The next is a visitor publish by Vincent Maliepaard, Advertising Director at IntoTheBlock.

While you first hear about Bitcoin staking, you would possibly assume there’s a mistake, given Bitcoin’s Proof of Work (PoW) mechanism. Nevertheless, Bitcoin staking is certainly a actuality, with hundreds of addresses taking part and producing returns on their belongings. Right here’s what you might want to know.

Bitcoin Staking Defined

Staking historically refers back to the course of the place holders of a cryptocurrency lock up their funds to take part in community operations, equivalent to transaction validation on Proof of Stake (PoS) blockchains. Bitcoin, nonetheless, operates on a PoW consensus mechanism, which doesn’t natively assist staking. This dynamic has modified with the introduction of Bitcoin staking by platforms providing Bitcoin-based Liquid Staking Tokens (LSTs). These platforms allow BTC holders to have interaction in staking actions not directly.

EigenLayer, Babylon, and AVS’s

On Ethereum, the idea of “restaking” was launched in 2023 with EigenLayer, which gained important traction by mid-2024, reaching a complete worth locked (TVL) of over $20 billion in June. Usually, staking ETH helps safe the Ethereum community, rewarding stakers in return. EigenLayer extends this idea by permitting customers to “restake” their ETH to safe further providers, incomes further rewards.

Initially coined as Lively Validated Providers (AVS) on Eigenlayer, these purposes by totally different phrases relying on their related (re)staking platform. AVSs are purposes or providers that may be secured with restaked ETH. This idea is now being prolonged to the Bitcoin blockchain and BTC-pegged tokens. Babylon is main this effort, constructing an structure that enables purposes to leverage Bitcoin’s crypto-economic safety. In the meantime, on the Ethereum facet, Symbiotic and shortly Eigenlayer are restaking protocols accepting tokens equivalent to Wrapped Bitcoin (WBTC) as collateral to assist purposes that search to make the most of these belongings for enhanced safety.

Understanding Bitcoin Staking

In Bitcoin staking, customers deposit their BTC right into a staking protocol and obtain Liquid Staking Tokens (LSTs) in return. These LSTs characterize the staked BTC however typically provide enhanced liquidity and different functionalities. This enables members to have interaction in DeFi actions with out sacrificing staking rewards.

Presently, the most well-liked Bitcoin LST is LBTC, originating from the Lombard protocol. Right here’s a breakdown of the way it works:

- How LBTC is Created: To mint LBTC, customers ship their BTC to particular addresses linked to the Babylon protocol. This motion creates LBTC on Ethereum, appearing as a placeholder for the Bitcoin you despatched.

- What Occurs to the BTC: The precise BTC despatched is held securely inside Babylon protocol’s contracts. At current, this BTC isn’t being utilized or accessible, but it surely stays safely saved.

- Rewards for Depositors: Whereas the BTC is held in reserve, depositors are rewarded with factors from each the Babylon and Lombard programs as an incentive for his or her participation.

- The Future Plan: The objective is to finally use the BTC held by Babylon’s contracts to safe a broader ecosystem. This may contain permitting totally different apps and chains to make the most of this BTC to safe their networks whereas sustaining a connection to the primary Bitcoin community.

Main Protocols in Bitcoin Staking

A number of protocols have emerged as frontrunners within the Bitcoin staking enviornment:

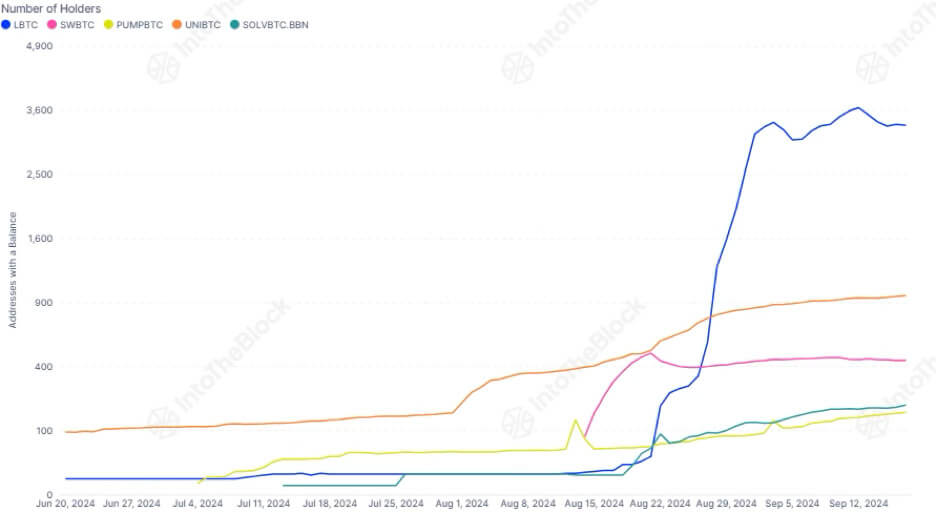

- Lombard Staked BTC (LBTC): As a frontrunner on this market, LBTC has seen its market cap develop considerably, now sitting at $300 million with over 3,000 holders.

- UniBTC: UnitBTC secured a major variety of holders early on. Whereas LBTC has surpassed it, it nonetheless ranks second with roughly 1000 holders.

- Swell BTC (SWBTC): SWBTC had a robust begin and appeared prone to surpass uniBTC. Nevertheless, progress has slowed down and it at present ranks third with round 440 holders.

Is Bitcoin Staking the Way forward for Bitcoin yield?

Bitcoin staking has seen a robust begin, with hundreds of holders already incomes factors by main protocols. Presently, staked Bitcoin represents 3.75% of all wrapped Bitcoin, indicating there may be nonetheless loads of room for progress within the coming months.

The idea is promising, however its long-term success will depend upon whether or not the economics of staking make sense past the preliminary level rewards. The important thing issue would be the improvement of providers constructed on high of those protocols. If a sturdy ecosystem of providers develops, Bitcoin staking may turn into one of the vital enticing yield alternatives for Bitcoin holders.