundmoney

When extra ETH tokens enter circulation, the obtainable provide rises, which may result in a value dip as provide outpaces demand. This inflow of tokens might contribute to short-term value volatility in November, particularly if community exercise stays subdued.