Ethereum is at the moment making an attempt to get well after months of bearish strain, however key resistance ranges and liquidation dynamics counsel warning remains to be warranted.

Technical Evaluation

By Edris Derakhshi

The Day by day Chart

On the every day chart, ETH has managed to bounce from the $1,900 assist zone and is now pushing towards the $2,200 resistance space. Nonetheless, the asset stays nicely under the 200-day transferring common, which is round $2,900, which continues to behave as a serious hurdle.

The RSI is step by step climbing however nonetheless hasn’t entered overbought territory. Until ETH decisively breaks above $2,400 and holds, the downtrend construction stays intact, with the $1,900 and $1,600 ranges appearing as key helps to look at.

The 4-Hour Chart

The 4-hour chart reveals Ethereum forming an ascending channel, not too long ago pushing in direction of the higher boundary close to $2,150. This rally from the $1,900 assist zone has been robust, however the asset is approaching a confluence of resistance ranges, together with the $2,200 zone marked by earlier breakdowns.

RSI has additionally entered the overbought area, hinting at attainable exhaustion. A breakout above $2,200 might shift the short-term bias bullish, whereas rejection from the present vary might pull ETH again towards the $1,900 zone.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

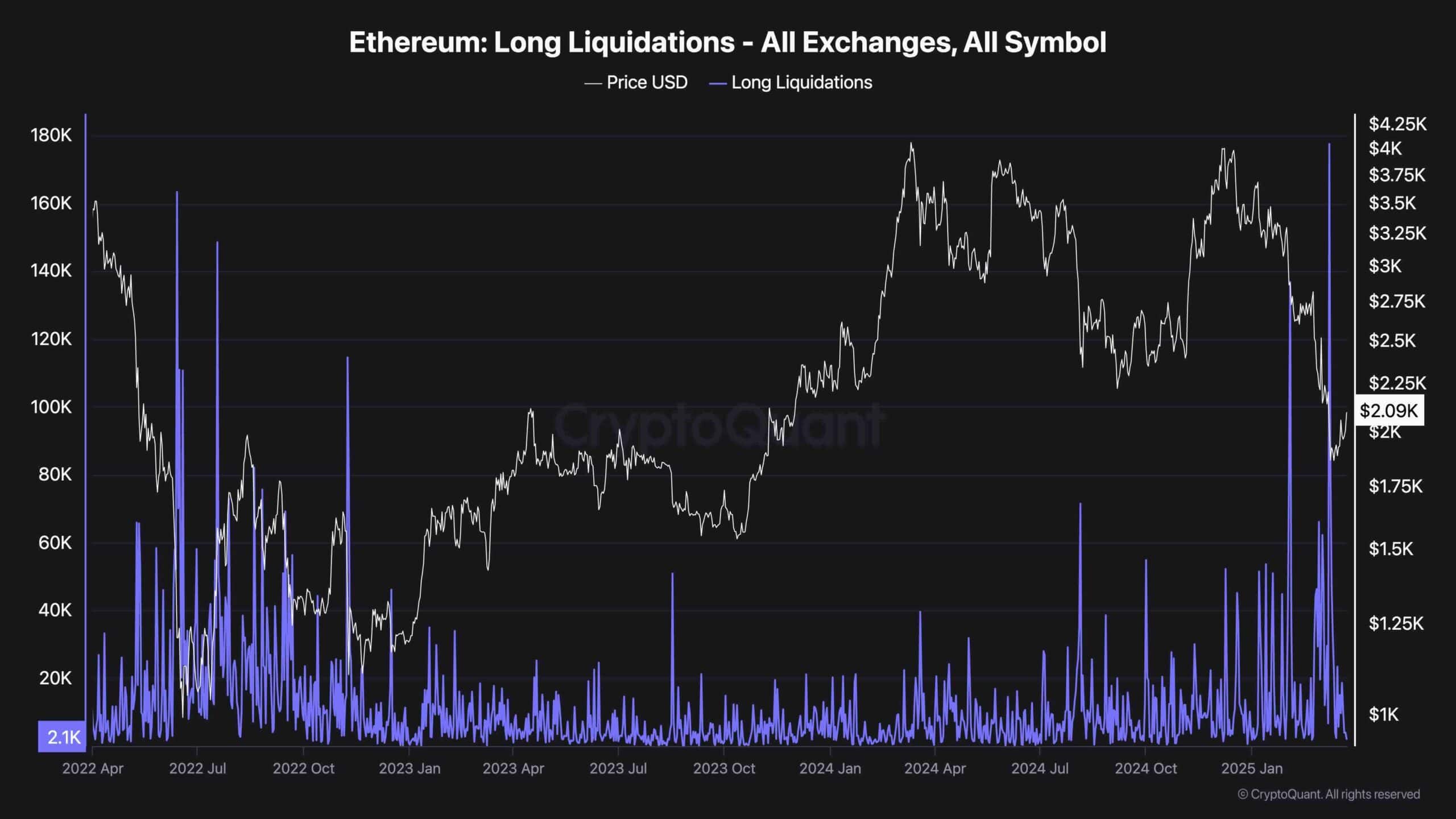

Lengthy Liquidations

The lengthy liquidations chart reveals a pointy spike in current months, notably throughout ETH’s drop under $2,000. These mass liquidations worn out leveraged lengthy positions, contributing to heightened volatility. Though liquidation occasions have now cooled down, the market stays susceptible to sharp strikes if leverage builds up once more.

The earlier spikes point out a fragile sentiment amongst speculators, and any sharp rejection at resistance zones might set off one other cascade of lengthy liquidations, reinforcing bearish strain. Total, worth stability and a sustainable restoration would require a discount in extreme leverage and stronger spot-driven demand.