Main altcoin Ethereum trended sideways in early September because the market tried to get better from August’s steep correction. Nonetheless, bears gained the higher hand on September 12 and have since pressured ETH right into a downtrend. ETH trades at $4,113 at press time, down almost 15% since then.

With broader sentiment worsening, person demand falling throughout the Ethereum community, and institutional buyers pulling again, the coin faces mounting headwinds in October.

ETH Provide Climbs as Demand Fades

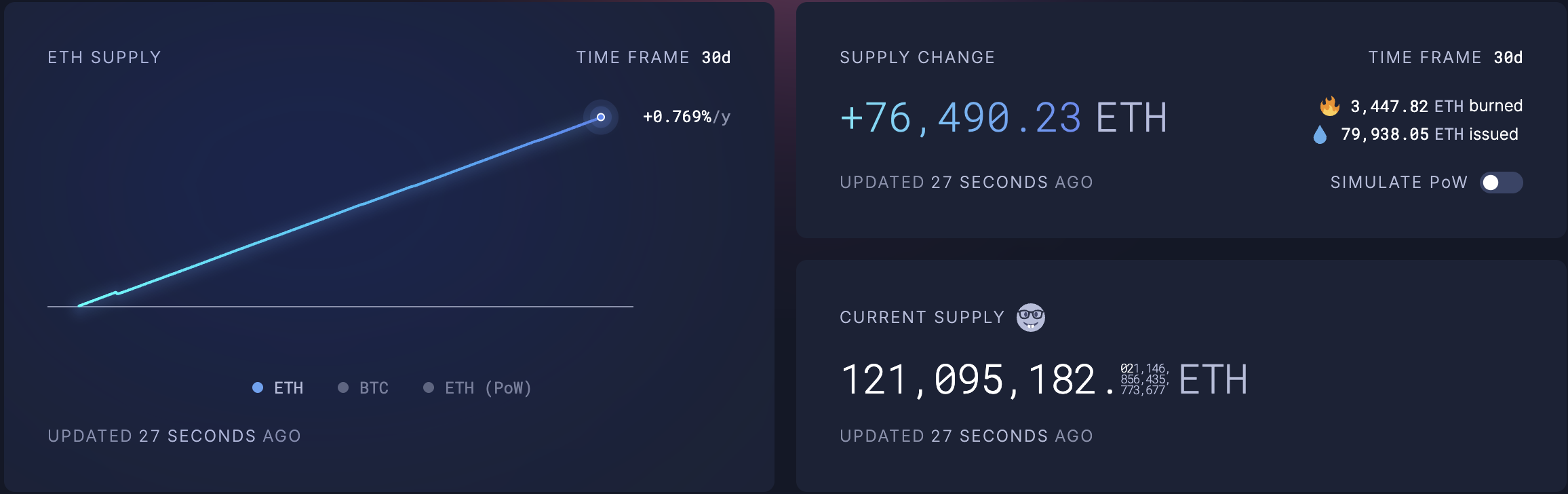

On-chain information exhibits Ethereum’s circulating provide has surged over the previous month. In keeping with information from Ultrasoundmoney, 76,488.71 ETH has been added to the cash out there to the general public.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

ETH Circulating Provide Change. Supply: Ultrasoundmoney

Ethereum’s circulating provide will increase when person exercise declines, as this reduces the burn price on the Layer-1 blockchain.

Usually, as extra customers transact and have interaction with Ethereum, the burn price (a measure of ETH tokens completely faraway from circulation) will increase, contributing to Ether’s deflationary provide dynamic.

Nonetheless, with a drop in person exercise on the community, its burn price additionally plummets, leaving many cash in circulation and including to its circulating provide.

With ETH going through a climbing bearish bias and no matching demand to soak up the rising provide, draw back strain on ETH strengthens.

Spot ETH ETFs Document Sharp Outflows

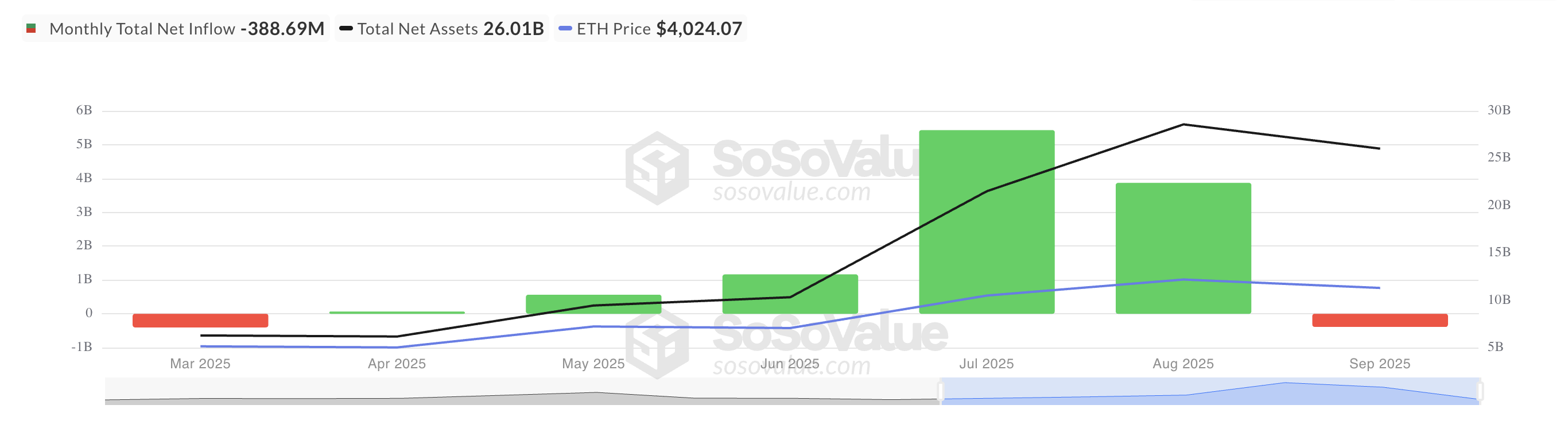

The declining institutional urge for food for ETH additionally factors to a bearish outlook heading into October. In keeping with Sosovalue, outflows from ETH-focused funds have reached $389 million this month, the most important month-to-month capital exit since March.

Whole Ethereum Spot ETF Internet Influx. Supply: SosoValue

This issues as a result of ETH’s worth has strongly correlated with ETF inflows. So when these inflows dip, it alerts waning conviction amongst institutional gamers. If this development continues unabated, it may have an effect on the coin’s worth efficiency over the approaching weeks.

A scarcity of institutional curiosity may additionally weigh on retail participation. With out the arrogance and liquidity that bigger gamers deliver, retail buyers might refuse to take positions or commit capital, worsening ETH’s efficiency within the weeks forward.

Weak Spot Demand Threatens $4,000 Help

Readings from the ETH/USD one-day chart verify that spot market participation can be weakening. Its On-Steadiness Quantity (OBV) indicator has trended downward since September 12, signaling falling purchaser demand.

The OBV tracks cumulative buying and selling quantity by including quantity on up days and subtracting it on down days. When the OBV rises, consumers are driving costs larger with robust quantity assist.

Conversely, a declining OBV like ETH’s means that promoting strain outweighs shopping for exercise. This amplifies the draw back dangers for ETH’s worth within the coming month.

If buy-side strain continues to fade, the altcoin may plunge again under $4,000 and fall towards $3,875.

EtH Value Evaluation. Supply: TradingView

Then again, if sentiment improves and demand surges, ETH’s worth may acquire some energy, breach resistance at $4,211, and climb to $4,497.

The publish What to anticipate from Ethereum in October 2025 appeared first on BeInCrypto.